Report Code: 11471 | Available Format: PDF | Pages: 68

U.S. Coding and Marking Systems Market by Technology (Continuous Inkjet, Thermal Transfer Overprinting, Thermal Ink Jet, Drop on Demand, Print & Apply Labelers, Laser Coding & Marking), by End User (Food & Beverages, Electrical and Electronics, Automotive & Aerospace, Chemicals, Healthcare) -Market Size, Share, Development, Growth, and Demand Forecast, 2013-2023

- Report Code: 11471

- Available Format: PDF

- Pages: 68

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

U.S. Coding and Marking Systems Market Overview

The U.S. coding and marking systems market was valued at $558.4 million in 2017 and is projected to reach $860.6 million by 2023, witnessing a CAGR of 7.6% during the forecast period. The increase in demand for coding and marking systems in the country is driven by the surge in R&D activities by key manufacturers and rising demand from the automotive industry.

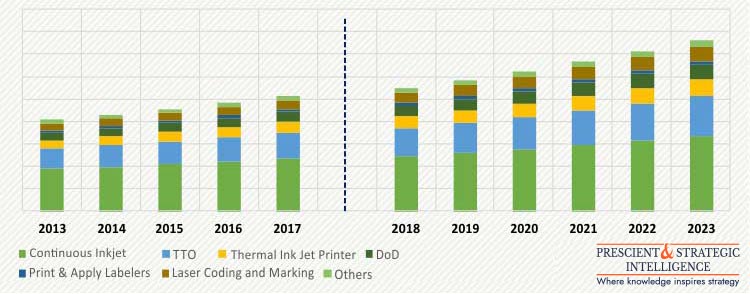

U.S. CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY, UNITS (2013–2023)

Coding and marking systems provide product related details on the packaging, such as batch number, price, manufacturing and expiry date, and other related information to end users. Coding and labelling allow the identification and tracking of components through the different phases of the production process.

On the basis of technology, the U.S. coding and marking systems market is segmented into continuous inkjet, thermal transfer overprinting (TTO), thermal ink jet, drop on demand (DoD), print and apply labelers, and laser coding and marking. Of these, continuous inkjet was the largest category in the market, with respective volume and value contributions of exceeding 40.0% and 35.0% in 2017. Continuous inkjet offers several benefits such as very high-speed printing, ability to print characters on virtually any material, and the ability to run for long hours with minimum servicing requirement. These properties lead to growth in it’s in the market.

On the basis of end user, the U.S. coding and marking systems market is segmented into food and beverage, electrical and electronics, automotive and aerospace, chemical, healthcare, and others. Food and beverage was the largest end user category in the market, with the respective volume and value contributions exceeding 45.0% and 40.0% in 2017. Stringent government regulations in the country regarding safety and traceability have mandated the proper labeling of manufacturing date, nutrition facts, ingredient list, and manufacturer details on the primary and secondary packages of food and beverage items; thereby leading to the market growth.

In the U.S., the market growth is driven by the introduction of new variants of digital printing technology by leading players such as Danaher Corporation, Dover Corporation, and Domino Printing Sciences plc. In addition, boost in the manufacturing sector owing to stable macroeconomic outlook and decrease in the cost of managing the supply chain owing to vertical integration by leading players are also fueling the growth of the U.S. coding and marking systems market. For example, Dover corporation achieved more than 3.0% growth in printing and identification platform during the fourth quarter of 2017.

U.S. Coding and Marking Systems Market Dynamics

The major trend identified in the U.S. coding and marking systems market is a shift from conventional printing to digital printing solutions. Surge in R&D activities by key manufacturers and rising demand from the automotive industry are the major drivers in the market.

Trends

Many industries are moving from conventional printing to digital printing solutions. The main reason behind the shift is that digital printing solutions such as continuous inkjet offer printing of millions of characters using just a litre of ink. Also, the ink used in digital solutions dries quickly, while conventional printing solutions (such as flexo and gravure as well as offset printing press) are time consuming and generate more inventory waste. This makes the digital printing process quick, efficient, and cost-effective. Hence, shift from conventional printing to digital printing solutions is a major trend witnessed in the U.S. coding and marking systems market.

Drivers

Coding and marking manufacturers are increasing their R&D activities in order to meet the growing demand for printing solutions from various end use industries. For instance, in March 2018, REA JET U.S. opened a new service center in Texas, the U.S. Through this center, the company aims to provide high resolution ink jet, DoD large and small character ink jet, and other coding technologies, on-site technical training and service, and equipment repairs to its customers. Hence, surge in the R&D activities by key manufacturers is the major driving force witnessed in the U.S. coding and marking systems market of the country.

Restraints

Coding and marking in the food and beverage industry, especially directly onto the surface of the food, needs specific equipment and inks. Hence, manufacturers dealing in the coding and marking solutions must comply with U.S. Food and Drugs Administration (FDA) standards while providing high quality codes and labels to meet consumer demands for freshness and to ensure complete traceability. For example, in the U.S., drug manufacturers need to follow coding and marking guidelines mentioned in Drug Supply Chain Security Act. Hence, such stringent requirements from the regulatory authority of the country, hampers the U.S. coding and marking systems market growth in the country.

U.S. Coding and Marking Systems Market Competitive Landscape

Some of the major players operating in the U.S. coding and marking systems market are ID technology, REA Elektronik GmbH, Domino Printing Sciences plc, Matthews International Corporation, Dover Corporation, and Danaher Corporation.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws