Report Code: 10822 | Available Format: PDF

Solar Microinverters Market Report: Size, Share, Strategic Developments, and Growth Potential Estimation, 2024-2030

- Report Code: 10822

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

Market Overview

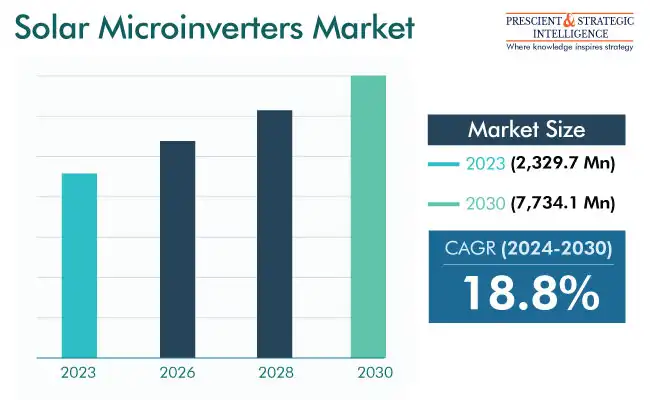

The global solar micro inverters market was valued at USD 2,329.7 million in 2023, and it is projected to grow at a rate of 18.8% during 2024 and 2030, reaching USD 7,734.1 million in 2030.

A solar micro inverter is a plug-and-play device utilized in photovoltaic installations to change the DC generated by a PV module to AC. Contrary to the orthodox central inverters, micro inverters work on the module level, allowing power transformation for every individual module. This method reduces the opposing effects of module disparity and leads to advanced overall system efficiency.

Furthermore, these devices have several benefits, including easy installation, module-level tracker, higher design flexibility, and better security in comparison to orthodox inverters. Thus, their module-level power electronics provide significantly enhanced efficiency in comparison to conventional systems, using maximum power point tracking to make the most of the output from every module.

High-Potential Indian Market Can Offer Significant Business Opportunities

India renewed its target to increase its solar energy capacity from the current 7.6 GW to 100 GW by 2022. A major part of this increase, around 40 GW, was to come from rooftop installations. Therefore, according to professionals, the market for solar micro inverters in India is expected to develop at a significant pace. Further, this development is likely to contribute significantly to the overall market growth in the Asia-Pacific region. Businesses in this sector have the potential to create solutions precisely focused on customers in India.

Fast Shift toward Central Inverters across Sectors

As per the World Bank, the worldwide economy is predicted to develop by 3.3% in 2023, creating a big possibility for the construction industry to thrive. In tandem with this, the surging investment in renewable electricity technologies, specifically BIPV, is poised to drive the expansion of the market.

In May 2022, SMA launched Sunny Tripower X, a three-phase solar inverter that enhances solar power production and features SMA Data Manager M abilities powered via ennexOS. The Sunny Tripower X can control and monitor up to five inverters in an industrial or residential energy system with a combined capacity of up to 135 kW.

Therefore, The continuous improvement and acceptance of more-efficient and accessible PV systems are set to propel the demand for them. These systems, unlike traditional string and central inverters, provide several benefits, such as higher power output, module tracking, longer life, tougher security, extended flexibility, ease of installation, and minimized risk of failure. Additionally, the rising use of AC modules might even entice new players to invest in the micro inverters market.

Integrated Category To Showcase Higher Revenue Growth Rate

The integrated category is projected to showcase the quicker solar micro inverters industry revenue growth during the projection period. This can be credited to the lower cost of these alternatives, rising focus of the major companies on integrated variants, growing count of product introductions, and surging frequency of strategic partnerships.

On the basis of end user, the residential category dominates the market within the end user segment. This is mainly because of the surge in the requirement for these devices in residential photovoltaic installations and the rise in the electricity requirements in India, the U.S., China, Japan, and almost all other nations. Moreover, with the burgeoning trend of green buildings, solar installations are becoming common at homes, as they not only allow people to reduce their fossil-based energy usage but also avail of feed-in tariffs.

| Report Attribute | Details |

Market Size in 2023 |

USD 2,329.7 Million |

Revenue Forecast in 2030 |

USD 7,734.1 Million |

Growth Rate |

18.8% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

Rising Spending on Renewable Energy

The growing concerns about fossil fuel depletion and rising emissions are driving the interest in solar modules and other alternative energy sources. This heightening focus on solar energy is expected to boost micro inverter sales, given their crucial role in enabling solar power production. China leads the way in PV capacity, accounting for an increase of 100 GW in 2021 from 2020, according to the International Energy Agency (IEA).

On the global level, solar energy capacity rose by 270 TWh and reached around 1,300 TWh in 2022. Further changes in government guidelines and augmenting investments in solar technologies, encouraged by subsidies, are expected to drive the demand for solar microinverters.

Micro solar inverters offer various advantages over the traditional string and central inverters. These benefits include increased energy yield, module-level monitoring, longer lifecycles, enhanced safety features, improved flexibility, simplified operation, and the absence of a single point of failure. Essentially, if one inverter fails, those connected to other modules keep working.

Growing Traction for Solar Photovoltaic (PV) Inverters

The increasing use of solar modules in homes is the biggest trend in the market. As the world rapidly moves toward renewable power sources, experiences significant urbanization, and witnesses a surge in the traction of photovoltaic (PV) inverters, the demand for solar micro inverters is set to remain high throughout the projection period.

PV modules produce direct current, which makes them unusable for the majority of the industries on their own. This is why inverters are used to change the DC to AC, thus enabling the acceptance of solar energy for grid, distributed residential, industrial, and other applications.

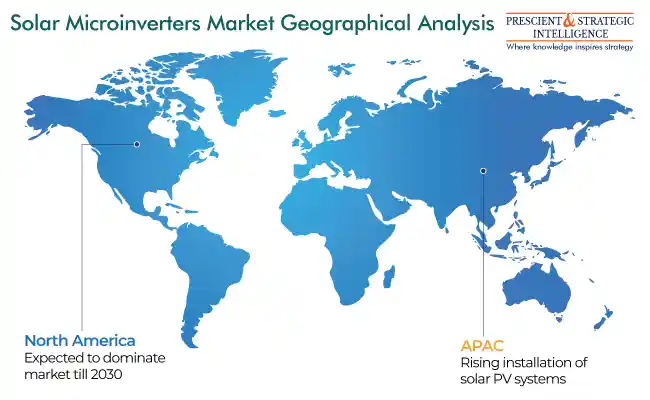

North America Is Dominating Market

During the historical period, North America held the top position in the market, and this trend is set to continue till 2030. The primary reasons behind this include a significant number of homes with on-site PV systems and government initiatives promoting solar PV systems in the region. The Inflation Reduction Act of 2022 allows for substantial investment in the solar energy industry of the U.S.

In the forecast period, the Asia-Pacific (APAC) region is expected to experience the swiftest growth in revenue. This is attributed to the increasing number of PV installations, surging electricity demand, considerable reductions in micro inverter costs, advancements in device functionalities, and overall improved efficiency.

Within the APAC region, China leads the market, benefiting from the government funding and law amendments to encourage the adoption of clean energy technologies.

Key Companies in Solar Micro Inverters Market

- Enphase Energy Inc.

- SolarEdge Technologies Inc.

- ABB Ltd.

- SMA Solar Technology AG

- SunPower Corporation

- Altenergy Power System Inc.

- Darfon Electronics Corp.

- Northern Electric and Power Co. Ltd.

- Chillicon Power LLC

- Sparq Systems

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws