Report Code: 11538 | Available Format: PDF | Pages: 70

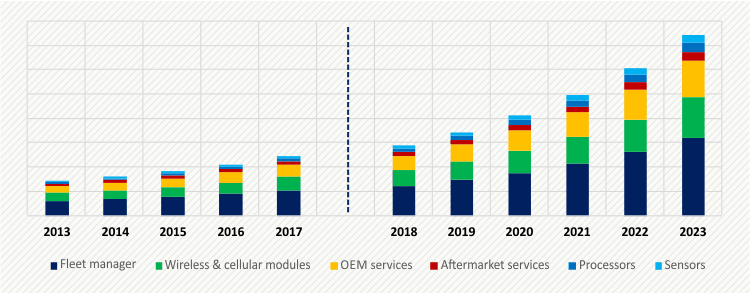

U.S. Connected Car Market by Products & Services (Fleet Manager, Wireless & Cellular Modules, OEM Services, Aftermarket Services, Processors, Sensors), by Technology (4G/LTE, 3G, 2G), by Application (Navigation, Infotainment, Telematics), by Connectivity (Integrated, Embedded, Tethered) - Market Size, Share, Development, Growth, and Demand Forecast, 2013-2023

- Report Code: 11538

- Available Format: PDF

- Pages: 70

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

U.S. Connected Car Market Overview

The U.S. connected car market attained a size of 12,354.8 million in 2017 and is forecasted to reach $37,350.1 million by 2023, registering a CAGR of 20.8% during 2018–2023. The major factors driving the market growth are increased focus toward safety and security, advancement of vehicle-to-vehicle (V2V) connectivity, and introduction of internet of things (IoT) in automotive industry.

A connected car is a car which is equipped with internet access, and has the ability to optimize its own operations on fixed intervals. The network connectivity permits the car to share content with a range of devices lying within and outside the vehicle’s environment. The various applications of network connectivity include navigation, telematics, and infotainment.

Based on products and services segment, the U.S. connected car market is categorized into fleet manager, wireless and cellular modules, OEM services, aftermarket services, processors, and sensors. Of these, fleet manager held the largest share in the U.S. market in 2017. This category is growing owing to the adoption of connected car technologies, primarily tracking of vehicles in the fleet by fleet managers. Such technologies help fleet managers to track the vehicle condition and do vehicle maintenance before the occurrence of any serious vehicle casualties.

Based on technology, the U.S. connected car market is categorized into 4G/LTE, 3G, and 2G. Among these, 4G/LTE technology is expected to be the fastest growing technology in the market, registering a CAGR of 23.8% during the forecast period. 4G/LTE technology enables consumers to quickly download files over a wireless network, and provides enhanced high voice quality, ease in usage of IM, social networks, streaming media, video calling, enhanced navigation system for the vehicle, and higher bandwidth.

Integrated category was the largest category in the connectivity segment in U.S. connected car market, holding 43.9% market share in 2017. The dominance of the integrated connectivity category can be owed to its compact structure and user-friendly characteristic nature.

U.S. Connected Car Market Dynamics

Trends

The emergence of AV technology in the U.S. connected car market is one of the key trends that is here to stay. The market has already witnessed advanced driver-assistance system (ADAS) solution which has changed the face of driving experience, making it safer than ever. Up until now, the automotive OEMs, in collaboration with their technology partners (for instance, BMW AG and NVIDIA Corporation; Volvo AB and Google LLC), have delivered significant breakthroughs in the market.

The technologies used in semi-autonomous vehicles, including adaptive front lighting system, lane-departure warning system, and surround view, have made the headway for the AV technology. Although, the AV technology is already being tested at working level under fixed circumstances, its commercial incorporation in cars is still underway. The growth and acceptance of such technology are predominantly dependent upon the hardware and software innovations. The hardware development is already approaching the level required for the AV technology to be commercialized, but the growing demand for related software to increase the driver experience is rising the attention toward software that needs to be upgraded to unlock the full potential of the AV technology and the hardware involved.

Drivers

Increased focus toward safety and security is one of the major drivers in the U.S. connected car market. Vehicle safety and security have become major areas of focus for the OEMs, end users, and the government. Technologies like ADAS, automatic braking, and lane assist significantly enhance the driving experience, making it safer than ever. Such technologies help to reduce traffic rule violation, in turn causing a decline in the road accidents.

For example, the National Highway Traffic Safety Administration (NHTSA) of the U.S. Department of Transportation recommends technologies, such as crash imminent braking (CIB), dynamic brake support (DBS), and other promising technology including pedestrian automatic emergency braking (PAEB), to increase road safety. The NHTSA works closely with the industry partners and safety advocates to spread awareness among the vehicle buyers about the use of such technologies for passenger safety, thereby promoting the penetration of the U.S. connected car market in the coming years.

Restraints

The major restraint witnessed in the U.S. connected car market is security threat. The connected cars use a range of technologies that are predominantly powered by IoT. Although, the connected cars offer passenger safety and enhance driving experience, but their vulnerability to the security threats is one of the major concerns. The automotive OEMs are working closely in collaboration with their technological partners to come up with the solutions to counter such threats to make the connected car experience safe and secure, but the efforts do not seem to be enough, thereby restraining the growth of the connected car market in the U.S.

Competitive Landscape

The key players in the U.S. connected car market are taking strategic measures to gain a competitive edge over their competitors in the market. The strategic moves range from mergers and acquisitions to business expansions and partnerships. To gain a competitive edge over other players in the market, the companies are focusing on improving their existing connected car products and working in collaborations with other market leaders to expand their market reach. The major players in the market are Delphi Technologies PLC, Robert Bosch GmbH, Denso Corporation, Autoliv Inc., Continental AG, and ZF Friedrichshafen AG.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws