U.S. Diesel Genset Market Analysis

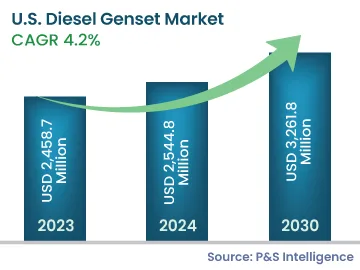

The U.S. diesel genset market generated revenue of USD 2,458.7 million in 2023, which is expected to witness a CAGR of 4.2% during 2024–2030, to reach USD 3,261.8 million by 2030. The market growth is supported by the augmenting requirement for an uninterrupted and reliable power supply and the rising instances of power outages in the country. Further, the surging development of corporate offices, hotels, and residential homes boosts the demand for power backup solutions, which, in turn, bolsters the demand for gensets.

According to a report published by the U.S. Census Bureau, construction spending in February 2022 was USD 1,704.4 billion, about 0.5% more than the revised January estimation of USD 1,695.5 billion. This growth in the U.S. construction sector generates a significant demand for diesel gensets, as a considerable number of construction activities are taking place in areas with an insufficient supply of grid-based power.

Further, there has been an increase in the instances of power outages in the U.S. in recent years, primarily due to natural calamities and other factors, such as the aging power grid infrastructure and overloading. Important places, such as hospitals, nuclear power plants, telecom towers, data centers, and fire stations, require a 24/7, stable, and continuous supply of power. Power failure can affect devices and equipment in these application areas, thereby hampering their ability to function properly, owing to their inability to handle load surges and discontinuous power supply. Therefore, the growth in these areas boosts the demand for gensets in the country.