Report Code: 10950 | Available Format: PDF | Pages: 174

Solar Encapsulant Market Research Report: By Material (Ethylene Vinyl Acetate, Polyvinyl Butyral, Polyolefin Elastomer), Technology (Crystalline Silicon Solar Technology, Thin-Film Solar Technology [Cadmium Telluride, Copper Indium Gallium Selenide, Amorphous Silicon]), Application (Construction, Electronics, Automotive)- Global Industry Size, Share, Trends, Growth, and Demand Forecast to 2023

- Report Code: 10950

- Available Format: PDF

- Pages: 174

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

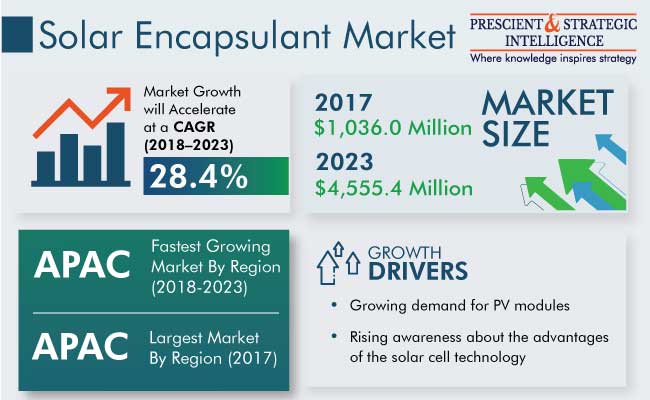

The global solar encapsulant market was valued at $1,036.0 million in 2017, and is expected to surpass $4,555.4 million by 2023 with a CAGR of 28.4% between 2018 and 2023.

Globally, the APAC region is expected to witness the fastest growth in the industry during the forecast period both in terms of volume and value. This can be mainly attributed to an increase in the production capacity of solar modules by key manufacturers in the region. In recent years, the price inflation of solar products in Europe resulted the shift of module manufacturers from Europe to China. According to the National Energy Board data of 2016, China expanded its PV power generation capacity by 34.54 GW.

Moreover, favorable governmental policies and easy availability of low-cost skilled labor in this region have led to the growth of the APAC solar encapsulant market.

Fundamentals Governing Solar Encapsulant Market

Currently, crystalline silicon solar technology is implemented in building solar modules. Crystalline silicon-based solar modules are fragile in nature and exhibit high production cost. This has resulted manufacturers to focus on cost-efficient and reliable alternative of this technology, that is, the thin-film solar cell technology. The major advantage of the thin-film solar cell technology over the crystalline silicon solar technology is its low cost and they are flexible in nature. Due to these reasons, adoption of the thin-film solar cell technology is observed as major trend in solar encapsulant market.

A major factor driving the growth of the solar encapsulant market is the growing demand for PV modules, which convert solar energy in electrical energy through solar cells. Following this, solar material manufacturers have increased their production capacity. Owing to their benefits, such as economic viability, and ability to provide environmentally sustainable solutions, many countries have increased their production capacity of PV modules. For instance, according to the China Photovoltaic Industry Association (CPIA), in 2016, China increased its solar panel production capacity to 48 gigawatt (GW), which is expected to reach 110 gigawatt (GW) by 2020.

There have been continuous research and development activities in the solar energy sector, particularly solar cell technology, for efficiency improvement and durability of solar cells. This has resulted in the development of third-generation PVs that possess the potential to overcome current efficiency and performance limits. Growing energy requirements and technological advancements in the solar PV module industry have led to sharp decline in the price of these materials in recent years. This scenario attracts heavy investments by investors for the development of solar PVs, which generates ample growth opportunities in the solar encapsulant market.

Segmentation Analysis of Solar Encapsulant Market

The ethylene vinyl acetate (EVA) category in terms of material held the largest revenue market share, generating $724.5 million, in 2017. Since EVA provides excellent elasticity and toughness, efficient adhesive strength, and strong protection against corrosion and delamination, it is highly preferred over other encapsulating materials for application in PV cells.

The crystalline silicon solar technology category is expected to exhibit the faster growth with a CAGR of 28.1% during the forecast period in the solar encapsulant market. This is mainly due to its ability to provide high conversion efficiency and quick payback in terms of energy savings, owing to which its demand is expected to increase.

The construction category held the largest share by application in the solar encapsulant market during the historical period. Rooftop panel installation in the construction industry has significantly increased in the recent years, owing to the increasing awareness of benefits of renewable energy. In addition, the growth of the construction industry is further expected to drive the market demand for solar encapsulants.

| Report Attribute | Details |

Historical Years |

2013-2017 |

Forecast Years |

2018-2023 |

Market Size by Segments |

Material, Technology, Application |

Market Size of Geographies |

U.S., Canada, Germany, U.K., France, Italy, Spain, China, India, Japan, Australia, South Korea, Brazil, Mexico, Saudi Arabia, South Africa |

Explore more about this report - Request free sample

Geographical Analysis of Solar Encapsulant Market

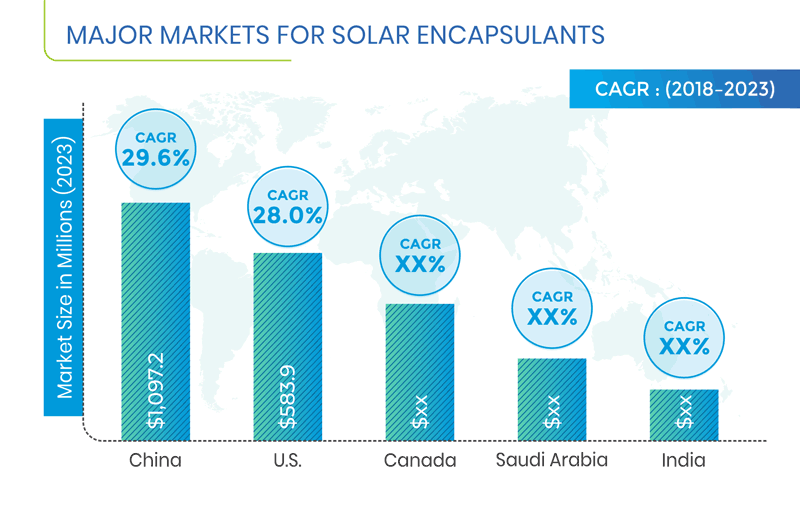

The APAC region accounted for the largest share in the global solar encapsulant market during the historical period and is expected to maintain the same trend during forecast period as well. This can be owing to an increase in the production capacity of solar modules by key manufacturers in the region. According to Energy Trend, in 2017, the global PV installation production capacity was 70.3 GW, of which China accounted for 31%. Considering the future industry scenario, China is expected to lead the APAC region market, generating revenue worth $1,097.9 million in 2023.

Competitive Landscape of Solar Encapsulant Market

The solar encapsulant market is consolidated in nature with the presence of established companies, such as Hangzhou First Applied Material Co. Ltd., Sveck, EVASA, RenewSys India Pvt. Ltd., and STR Holdings Inc. Some of the other key players present in the market are E.I. du Pont de Nemours and Company, Jiangsu Akcome Science & Technology Co. Ltd., Saint-Gobain S.A., ISOVOLTAIC AG, Eastman Chemical Company, Bridgestone Corporation, Mitsui Chemicals Inc., and The 3M Company.

Recent Strategic Developments of Major Solar Encapsulant Market Players

In recent years, major players in the solar encapsulant market have taken several strategic measures, such as product launches and investment aimed at expansions, to gain competitive edge in the industry. For instance, in July 2016, Suzhou Zhongkang Power, a subsidiary of Jiangsu Akcome Science & Technology Co. Ltd., invested $150.57 million for building three PV power stations, with a combined power generation capacity of 110 MW.

Moreover, in June 2017, RIPL launched five Bus Bar (BB) solar PV cells. These cells offer lower resistance and enhance overall module performance. The launch aimed at expanding the company’s PV cell product line in the global market.

Market Size Breakdown by Segment

The Solar Encapsulant Market report offers comprehensive market segmentation analysis along with market estimation for the period 2013–2023.

Based on Material

- Ethylene vinyl acetate (EVA)

- Polyvinyl butyral (PVB)

- Polyolefin elastomer

Based on Technology

- Crystalline Silicon Solar Technology

- Thin-film Solar Technology

- Cadmium Telluride (CdTe)

- Copper Indium Gallium Selenide (CIGS)

- Amorphous silicon (a-Si)

Based on Application

- Construction

- Electronics

- Automotive

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific (APAC)

- China

- Japan

- Australia

- India

- South Korea

- Latin America (LATAM)

- Brazil

- Mexico

- Middle East and Africa (MEA)

- Saudi Arabia

- South Africa

Key Questions Addressed

- What is the current scenario of the global solar encapsulant market?

- What are the emerging technologies for the development of solar encapsulant?

- What are the historical and the present size of the market segments and their future potential?

- What are the major catalysts for the solar encapsulant market and their impact during the short, medium, and long terms?

- What are the evolving opportunities for the players in the market?

- Which are the key geographies from the investment perspective?

- What are the key strategies adopted by the major players to expand their market share?

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws