Report Code: 12876 | Available Format: PDF | Pages: 330

Surface Disinfectant Market Size and Share Report by Composition (Alcohol, Chlorine Compounds, Quaternary Ammonium Compounds, Hydrogen Peroxide, Peracetic Acid), Type (Liquid, Wipes, Spray), Application (Surface, Instruments), End User (Hospitals, Diagnostic Laboratories, Pharma & Biotech Companies, Research Laboratories) - Global Industry Growth Forecast to 2030

- Report Code: 12876

- Available Format: PDF

- Pages: 330

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Surface Disinfectant Market Overview

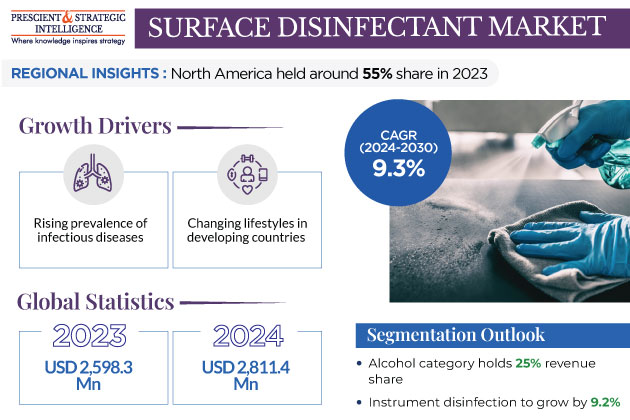

The global surface disinfectant market size was USD 2,598.3 million in 2023, and it is expected to reach USD 4,786.7 million in 2030, with a growth rate of 9.3% during 2024–2030. This is attributed to the increasing number of surgeries in healthcare facilities and the recent outbreak of infectious diseases. Additionally, the launch of innovative disinfectant products and developing countries will provide immense opportunities for key players in the coming years.

For instance, on January 2023, Health Canada granted a Drug Identification Number to GermStopSQ by Good Theorem. This disinfectant kills 99.999% of bacteria and 99.9% of human coronavirus 229E for 24 hours.

Moreover, the growth is attributed to several factors, including

- increasing hygiene lifestyle in developing countries

- rising awareness about overall hygiene

- escalating demand for disinfectants for use in hospitals, and

- surging demand for cleaning products, sanitizers, and disinfectants.

Alcohol Category To Dominate Market

Alcohol category accounted for the largest market share in 2023. This is attributed to high efficacy of alcohol-based disinfectants against bacteria and virus. Alcohol-based disinfectant are bactericidal rather than bacteriostatic against different forms of bacteria. Moreover, they are fungicidal and tuberculocidal as well.

Further, companies are launching several alcohol-based disinfectants.

- In September 2022, Deepak Fertilisers and Petrochemical Corporation Ltd. (DFPCL), a manufacturer of fertilizers and industrial chemicals, announced the launch of Cororid disinfection solution specifically for hospitals, laboratories, clinics, and other medical and healthcare facilities.

Furthermore, the WHO recommends two alcohol-based formulations, which, in a study published in January 2023, showed significant inactivation of the monkeypox virus. The WHO recommends these inexpensive alcohol-based hand rub formulations to reduce the transmission of pathogens. The study found that MPXV was inactivated by both formulations, supporting their use in healthcare and during virus outbreaks. The spread of monkeypox virus has led the WHO to implement its highest level of alert, declaring the contagion a public health emergency, much like COVID-19.

Chlorine and its compounds account for the second-largest share in the market, and they are expected to grow at significant CAGR during 2024–2030. This is because:

- They have a broad spectrum of antimicrobial activity

- They are unaffected by water

- They do not leave toxic residue

- They are fast-acting and inexpensive

- They remove fixed organisms and biofilms from surfaces

- They have little risk of toxicity

Hydrogen peroxide also holds a significant share in the market, attributed to some studies in which it has shown promising results.

- A study concluded that 3% hydrogen peroxide can rapidly eliminate 99.99% of SARS-CoV-2 on different types of fabrics. Thus, this chemical can be effectively applied as a disinfectant to reduce the further spread of SARS-CoV-2 through fabrics.

- Moreover, a study showed that a combination of hydrogen peroxide and iodine was successful at stopping the growth of 16 types of fungi.

In addition, the most-commonly used concentration of hydrogen peroxide is 3%. Stronger concentrations are used in different industries, such as hair coloring. As per the EPA, hydrogen peroxide is ideal for killing many kinds of germs on surfaces found at homes and environment-friendly for these spaces as well.

Quaternary ammonium compounds also hold significant share. This is because government agencies in the U.S. and many other countries have published official lists of recommended disinfecting products with possible viricidal efficacy.

- Bactericidal and viricidal ingredients include quaternary ammonium salts, phenolic compounds, biguanides, and diols, which differ substantially in properties and environmental behavior.

- In addition, majority of disinfectant products contain a quaternary ammonium compound as the main ingredient, while others may contain single ingredients, such as isopropanol, hydrogen peroxide, sodium hypochlorite, peroxyacetic acid, ethanol, octanoic acid, phenolic, L-lactic acid, and glycolic acid.

- Quaternary ammonium compounds represent the largest category of the U.S. EPA’s approved SARS-CoV-2 disinfectants and consist of a variety of compounds that share an organically substituted ammonium compound. In a solution, they can ionize to produce cations.

Peracetic acid is expected to grow at a significant CAGR during 2024–2030, attributed to the innovations being brought about by the players in disinfectants containing this chemical.

- In September 2021, Enviro Tech Chemical Services (ETCS) introduced, PeraGuard, a dry peracetic acid (PAA) floor and equipment disinfectant.

- PeraGuard is designed to improve environmental biosecurity and sanitation on surfaces. The product is EPA-registered for use in food & beverage facilities, wineries, milking barns, farm premises, animal laboratories, pet food plants, breweries, beverage plans, and transport vehicles.

| Report Attribute | Details |

Market Size in 2023 |

USD 2,598.3 Million |

Market Size in 2024 |

USD 2,811.4 Million |

Revenue Forecast in 2030 |

USD 4,786.7 Million |

Growth Rate |

9.3% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Composition, By Type, By Application, By End User, By Region |

Explore more about this report - Request free sample

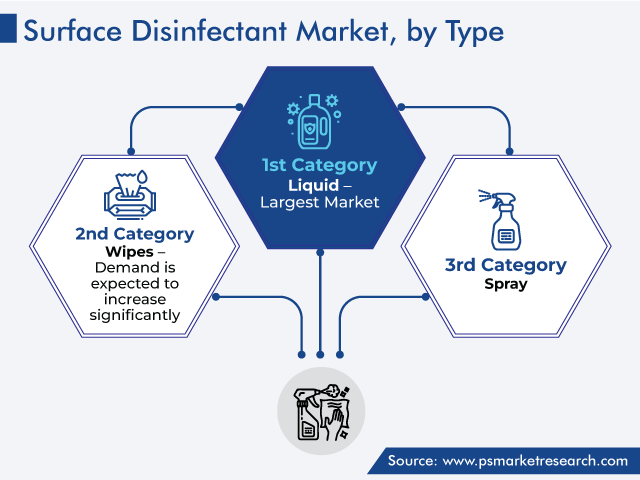

Liquid Variants Account for Largest Share

The liquid category accounted for the largest revenue share, of around 50%, in 2023. This is attributed to a wide scope of application of liquids in the household and industrial sector and cleaning of tile, windows, plastics, exterior surfaces, and glass. In addition, as it has low viscosity, it can disinfect more area in less amount. Furthermore, liquid surface disinfectants are used in large amount in the food & beverage industry and hospitals as they are easily available in the market.

Wipes are expected to be the fastest-growing segment during 2024–2030. This is because of the cheaper rate and availability of a variety of wipes, such as quaternary ammonium-based and alcohol-based. Furthermore, the rising investment in the production of wipes is expected to boost the growth of this category during the forecast period.

- In January 2022, the Government of Ontario announced plans to invest approximately USD 10 million in a new disinfectant wipe production facility of Empack Spraytech Inc. in Barrie.

- This new facility will help Empack Spraytech Inc. expand its production capacity for the Zytec Germ Buster brand of disinfectant wipes.

- This investment will help this 100,000-square-foot facility produce more than 4 million wipes per day, to meet the growing demand for disinfection consumables.

Further, Health Canada has approved disinfectants containing a wide range of active ingredients, such as benzalkonium chloride, citric acid, and combinations of QAC, all of which have been tested to prove efficacy against the coronavirus. It is also developing novel products using hydrogen peroxide at the new facility to further expand the market.

Moreover, companies are launching their next generation of such products. For instance, in June 2022, Kinnos Inc. announced the launch of its next generation of Highlight temporarily colors disinfectant wipes. They provide hospital staff members with a visual cue to see where they have wiped and instantly improve the quality of disinfection.

The spray category also holds a significant share in the market due to product launches. For instance, the Clorox Company, in March 2022, launched new refillable Clorox Disinfecting, an aerosol-free disinfecting mist, which effectively kills 99.9% of the viruses and bacteria on surfaces. Its bleach-free formula allows consumers to disinfect a variety of surfaces.

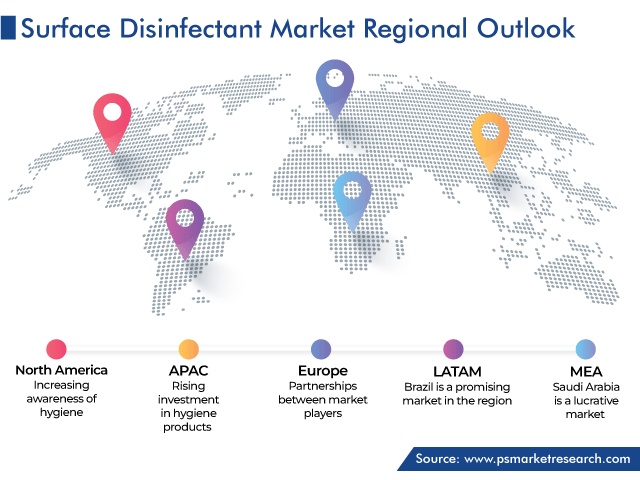

North America Is Largest Surface Disinfectant Market

North America held the largest share, of around 55%, in the surface disinfectant market in 2024, and it is expected to grow at a CAGR of 9.4% during 2024–2030. This is due to the rising prevalence of chronic disease, increasing awareness of hygiene, and surging approvals of disinfectants for usage amidst the COVID-19 threat in the U.S. and Canada.

- The EPA has approved two Lysol products—Lysol Disinfectant Spray and Lysol Disinfectant Max Cover Mist—for use against the novel coronavirus.

- Both the products have been approved for application on hard, non-porous surfaces.

- A study published in the American Journal of Infection Control highlights the effectiveness (99.9%) of such products against COVID-19.

Europe also holds a significant share due the partnership between the market players. Moreover, companies are creating disinfectant that can kill the coronavirus.

- In November 2022, Reckitt Benckiser Group pl and Essity AB launched co-branded disinfection products. The antimicrobial foam soap, antibacterial multipurpose cleaner spray, and a hand sanitizer gel for exclusive dispensing via Tork dispensers, were launched under the Dettol, Tork, and Sagrotan brands in the U.K., Germany, Ireland, and Austria.

- Rely+On Virkon is a broad-spectrum disinfectant for cleaning and disinfecting hard non-porous surfaces from LANXESS AG. It has been independently proven to kill the SARS-CoV-2 virus in just 60 seconds.

Asia-Pacific Will be the fastest-growing region, with a CAGR of 9.7%, during 2024–2030. This is attributed for the rise in the investment in hygiene products and partnerships to raise awareness of cleanliness among local communities.

- In April 2022, Reckitt Benckiser Group plc announced partnerships with four NGOs, named Hong Kong Red Cross, Feeding Hong Kong, Evangelical Lutheran Church Social Service, and Hong Kong Council of Early Childhood Education and Services.

- The aim was to launch the Hong Kong Community Care Programme 2022, providing quality hygiene, nourishment, and wellness solutions in rural areas.

Some Key Players Operating in Market Are:

- Reckitt Benckiser Group Plc

- Ecolab Inc.

- The Clorox Company

- Diversey Inc.

- Metrex Research LLC

- Medline Industries

- GOJO Industries Inc.

- Brulin Holding Company Inc.

- GESCO Healthcare Pvt. Ltd.

- Paul Hartmann AG

Market Breakdown

This fully customizable report gives a detailed analysis of the surface disinfectant market from 2017 to 2030, based on all the relevant segments and geographies.

Segment Analysis, By Composition

- Alcohol

- Chlorine Compounds

- Quaternary Ammonium Compounds

- Hydrogen Peroxide

- Peracetic Acid

Segment Analysis, By Type

- Liquid

- Wipes

- Spray

Segment Analysis, By Application

- Surface

- Instruments

Segment Analysis, By End User

- Hospitals

- Diagnostic Laboratories

- Pharma & Biotech Companies

- Research Laboratories

Region/Countries Reviewed for this Report

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws