U.S. Electric Vehicle Compressor Industry Analysis

Type Insights

- The scroll category will hold the largest market share, of 40%, in 2024, and is expected to grow at the highest CAGR, of 17.7%, during the forecast period. This is because of the high efficiency and reliability of these compressors.

- Additionally, scroll compressors are compact and have a lightweight design, which is suitable for EVs.

- Moreover, they produce lower sound emissions in comparison to other compressors.

The types analyzed in this report are:

- Swash

- Wobble

- Screw

- Scroll (Largest and Fastest-Growing Category)

- Air E-Compressor

Application Insights

- The air conditioning category will hold the largest market share, of 35%, in 2024, due to the increasing consumer focus on comfort and convenience.

- Geographically, the U.S. is a diverse nation with a vast range of climates. The Southwest has a warm climate, due to which air conditioning becomes an essential part of improving comfort.

- The vehicle electronics cooling category is expected to grow at the highest CAGR, during the forecast period.

- It is essential to maintain the temperature of the components used for the operation of EVs, such as sensors, power electronics, and onboard computers.

- With the increased temperature during their operation, these components have the potential to undergo thermal runaway, which can reduce component efficiency. This thermal runaway can be prevented with the help of good thermal management.

The applications analyzed in this report are:

- Air Conditioning (Largest Category)

- Battery Cooling

- Vehicle Electronics Cooling (Fastest-Growing category)

- Others

Drivetrain Type Insights

- The battery electric category will hold the larger market share, of 65% in 2024, and is expected to grow at a higher CAGR of 17.5%, during the forecast period.

- BEVS feature zero emissions and come with low operational costs, which make them popular.

- Increasingly, consumers in the U.S. are focusing on BEVs because of the declining cost of electrical batteries and the expansion of charging stations, which is driving up demand for compressors for pure-electric variants.

The drivetrain types analyzed in this report are:

- Battery Electric (Larger and Faster Growing Category)

- Hybrid/Plug-in Hybrid

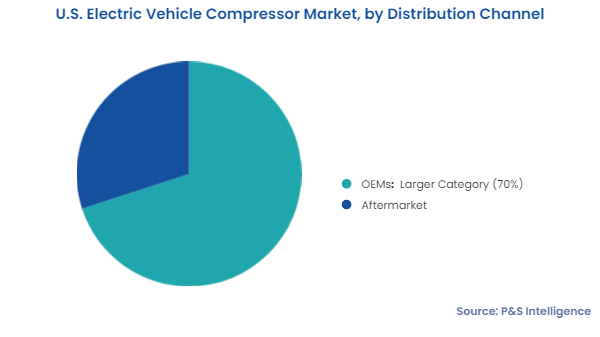

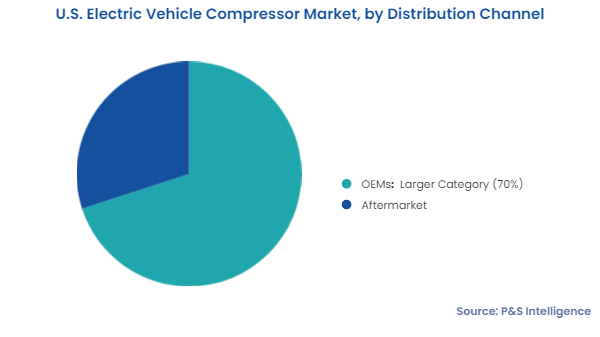

Distribution Channel Insights

- The OEM sales channel will hold the larger market share, of 70%, in 2024, and is expected to grow at a higher CAGR during the forecast period.

- OEMs provide better quality and dealership warranties than the aftermarket, which makes it a better channel.

- Furthermore, they focus on safety, and mass production of the products.

The distribution channels analyzed in this report are:

- OEMs (Larger and Faster Growing Category)

- Aftermarket

Vehicle Type Insights

- Passenger vehicles will hold the largest market share, in 2024, and are expected to grow at the highest CAGR, of 17.4%, during the forecast period.

- This is due to the rise in the demand for electric cars and motorcycles in the U.S., as people are increasingly focusing on environmental sustainability.

- Furthermore, this rise in the sale of passenger electric vehicles is due to new government policies regarding environmental concerns and sustainable development.

The vehicle types analyzed in this report are:

- Passenger Vehicles (Largest Category and Faster-Growing Category)

- Hatchbacks

- Sedans

- Utility vehicles

- Light Commercial Vehicles

- Medium- and Heavy-Duty Trucks

- Buses and Coaches

- Off-Highway Vehicles

- Construction and mining equipment

- Agricultural vehicles

- Industrial vehicles

Geographical Analysis

- The West region will hold the largest market share, of around 55%, in 2024, and is expected to grow at the highest CAGR of 17.5% over the forecast period.

- This is due to the increasing sales of electric vehicles in the particular region.

- California has been a leader in the EV industry by setting encouraging manufacturing and purchase policies. In California, EV registrations increased by more than 60% between 2021 and 2022.

- Additionally, the average number of electric cars (EVs) per 1,000 registered vehicles in the Golden State is 25.02, which is more than any other state in the U.S.

The regions analyzed in this report are:

- Northeast

- Midwest

- West (Largest and Fastest-Growing Region)

- South