Wind Turbine Protection Market Analysis

Explore In-Depth Wind Turbine Protection Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2030

Report Code: 13240

Explore In-Depth Wind Turbine Protection Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2030

Physical protection systems are the largest category in the wind turbine protection market, and its size is expected to reach USD 1.8 billion by 2030. Physical protection is essential to keep the wind tower intact in extreme weather conditions, particularly in offshore locations; and potential operational risks. Since wind turbine and tower components are expensive, regular upkeep is vital to ensure optimal performance and extended service life. Integrating specialized coatings for lightning and corrosion protection helps in minimizing severe breakdowns and avoiding costly repairs.

Software revenue is projected to rise at the highest CAGR, of 12%, in the next six years. The ease of operability provided by the recent innovations in digital technology and data-driven analytics helps optimize wind farm operations. Predictive maintenance, enabled with digital twins, is also gaining focus as it encompasses methods that forecast and identify issues in the physical condition of the components, aiding in timely maintenance.

The report offers insights for the below-mentioned product types:

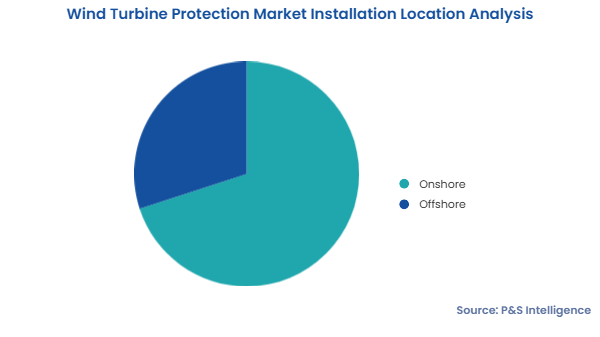

The onshore category dominates the wind turbine protection market with 70% share in 2024. Onshore farms offer more benefits than offshore ones, including quicker and cost-effective installation and easier maintenance, making the former more popular. As per the International Energy Agency, of the 900 GW of the global installed wind power capacity in 2022, 93% was accounted for by onshore installations. Existing infrastructure, including better connectivity via roads and to power grids, reduces the transportation and transmission costs. This lower cost to run ultimately decreases electricity prices.

Offshore is the faster-growing category, expected to rise at a CAGR of 11% during the projected period. Offshore deployment requires fewer turbines to generate the same amount of electricity as the farms onshore. The higher wind speeds and consistency help in a higher energy potential, making offshore installations increasingly preferable. Further, governments, driven by environmental concerns, are implementing significant policies and incentives to support the development offshore wind projects.

The segment is bifurcated as below:

Blades are the largest category in the wind turbine protection market, with 55% share in 2024. They are highly susceptible to damage, being directly exposed to environmental forces, including UV radiation, rain, hailstorms, snow, and debris, apart from the strong winds. In order to withstand wind forces, lightning strikes, and corrosion, the blades require coatings to prevent pitting. These factors drive the demand for innovative protection solutions to extend the life of blades and reduce maintenance costs.

Nacelles are the fastest-growing category, with a CAGR of 13% over the forecast period. The nacelle houses the turbine’s key and most-expensive components, including the gearbox, shafts, generator, and brakes, therefore requiring strong protection from thermal, electrical, and environmental forces, to maintain operational integrity.

The following equipment has been analyzed:

Wind farm operators dominate the end user segment. These operators manage multiple wind turbines and oversee expansive wind farms, which is why the demand for wind turbine protection solutions is the highest among them. They need to safeguard their assets, minimize maintenance costs, and optimize efficiency. Operators could be overtly affected by any potential loophole, issue, and risk; therefore, it is their primary responsibility to ensure the timely upkeep of the turbines for reliable operations.

Maintenance service providers are the fastest-growing category. As the deployment of wind turbines increases, the focus on their maintenance, to improve longevity and dependability, also amplifies. The recent advances in fault diagnostics and predictive maintenance have expanded the scope for independent service providers. Moreover, to reduce the hassles of maintaining the turbines themselves, utility companies are increasingly outsourcing these operations to industrial facility management firms.

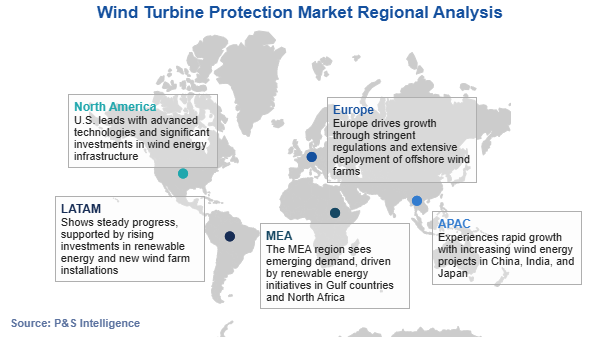

Asia-Pacific leads the wind turbine protection market with an estimated revenue of USD 0.8 billion in 2024. It will also witness the highest CAGR, of 14%, during the forecast period. This region is witnessing a huge population surge and economic development, correspondingly influencing energy consumption. The emerging economies of India and China are extensively investing in the deployment of wind turbines as they aim to meet the rising energy needs and contribute to emission reduction.

For instance, in India, the Ministry of New and Renewable Energy has brought the updated National Repowering and Life Extension Policy for Wind Power Projects 2023, allowing for the replacement of obsolete turbines with newer one. It encourages the optimization of the average energy yield and maximize the overall use of wind energy resources by enhancing the chief components, such as the shafts, gearboxes, and generators.

China also has an established a strong financial base and extensive domestic supply chain for both onshore and offshore wind turbines. This has helped lower the costs of manufacturing, operating, and managing these installations, by controlling the volatility in the prices of raw materials. As a result, companies that offer protection solutions for wind turbines are well-positioned to expand in China, the largest wind energy producer in the world.

The geographical breakdown of the market is as follows:

Want a report tailored exactly to your business need?

Request Customization

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages