Report Code: 11446 | Available Format: PDF | Pages: 422

Sauces, Dressings, and Condiments Market by Type (Table Sauces [Mayonnaise, Tomato Sauce, Soy Sauce, Chili Sauce , Barbecue Sauce, Mustard Sauce, Oyster Sauce, Horseradish Sauce], Cooking Ingredients [Bouillon/Stock Cubes, Wet Sauces, Dry Sauces/Powder Mixes], Dips, Pickled Products, Pastes & Purees), by Distribution channel (Supermarkets/Hypermarkets, Specialist Retailers, Convenience Stores), by Geography (China, India, Japan, Australia, Germany, U.K., Turkey, Spain, France, Italy, U.S., Canada, Brazil, South Africa) - Global Market Size, Share, Development, Growth, and Demand Forecast, 2013-2023

- Report Code: 11446

- Available Format: PDF

- Pages: 422

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Sauces, Dressings, and Condiments Market Overview

Valued at $115.3 billion in 2017, the global sauces, dressings, and condiments market is projected to advance at a CAGR of 3.8% during the forecast period. The key factors aiding in the growth of the market for sauces, dressings, and condiments across the world are introduction of low-fat substitutes, launch of new flavors, consumer willingness to try international cuisines, and increase in the use of natural and organic ingredients.

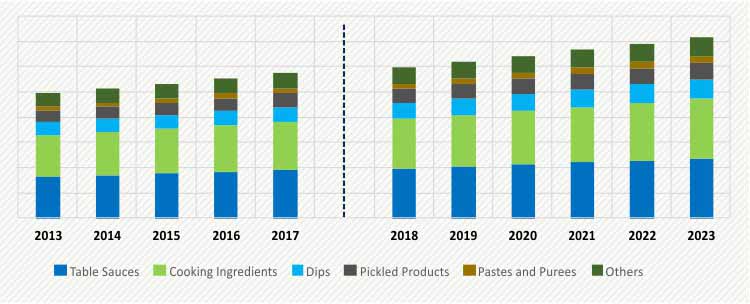

GLOBAL SAUCES, DRESSINGS, AND CONDIMENTS MARKET, BY TYPE, $M (2013-2023)

Based on type, the sauces, dressings, and condiments market is categorized into cooking ingredients, table sauces, pickled products, pastes and purees, dips, and others. Of these, table sauces dominated the market in 2017 with a revenue contribution of over 30.0%. Further, the table sauces category is subdivided into tomato sauce, mayonnaise, chili sauce, soy sauce, mustard sauce, barbecue sauce, horseradish sauce, oyster sauce, and others. Among these, tomato sauce and mayonnaise contributed almost equal revenue to the market during the historical period. These table sauces are widely used with fast food and snacks as instant accompaniments.

Cooking ingredients contributed the second-highest revenue, of over 30.0%, to the sauces, dressings, and condiments market in 2017. The demand for cooking ingredients is being driven by the rising preference for home-cooked meals among consumers across the world. Further, owing to the growing interest in healthy meals and desire to save money, millennials are getting inclined toward home-based cooking, thereby driving the demand for these ingredients.

Geographically, Asia-Pacific (APAC) dominated the sauces, dressings, and condiments in 2017. The region is witnessing a high adoption of Chinese and Mexican cuisines, especially among young people who continue to experiment with their eating habits. As various sauces, dressings, and condiments go into the making of the dishes from these international cuisines, the sale of such food products is rising across APAC.

Japan led the APAC sauces, dressings, and condiments market in 2017, with a revenue as well as sales volume contribution of almost 40.0% each. This can be majorly attributed to the considerable increase in use of sauces, such as teriyaki sauce, wasabi sauce, and soy sauce, in the traditional cuisine of the country. However, during the forecast period, India is expected to witness the fastest growth in the APAC market, as people in the country are getting increasingly drawn toward fast food.

Sauces, Dressings, and Condiments Market Dynamics

Trends

The rising demand for organic and gluten-free sauces is among the key trends being witnessed in the global sauces, dressings, and condiments market. As people are increasingly becoming health-conscious, they are eschewing food that can adversely affect their health. Owing to the growing focus on health, people are consuming a gluten-free diet and shunning food items that contain genetically modified organisms (GMOs) and artificial additives. Food and beverage companies, which earlier offered sauces with gluten, are now offering gluten-free variants. For instance, the tomato sauce with basil, canned tomato sauce, and no-salt-added tomato sauce sold by Del Monte are almost completely gluten-free, with the content of gluten below 20 parts per million.

Drivers

Rising disposable income, growing popularity of international cuisines, and busy lifestyle of people are among the key factors having a positive effect on the growth of the sauces, dressings, and condiments market, globally.

The growing popularity of international cuisines across the world is playing a crucial role in driving the market growth. The rising cross-cultural interaction and awareness are resulting in a considerable rise in demand for international cuisines, which, in turn, is leading to the increased consumption of dressings, sauces, and condiments.

Restraints

The increasing price of raw materials is one of the major factors hampering the growth of the sauces, dressings, and condiments market. Food product manufacturers are facing challenges because of the continuous rise in raw material prices. Additionally, any increase in the cost of transportation negatively affects the shipping cost of raw materials. This not only raises the cost of manufacturing but also leads to a reduction in the profit margin of vendors. Besides, the unending desire to remain competitive compels manufacturers to use low-cost raw material substitutes, which often affects the quality of the product negatively.

Opportunities

Governments in few countries have begun offering subsidies on the import of sauces, which might provide growth opportunities to the sauces, dressings, and condiments market players. For instance, under the Korea–Australia Free Trade Agreement (KAFTA), the Korean government reduced the tariff on prepared mustard (used in the production of mustard sauce) and tomato ketchup from 4.5% in 2016 to 3.4% in 2017; the tariff is to be completely eliminated by 2020. Similarly, the tariff on tomato sauce was also decreased to 33.0% in 2017 from 36.0% in 2016, with the government planning to eliminate the tariff by 2018. Such reductions in tariff are offering ample growth opportunities to Australian exporters to enter the South Korean market.

Sauces, Dressings, and Condiments Market Competitive Landscape

As the number of international and regional players currently operating in the sauces, dressings, and condiments market is not extremely high, the rivalry is moderately intense. Kikkoman Corporation, Nestle SA, McCormick & Company Incorporated, Tas Gourmet Sauce Co., The Kraft Heinz Company, Unilever Group, Bolton Group, General Mills Inc., Del Monte Foods Inc., and Conagra Brands Inc. are some of the key players in the market.

The major players in the sauces, dressings, and condiments market are focusing on acquisitions to increase their market share. For example, in August 2017, Reckitt Benckiser’s food division was acquired by McCormick & Company Incorporated in a $4.2 billion deal. The acquisition was aimed at strengthening the position of McCormick & Company in the hot sauce and condiments market. Under the deal, McCormick agreed to integrate the acquired products, including French’s mustard, Frank’s RedHot sauce, and Cattlemen’s BBQ sauce, in its industrial and consumer segments.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws