Report Code: 11665 | Available Format: PDF | Pages: 98

U.S. Sauces Market Research Report: By Type (Table Sauces, Cooking Sauces, Dips), Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online, Specialist Stores), Regional Insight (South, West, Northeast, Midwest) - Industry Size, Share Analysis and Forecast to 2024

- Report Code: 11665

- Available Format: PDF

- Pages: 98

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

U.S. Sauces Market

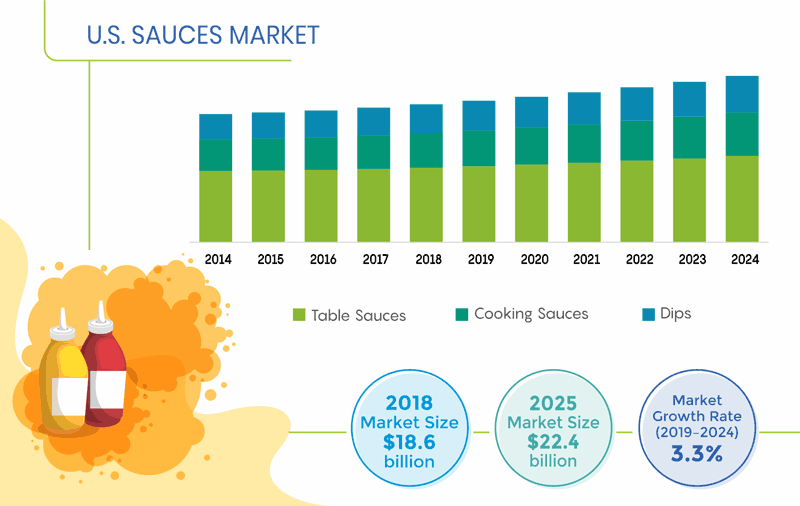

The U.S. sauces market recorded $18.6 billion in 2018, and is expected to growth at a CAGR of 3.3% during 2019-2024. The U.S. sauces market is projected to grow rapidly due to increasing popularity of ethnic cuisines, healthier food options, and shift toward organic or all-natural products, and growing number of immigrants in the country.

Based on type, U.S. sauces market is segmented into table sauces, cooking sauces, and dips. Among these, table sauces category accounted for largest share in the market in 2018. Food preferences is one of the major driving factors behind the dominant position of table sauce category. Additionally, dips is expected to be the fastest growing category during the forecast period. Shifting consumer preference toward ethnic cuisines, along with growing number of ethnic food chains, is providing strong growth to the dips market in the country.

Based on cooking sauces by type, U.S. sauces market is segmented into wet sauces, and dry sauces/powder mixes. Among these, wet sauces accounted for largest share in the market in 2018. Increasing health conscious consumer base offers a steady growth to the market, as consumers are shifting from ready-made meals to home-cooked food items.

Based on region, U.S. sauces market has been categorized into Northeast, Midwest, South, and West. Among these, South region held the largest share in the market. This is due to high population density in the region, along with growing inclination of consumers toward organic, and international flavors. Moreover, South and Northeast are expected to be the fastest growing regions during the forecast period. Rising number of Asian food outlets in Northeast districts such as New Jersey, New York, and Massachusetts, followed by increasing adoption of ethnic cuisines are some of the major drivers contributing to growth of the market.

U.S. Sauces Market Dynamics

Trend

The key trend observed in the U.S. sauces market are growing demand for organic and natural sauces. Consumers in the country are increasingly becoming health-conscious and are, therefore, trying to avoid consuming food products that have a negative impact on their health. With focus on their eating habits, numerous consumers are adopting an organic diet and are avoid consumption of food products that contain artificial additives and genetically modified organisms (GMOs). Sauce and snack companies are launching gluten-free variants in the market to cater to consumers with dietary considerations.

Another trend observed in the market include growing popularity of hot and spicy sauces. With the growing number of expatriates in the U.S. and the willingness of the natives to try out new cuisines, demand for hot sauces in the country is increasing more than ever. Asian and Mexican cuisines, which are known for their spicy and hot flavors, are gaining immense popularity, further driving the demand for spicy sauces.

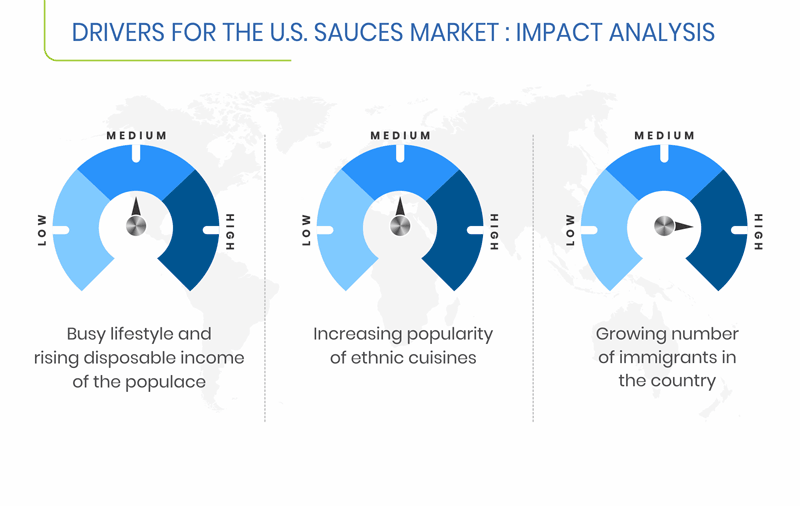

Driver

The key factors contributing to the growth of U.S. sauces market can be witnessed as busy lifestyle and rising disposable income of the populace. Factors such as busy lifestyle, longer working hours, and rise in the number of working professionals in urban areas are contributing to the increased demand for ready-to-use food products including sauces. Sauces are of great help for those who love cooking but generally do not have time for it owing to their busy schedule, as these ready-to-use condiments help in the quick preparation of meals.

Besides this, the rising disposable income of population continues to drive the demand for snack foods and sauces in the U.S. The disposable income of individuals in the U.S. increased to 4% from January 2018 to January 2019. Thus, with increasing disposable income, more people are opting for ready-to-use products and fast food joints across the country.

Opportunity

The key opportunity in the U.S. sauces market include growing demand for new variants and packaging solutions. New variants like honey–mustard sauce and mustard–mayonnaise sauces are gaining popularity and can be observed as lucrative areas of business by vendors to address the increasing demand for new flavors in the market. Moreover, many vendors have started integrating more natural ingredients into their products after exhibiting the growing consumer interest in organic and natural food products. Vendors in the market can focus on introducing new varieties of products in smaller packages, thereby allowing customers to try them without having the need to buy them in large quantities.

U.S. Sauces Market Competitive Landscape

The intensity of rivalry among players in the U.S. sauces market is moderate. The market is highly competitive characterizing a fragmented market share. The major players in the market are involved in mergers and acquisitions, product launches, and in partnerships. Some of the key players operating in the U.S. sauces market are Kikkoman Corporation, McCormick & Company Incorporated, The Kraft Heinz Company, Unilever Group, Conagra Brands Inc., Del Monte Foods Inc., Edward & Sons Trading Company Inc., Ken’s Foods Inc., General Mills Inc., Nestle S.A., C.H. Guenther & Son Inc., and Tas Gourmet Sauce Co.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws