Report Code: 11733 | Available Format: PDF | Pages: 143

Ultraviolet (UV) Curing System Market Research Report: By Type (Spot Curing, Flood Curing, Hand-Held Curing, Conveyor Curing), Technology (UV, UV LED), Pressure (Low, Medium, High), Application (Printing, Coating, Adhesive), End-User (Aerospace and Defense, Industrial Manufacturing, Electronics, Automotive, Healthcare), Geographical Outlook (U.S., Canada, U.K., France, Germany, Italy, China, Japan, South Korea, India, Mexico, Brazil, South Africa, Turkey, Saudi Arabia) - Global Industry Size, Share analysis and Demand Forecast to 2024

- Report Code: 11733

- Available Format: PDF

- Pages: 143

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Outlook

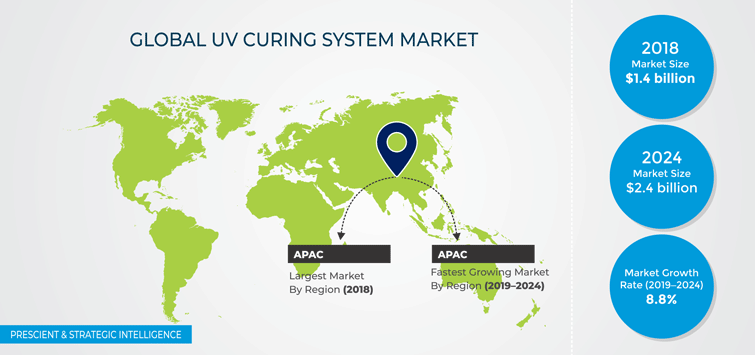

The ultraviolet (UV) curing system market revenue stood at $1.4 billion in 2018, and it is expected to witness a CAGR of 8.8% during 2019–2024. The market growth is because of the booming demand for consumer electronics, healthcare devices, and automobiles.

The Asia-Pacific (APAC) market for UV curing systems generated the highest revenue in 2018, and it is expected to register the fastest growth in the coming years. This can be primarily owed to the high demand for such systems in China, which is the largest manufacturing hub in the world.

Market Dynamics

The surging adoption of UV curing systems in furniture manufacturing units is emerging as a key market trend. These systems are widely used for curing the coatings on several substrates, such as wood, for high-quality finishing and quick drying, thereby leading to an improved productivity. In addition, UV-cured coatings offer protection to substrates against external agents, such as moisture, accidental chemical spills, and corrosion. Owing to these properties, these systems are being increasingly adopted in manufacturing plants.

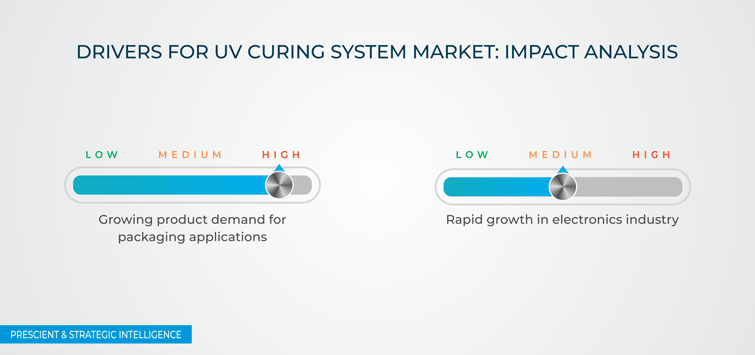

The increasing usage of UV curing for packaging applications is one of the most-prominent factors driving the growth of the UV curing system market. These systems are being deployed in the food & beverage industry because they are ideal for adhesive, printing, and coating applications, wherein they do not compromise the product quality and safety. Market players are, therefore, focusing on UV curing systems for food packaging due to the rising consumption of processed food and beverages.

Segmentation Analysis

In 2018, the conveyor category, within the type segment, generated the highest (nearly 30.0%) revenue. Conveyor curing provides uniform ink curing because the consistent speed of the conveyor ensures that each component is cured for the same period. This increases the throughput and facilitates mass production. In 2018, the APAC region recorded the highest demand for UV curing conveyor systems, accounting for over 35.0% of the market revenue share.

The conventional UV category held the largest market share within the technology segment, of over 65.0%, in 2018. Conventional UV systems can cure several types of substrates and produce different UV bandwidths for deeper-level curing. These are the prime reasons behind the wide adoption of this technology in the food & beverage sector, where it is primarily used for packaging applications.

The medium category, under the pressure segment of the UV curing system market, held the major share in 2018. These systems are widely used for varnishing, adhesion/bonding, glass decoration, metal decoration, and printed circuit board (PCB) curing.

In 2018, the coating category generated the highest (over 32.0%) revenue within the application segment of the UV curing system industry. UV-cured coatings protect the substrate from external agents, such as chemicals, dust, moisture, and extreme temperatures. UV curing is quick, and it helps increase the throughput and reduce the work-in-progress (WIP) time, thereby resulting in a higher manufacturing efficiency at a lower cost.

The automotive category generated the highest (over 40.0%) revenue in 2018, under the end user segment. This can be owed to the soaring demand for consumer electronics and electric vehicles (EVs) across the globe.

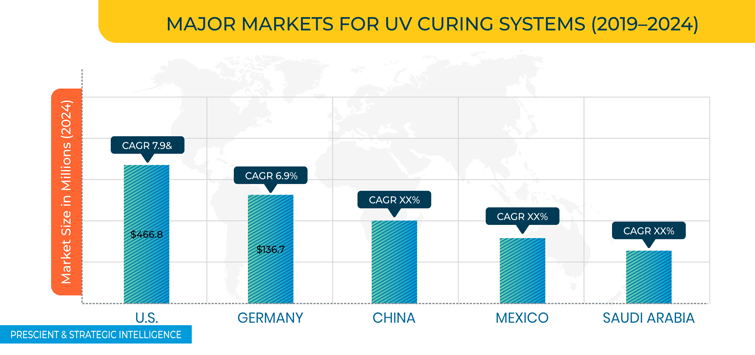

Geographical Analysis

The APAC region accounted for a 35.3% revenue share in 2018 due to the considerable growth in the automotive and electronics industries and notable demand for UV curing systems for plastic, metal, and wood finishing applications. Furthermore, the APAC region will register the fastest growth during 2019–2024 in the UV curing system market, at a CAGR of 10.0%. This can be attributed to the rapid economic growth and expansion of the manufacturing and food & beverage sectors in the region.

Additionally, the spurring demand for consumer electronics, including PCBs and consumer electronics, on account of the rising disposable income in India, Indonesia, Vietnam, and Thailand, is fueling the market growth. In 2018, APAC registered the highest demand for UV curing conveyors due to their large-scale adoption in the electronics industry of China, Japan, India, and South Korea.

The APAC market for UV curing systems will register the fastest growth in India during 2019–2024 owing to the rapid growth of the electronics industry in the country. According to the India Brand Equity Foundation (IBEF), the Indian electronics sector generated $100 billion in 2016, and it is projected to grow at a 41.4% CAGR during 2016–2020, to reach $400 billion.

Competitive Landscape

The UV curing system market is highly competitive in nature and is characterized by the presence of companies such as Heraeus Holding GmbH, Nordson Corporation, Dymax Corporation operating as key players. In 2018, the market players witnessed an increase in their sales volume, primarily in the APAC and LATAM regions, predominantly due to the increase in demand from the industrial manufacturing end-user category. This growth in demand is further projected to intensify the market competition during the forecast period.

Recent Strategic Developments of Major UV Curing System Market Players

Major players in the global UV curing system market are focusing on mergers and acquisitions, partnerships, product launches, and client wins to gain a competitive edge in the market. For instance, in April 2019, Heraeus Noblelight GmbH launched BlueLight Hygienic System, a system designed for food packaging applications. The UV light disinfection unit ensures safe and reliable food processing, further enhancing the shelf-life of F&B products. Besides, the system facilitates faster curing, which further results in lower production cost.

Furthermore, in May 2018, Heraeus Noblelight GmbH launched Light Hammer 10 Mark III, an IoT-enabled UV curing system. The system features a cloud-based advanced integrated monitoring system (AIMS) that enables remote monitoring in real time, further resulting in reduced downtime and total cost of ownership.

Key Questions Answered in the Report

- What is the current scenario of the UV curing system market?

- What are the emerging technologies that could impact the UV curing process?

- What are the key market segments and their market size and future potential?

- What are the major catalysts for the market and their impact during the short, medium, and long terms?

- What are the evolving opportunities for the players in the market?

- Which are the key regions from the investment perspective?

- What are the key strategies adopted by the major players to expand their market share?

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws