Light Sensor Market to Witness CAGR of 9.5% during 2020–2030

- Published: February 2020

With the increase in the disposable income of people around the world, especially in developing countries, the demand for consumer electronics and automobiles is increasing. This is the primary factor which is predicted to drive the global light sensor market at a 9.5% CAGR during 2020–2030 (forecast period); the industry generated $1,456.2 million revenue in 2019.

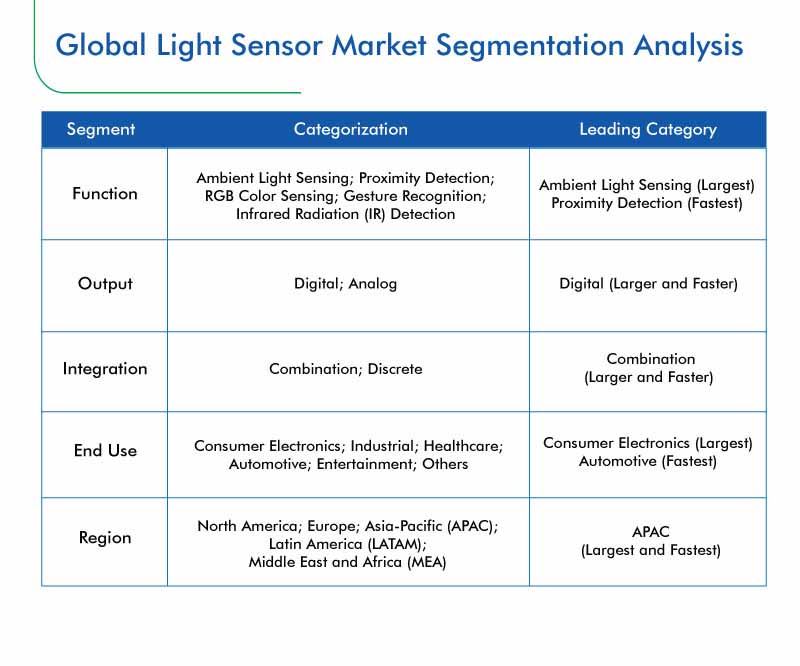

Light Sensor Market Segmentation

The proximity detection category is expected to grow at the highest CAGR in the light sensor market during the forecast period. This is credited to the increasing adoption of light sensors for this particular function by a rising number of companies in the healthcare and automotive sectors. These devices measure the amount of the reflected infrared (IR) energy, to ascertain the presence of a person or object.

In 2019, higher revenue to the light sensor market was contributed by the digital bifurcation, as the demand for digital sensors is quite high in the automotive, consumer electronics, and healthcare sectors. Furthermore, advanced driver assistance systems (ADAS) are being rapidly installed in vehicles, and these systems use digital light sensing devices for numerous functions. A digital light sensor is used to detect the light intensity; additionally, it reflects the digital signal voltage to the controller.

Asia-Pacific (APAC) would continue dominating the light sensor market till 2030, because of the rising requirement for consumer electronics and automobiles and booming population in the region. In the regional automotive sector, the adoption of electric vehicles (EV) is a key trend, as governments of many nations are extending support for their adoption. For instance, since Government of China started providing a subsidy of $10,000 in 2017, on the purchase of every EV, their sales surged rapidly. Parking assistance systems and interior lighting control are among the several functionalities in an EV where a light sensor is required; therefore, the growing adoption of EVs is driving the sale of light sensors in APAC.

Market Players Launching New Products to Dominate Competition

Light sensor market players are engaging in regular product launches, to stay ahead of their competitors, by offering customers better light sensing solutions.

For instance, Vishay Intertechnology Inc. introduced a line of integrated RGBC-IR color sensors, with I²C interface, in low-profile packages, in January 2020. Containing photodiodes, analog/digital circuits, and amplifiers, the devices can sense red, green, blue, and IR light. These sensors can be used for automatic white point balancing and color cast correction in digital cameras, active monitoring of light emitting diode (LED) color output in IoT devices and smart lighting, and automatic liquid crystal display (LCD) backlight adjustment.

Browse report overview with detailed TOC on "Light Sensor Market Research Report: By Function (Ambient Light Sensing, Proximity Detection, RGB Color Sensing, Gesture Recognition, IR Detection), Output (Analog, Digital), Integration (Discrete, Combination), End User (Automotive, Consumer Electronics, Industrial, Healthcare, Entertainment) - Industry Analysis and Growth Forecast to 2030" at:https://www.psmarketresearch.com/market-analysis/light-sensor-market

In the same vein, in September 2019, ams AG launched TMD2635, which is an extremely small digital proximity sensor module. The sensor, which comes in an ultra-small package, occupies merely 1 mm3 of volume, which gives consumer electronics companies, manufacturing True Wireless Stereo (TWS) devices, the freedom to develop smaller and lighter earbuds of industrial design.

Vishay Intertechnology Inc., ams AG, Sharp Corporation, STMicroelectronics N.V., Broadcom Inc., Texas Instruments Incorporated, Maxim Integrated Products Inc., Everlight Electronics Co. Ltd., Panasonic Corporation, and ROHM Co. Ltd. are the key players in the global light sensor market.