Report Code: 11050 | Available Format: PDF | Pages: 225

Service Integration and Management (SIAM) Market by Solution (Technology, Business), by Service (Consulting & Implementation, Assessment & Advisory, Integration & Automation), by Organization Type (Large Enterprise, SME), by Industry (Telecom & IT, BFSI, Retail & Manufacturing, Energy & Utility, Transportation & Logistics), by Geography (U.S., Canada, U.K., Germany, France, Italy, Spain, Finland, Japan, China, India, Brazil, Mexico, South Africa, U.A.E.) - Global Market Size, Share, Development, Growth, and Demand Forecast, 2013-2023

- Report Code: 11050

- Available Format: PDF

- Pages: 225

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Service Integration and Management Market Overview

The global service integration and management (SIAM) market was valued at $2,995.3 million in 2017 and is forecast to witness a CAGR of 9.4% during 2018–2023. The key drivers impacting the market growth include the cost reduction and enhancements in service quality offered by SIAM and increasing demand for multi-vendor solutions,.

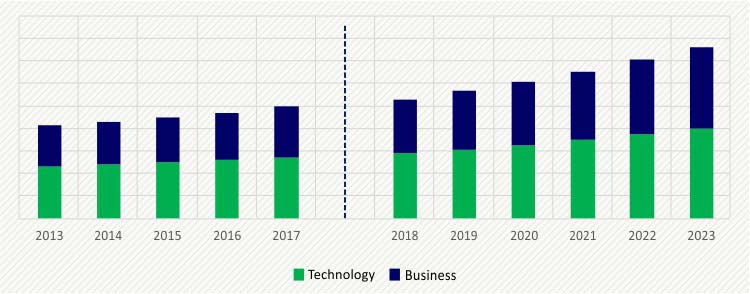

Based on solution, the service integration and management market is bifurcated into business and technology. Of these, the business solutions category is expected to grow faster during the forecast period. Further, in terms of business solutions, the market is categorized into procurement, auditing and invoicing, contract management, and governance, risk, and compliance (GRC) management. Procurement solutions dominated the market in 2017 with a 35.0% share. The transfer of procurement activities, related to selection of the supplier, to a third party is referred to as procurement outsourcing. Organizations mostly prefer procurement process outsourcing over other processes. Most of the times, organizations adopt procurement outsourcing to reduce costs or add expertise to their procurement department.

EUROPE SIAM MARKET, BY SOLUTION, $M (2013–2023)

The GRC solutions category is projected to witness the fastest growth in the SIAM market, at a CAGR of 11.2%, during 2018–2023. This is due to the fact that GRC solutions deliver the best practices for refining partnerships and improving internal client gratification and business value while addressing crucial factors such as information security. Due to these advantages, large enterprises are more likely to consider GRC management outsourcing.

On the basis of industry, the SIAM market has been classified into telecom and IT, banking, financial services, and insurance (BFSI), retail and manufacturing, energy and utility, and transportation and logistics. Of these, the telecom and IT category held the largest share in the market in 2017. The transportation and logistics category is anticipated to register the fastest growth during the forecast period.

Geographically, Europe held the largest share in the market in 2017, owing to the increasing requirement of enterprises to adjust their IT system infrastructure with varying information service settings. As the region has a strong and competitive supply base, the European service integration and management market has emerged as the largest in this domain across the globe. Here, organizations are continuously concentrating on integrating SIAM solutions and services in their work processes in order to achieve maximum growth and profits.

Service Integration and Management Market Dynamics

Drivers

The cost efficiency and value enhancement offered by SIAM are the key driving factors for the SIAM market. The service integration of any business process flow incurs additional costs to an organization, irrespective of it being provisioned externally or internally. The adoption of the SIAM model leads to business and IT cost optimization and an increase in the service value for the company. Therefore, on account of cost saving and service value improvement, the preference of more companies for SIAM solutions is increasing, thereby driving the market growth. The cost of service management for any organization gets reduced by the adoption of the SIAM model because of the innovative technologies it brings to the organization, competition between various service providers, proper use of skilled and scarce resources, and reduction in process execution costs.

Restraints

The lack of standardized and efficient SIAM solutions offered by various service providers is a key factor restraining the growth of the global SIAM market. Often, collaborations and dealings between cross-functional teams are not supported by a standardized process and interface. The SIAM model requires all the service providers to work in unison to ensure the processes are aligned. But if some of the service providers, integrators, or end users are unable or unwilling to make the necessary adaptations to support the process integration, then the outcome may get adversely affected. This may also result in inefficiency in the integrated process’s execution, failure in meeting the end-to-end service goals, miscommunication, and unforeseen overhead expenses.

Service Integration and Management Market Competitive Landscape

International Business Machines Corporation, HCL Technologies Limited, Accenture PLC, Tata Consultancy Services (TCS) Limited, Hewlett Packard Enterprise (HPE), Capgemini SE, Wipro Limited, and Atos SE are the top players in the service integration and management market. Companies such as HCL, TCS, and Wipro are focusing on providing industry-specific outsourcing capabilities, in order to have a competitive edge in the market. Similarly, companies such as Fujitsu Limited and CGI Group Inc. are gaining momentum by aligning their offerings with their clients’ needs. They are more prominent in North America and Europe.

The players in the SIAM market are engaging in product launches, mergers and acquisitions, and partnerships to increase their product offerings and capture a larger market share. For instance, in May 2018, Accenture PLC completed the acquisition of Certus Solutions to strengthen its capabilities in delivering digital transformation on Oracle Cloud. Based in the U.K., Certus Solutions is an Oracle Cloud implementation service provider. In December 2017, German equipment maker, Siemens, announced its partnership with HCL to develop and expand its IoT platform, Mind Sphere. According to the partnership, HCL would help Siemens in developing the platform with advanced tools and techniques, besides incorporating the platform into some of its existing products.

Key questions answered in the report:

- What is the current scenario of the global SIAM market?

- What are the emerging technologies in the global SIAM market?

- What are the major catalysts for the global SIAM market and their impact during the short, medium, and long terms?

- What are the historical size and present size of the categories within the market segments and their comparative future potential?

- What are the evolving opportunities for the players in the global SIAM market?

- What are the key strategies being adopted by the major players to expand their market share?

- What are the key regions from the investment perspective?

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws