Report Code: 11417 | Available Format: PDF | Pages: 84

Saudi Arabia Surgical Sutures Market by Product (Sutures [Absorbable, Non-Absorbable], Automated Suturing Devices [Disposable, Reusable]), by Application (General Surgeries, Gynecological Surgeries, Orthopedic Surgeries, Ophthalmic Surgeries, Cardiovascular Surgeries), by End User (Government Hospitals, Private Hospitals) - Market Size, Share, Development, Growth, and Demand Forecast, 2013-2023

- Report Code: 11417

- Available Format: PDF

- Pages: 84

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Saudi Arabia Surgical Sutures Market Overview

The Saudi Arabian surgical sutures market is estimated to be valued at $16.7 million in 2017 and is projected to grow at a CAGR of 3.6% during the forecast period. Based on product, the market has been categorized into sutures and automated suturing devices. Between the two, sutures are estimated to hold a larger share in the market, in 2017.

SAUDI ARABIA AUTOMATED SUTURING DEVICES MARKET, BY TYPE, $'000 (2013-2023)

The larger share of sutures can be attributed to their comparatively low cost and the lack of trained surgeons with right expertise to use automated suturing devices.

On the basis of type, automated suturing devices are further classified into disposable and reusable devices, where disposable automated suturing devices are estimated to hold a larger share as compared to reusable automated suturing devices, in the Saudi Arabia automated suturing devices market, in 2017. This can be attributed to low cost and ease of use associated with disposable automated suturing devices.

However, the reusable automated suturing devices category is gaining popularity among surgeons and is expected to grow at a higher CAGR, of 6.9%, during the forecast period, as they have less harmful impact on the environment and can be used multiple times, thereby saving costs in the long term.

Surgical sutures find application in general, gynecological, orthopedic, ophthalmic, cardiovascular, and other surgeries. Historically, sutures were most widely used for general surgeries in the country. The trend is expected to continue during the forecast period as well, as the number of general surgeries, as compared to that of other surgeries, performed in Saudi Arabia is on a rise and also because general surgeries require more use of sutures, as they are usually more invasive. Other than general surgeries, sutures also find wide application in gynecological surgeries. This category is estimated to account for 26.7% share in the surgical sutures market in 2017.

On the basis of end user, the surgical sutures industry in Saudi Arabia has been categorized into hospitals and others, where other end users include private clinics, nursing homes, and ambulatory surgery centers. The other end users are expected to witness higher growth in the demand of sutures as compared to hospitals during the forecast period. This can be majorly attributed to the increasing number of private clinics, nursing homes, and ambulatory surgery centers as well as surgical facilities in the country.

Saudi Arabia Surgical Sutures Market Dynamics

Market Trend

Development of customized sutures with high efficiency is a salient trend observed in the country’s surgical sutures market. Some of the emerging variants of sutures are anti-microbial sutures, drug-eluting sutures, stem cell-seeded sutures, and smart sutures. For instance, according to a research published in Micro Microsystems & Nanoengineering, in 2016, researchers integrated nano-scale sensors, electronics, and microfluidics into threads that could be sutured through multiple layers of tissue to gather diagnostic data wirelessly in the real time. These sutures hold huge potential to be used as smart sutures for surgical implants in the future.

Growth Drivers

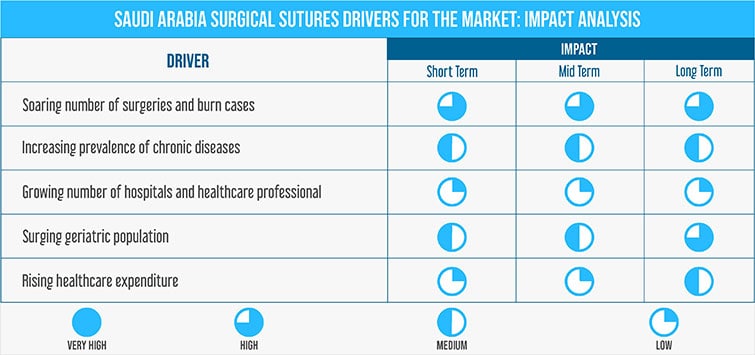

Some of the major factors contributing to the growth of the surgical sutures market in Saudi Arabia are the soaring number of surgeries and burn cases, increasing prevalence of chronic diseases, and rising number of hospitals and healthcare professionals. With the increasing prevalence of different kinds of diseases and health problems in Saudi Arabia, the number of surgeries performed in the country is also on the rise. According to the statistics published by the Ministry of Health (MoH) of the government of Saudi Arabia, a total of 66,911 burn cases were recorded in the MoH hospitals in 2012.

Opportunities

Growing popularity of cosmetic surgeries and improved healthcare infrastructure in the country are the key factors providing growth opportunities to the players in the surgical sutures market in Saudi Arabia. Cosmetic surgeries are gaining popularity in Saudi Arabia on account of increasing consumer awareness about cosmetic surgeries and technological advancements in surgical procedures.

There has been a noticeable rise in the number of cosmetic surgeries performed in the country in recent years, with increased inclination of Saudi women towards beauty enhancement procedures. According to a study conducted by the International Society of Aesthetic Plastic Surgery (ISAPS), in 2011, Saudi Arabia ranked 22nd among the top 25 countries with the highest rates of cosmetic procedures in the world. The study revealed that Turkey and Saudi Arabia were the only Muslim countries with 104,767 and 46,962 surgical procedures performed, respectively, in 2011.

Saudi Arabia Surgical Sutures Market Competitive Landscape

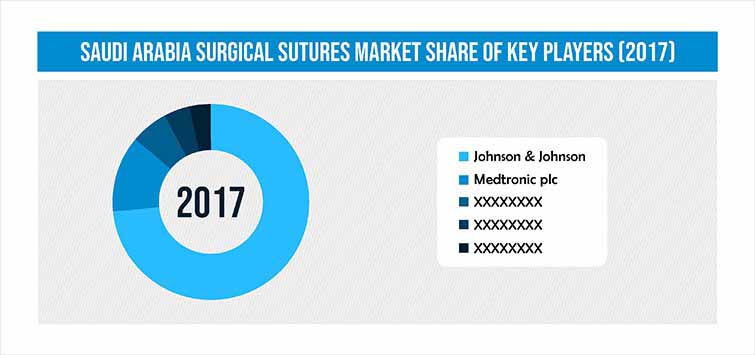

The Saudi Arabian surgical sutures market is consolidated with the presence of very few players. The top three players held more than 90% share in the Saudi Arabian market, in 2017. Johnson and Johnson held the largest market share in 2017, owing to its robust surgical sutures portfolio and competitive pricing strategy.

Some of the other key players operating in the surgical sutures market in Saudi Arabia are Medtronic plc, Smith & Nephew plc, United Medical Industries Co. Ltd., and B. Braun Melsungen AG.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws