U.S. Water Pumps Industry Analysis

Type Insights

- The dynamic category will dominate the market by contributing 60% revenue in 2024.

- These variants’ adaptability, efficiency, and capacity to manage high flow rates make them preferred in a variety of applications such as agriculture, industrial processes, and residences.

- The dynamic centrifugal category will dominate the market by contributing 5.7% revenue in 2024. The centrifugal pumps are generally less expensive and easier to maintain in comparison to other categories.

- The positive displacement category is expected to witness highest CAGR in 2024−2030 because these variants are commonly used in applications where high pressure, accurate flow control, or handling viscous fluids is required.

- Oil and gas, chemical processing, and water treatment are the major industries that utilize these kinds of pumps.

The types covered in the report include:

- Positive Displacement (Fastest-Growing Category)

- Gear

- Peristaltic

- Cam

- Piston

- Others

- Dynamic (Largest category)

- Centrifugal (Largest category)

- Submersible

- Others

Technology Insights

- The electric category will dominate the market by contributing 75% revenue in 2024.

- This category will expand with sales and installs in a range of applications, such as residential use, commercial use, agricultural use, and municipal water supply.

- Additionally, it offers various advantages, such as high performance, dependable operation, and the capacity to manage high flow rates.

The technologies covered in the report are:

- Manual

- Electrical (Larger and Faster-Growing Category)

Power Insights

- The 0–1.5 hp category will dominate the market in 2024, and it is expected to witness highest CAGR in 2024−2030.

- This range of pumps is majorly used in smaller-scale applications, like irrigation systems, residential water supply, and light industrial processes.

- Additionally, they are affordable as well as suitable for smaller-scale applications, which normally require low flow rates and pressure requirements.

The following applications are included in the report:

- 0−1.5 hp (Largest and Fastest-Growing Category)

- 1.6−2 hp

- 2.1−4 hp

- 4.1−6 hp

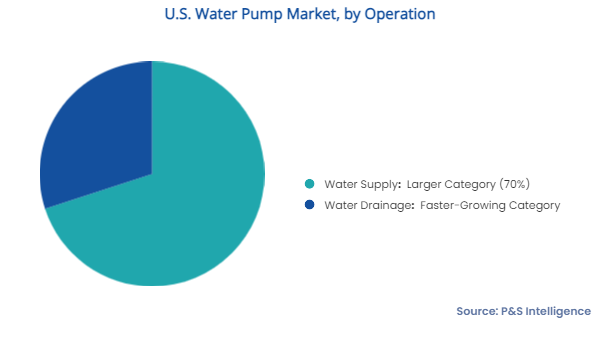

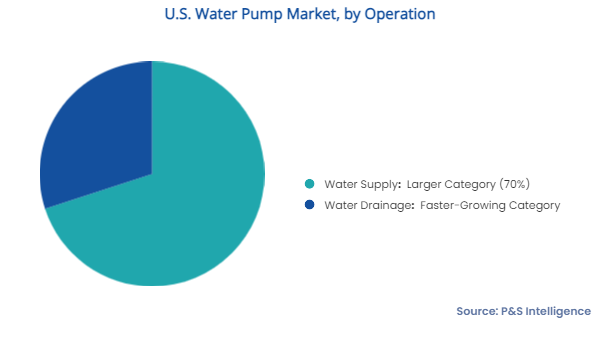

Operation Insights

- The water supply category will dominate the market by contributing 70% market revenue in 2024.

- They are used for supplying water to various end users and support the provision of drinkable water for industrial, commercial, and residential consumers, as well as agricultural irrigation.

- This category includes a wide range of applications, such as water distribution systems, water treatment plants, well pumps, booster pumps, and irrigation pumps.

- The water drainage category is expected to witness higher CAGR in 2024−2030.

- They are used for removing excess water from various locations, such as basements, construction sites, mines, and flood-prone areas.

- This category includes sump pumps, dewatering pumps, and sewage pumps, which help prevent flooding, manage groundwater levels, and facilitate drainage systems.

The following operations are included in the report:

- Water Supply (Larger Category)

- Water Drainage (Faster-Growing Category)

End User Insights

- The agriculture category will dominate the market by contributing 35% market revenue in 2024.

- The agriculture sector uses it for irrigation, particularly in the country’s arid and semi-arid areas.

- The residential category is expected to witness highest CAGR in 2024–2030 due to population growth, urbanization, and the construction of new buildings.

- Water pumps are used in various residential applications, such as water supply, pressure boosting, irrigation, and hot water recirculation.

- In 2024, according to a report, the average American family uses more than 300 gallons of water per day.

The following end users are included in the report:

- Agriculture(Largest Category)

- Mining

- Construction

- Manufacturing

- Water Treatment

- Oil and Gas

- Residential (Fastest-Growing Category)

- Others

Regional Analysis

- The western region will acquire the largest market share, of 55%, in 2024 because states such as California, Arizona, and Nevada have a high demand for water pumps.

- This demand occurs due to the presence of an arid climate, a large agricultural sector, and population growth in this region.

- Additionally, water scarcity issues are being faced by various states in this region, which increases the demand for efficient water pumping systems.

- The Northeast region will become the fastest-growing market, with a CAGR of 5.9%, in 2024−2030 due to the population growth in the states such as New York, Pennsylvania, and Massachusetts.

- Additionally, aging infrastructure replacements, the presence of expansive municipal water supply systems, and rising industrial activity are further propelling the market.

The regions analyzed in this report include:

- Northeast (Fastest-Growing Region)

- Midwest

- West (Largest Region)

- South