X-Ray Systems Market Analysis

Explore In-Depth X-Ray Systems Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2032

Report Code: 10650

Explore In-Depth X-Ray Systems Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2032

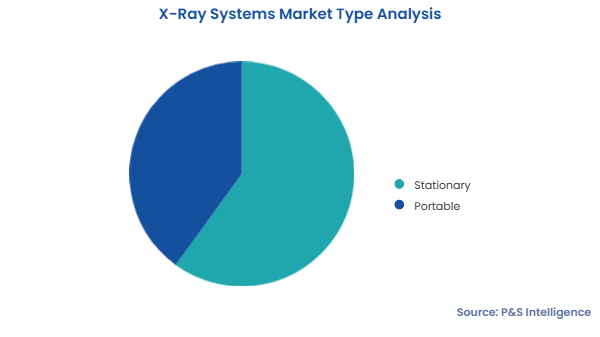

The stationary category holds the larger market share in 2024, of 60%. They are the most-commonly used X-ray systems due to their high-quality images and cost-effectiveness. They help in generating images of the tissues and organs inside the body, thereby helping in the early detection of bone fractures, pneumonia, certain tumors and other abnormal masses, some kinds of injuries, foreign objects, calcifications, and dental problems.

Generally, older people are at a higher risk of musculoskeletal disorders, due to the loss of the mineral content of the bones. This is why bones become less dense and fragile, where stationary systems help in the detection of these abnormalities.

The portable category is expected to grow the faster during the forecast period. Since the COVID-19 pandemic, there has been a growth in the demand for mobile equipment, as it can be easily transported across hospitals or to a patient's house, which eventually helps in reducing the danger of virus transmission. With the improvement in the image quality, the accuracy of diagnoses rises. This can facilitate in the quicker detection and treatment of a number of ailments that are life-threatening, including cancer and certain cardiovascular diseases.

Therefore, market players are increasingly investing in new technologies, especially mobile scanners. For instance, Konica Minolta Healthcare Americas Inc. has developed the Dynamic Digital Radiography (DDR) technology, which enables the visualization of the anatomy in real time and helps in enhancing the diagnosis and management of pulmonary and orthopedic conditions.

Moreover, the prevalence of illnesses is rising among the young generation, majorly due to the consumption of junk food, excessive smoking and drinking, sedentary lifestyles, and a lack of physical activity. Hence, the major healthcare players are increasingly investing in AI-integrated radiography platforms. For instance, in August 2021, GE Healthcare announced a strategic collaboration with Amazon Web Services (AWS) to facilitate AI and cloud-based imaging solutions. Integrating AI-enabled data with the cloud helps in providing clinical and operational insights to hospitals and healthcare providers.

These types are part of the research scope:

In 2024, hospitals dominate due to the rise in the number of patients visiting hospitals for the diagnosis and treatment of chronic ailments. Radiography machines are among the essential equipment at hospitals, which is why they draw the highest volume of patients. Different X-ray system types, such as portable and stationary and analog and digital, are used in such places for diagnosis and treatment.

Portable or mobile equipment is mostly utilized in intensive care units (ICUs), where the patients are unable to move. Additionally, due to the numerous benefits of digital radiographs over analog ones, hospitals are switching to the latter as the technology advances.

Digital X-rays expose patients and caregivers to 70% to 80% less radiation than traditional systems. The advancements in radiology over the last two decades have completely changed how imaging is done. Since there is no processing time involved in the digital format, the results are immediately available for viewing. This helps in the early detection and possible cure of diseases.

Diagnostic imaging centers will have the highest CAGR, of 4%, over the forecast period. Because X-rays are the most-widely performed of all radiological scans, hospitals are finding it increasingly difficult to cater to the booming patient count. This is now driving people to diagnostic imaging centers, where the wait times are considerably shorter. These places also offer affordability over hospitals, which is essential to make diagnoses accessible in emerging economies. The lower patient count has especially been attracting people to diagnostic imaging centers since the onset of the pandemic, where fears of hospitals-acquired COVID-19 were rampant.

Here are the end users covered in the report:

The dental category holds the major share in the market, due to the growing number of people with dental disorders, especially the geriatric and adult populations. Further, there is rising awareness regarding these disorders, which is driving the spending on diagnosis and treatment. Dental X-rays are commonly used to diagnose cavities, jaw fractures and infections, misaligned teeth, abscess in the gums, cysts, and tumors.

The mammography market is predicted to expand the most rapidly due to the increasing prevalence of breast cancer and public awareness of this disease. According to data, there will be approximately 290,560 people diagnosed with breast cancer in the U.S. in 2022. Moreover, breast cancer is the most-common cancer diagnosed among American women, and it is a major cause of death in developing countries as well.

In addition, as the technology advances, more medical facilities are predicted to embrace mammography equipment, since it allows for the early detection of ailments in the breasts, which could lead to a potentially timely cure.

We have studied the following applications:

Digital is the larger bifurcation, and it will also witness the higher CAGR during the forecast period, of 4.5%. With the advancements in technologies, most hospitals and diagnostic imaging centers around the world have adopted digital radiography systems. They quicken up diagnoses by eliminating the need to acquire images from the system and print on an X-ray film. This also reduces inventory expenses, enabling hospitals and diagnostic centers to provide cost-effective scans to a larger portion of the population. The ability of these systems to be integrated with PACS and EHRs further drives their preference among care providers.

The following technologies have been analyzed:

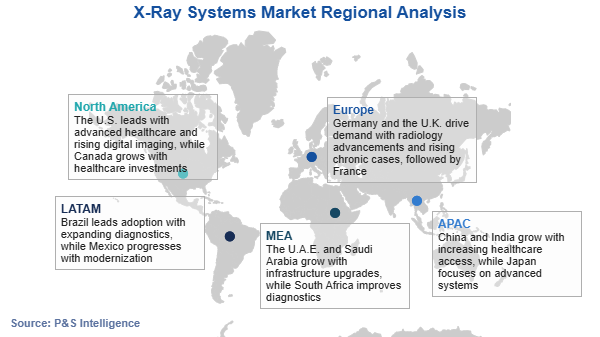

North America accounts for the largest market share, of 40%, in 2024 due to the rising healthcare costs, growing elderly population, and burgeoning prevalence of chronic problems. Thus, the U.S. and Canada are increasingly investing in their healthcare infrastructure, which is driving the North American market.

The senior population in North America is growing quickly, and it is more prone to diseases. The development of the North American market is also driven by the government programs to increase the awareness of early disease diagnosis and imaging technology.

The market is set to grow at the highest CAGR, of 5%, in Asia-Pacific during the projection period, as a result of the region's booming need for improved imaging tools and encouraging government measures to upgrade healthcare infrastructure. This trend will be especially prominent in the rapidly expanding economies of Southeast Asia, China, Japan, and India. In addition, it is expected that the aging population and rising frequency of chronic diseases will boost the market expansion in the Asia-Pacific region.

With the advancement in technology, the application of digital systems is rising, since the images generated by them are converted into digital data on a real-time basis, which helps in the analysis of the patient’s condition within seconds. This feature has led to widespread application of these variants in dentistry, surgery, and mammography.

Additionally, companies are increasingly investing in new technologies. For instance, Fujifilm recently launched a mobile digital radiology system, which offers high-resolution imaging with low radiation doses. This new technology enables noise reduction circuits, which improves the granularity and ensures a high image quality.

Below is the regional breakdown of the market:

Want a report tailored exactly to your business need?

Request Customization

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages