Report Code: 10494 | Available Format: PDF | Pages: 180

RF Transceiver Market Research Report: By Design (Single-Chip Transceiver, Standalone-Chip Transceiver), Type (5G Transceiver, 4G Transceiver, 3G Transceiver, 2G Transceiver), Application (Mobile Devices, Routers, Add-On Cards, Embedded Modules), Vertical (Consumer Electronics, Telecommunications, Cable/Broadcasting, Aerospace, Military & Defense, Healthcare) - Global Industry Analysis and Growth Forecast to 2030

- Report Code: 10494

- Available Format: PDF

- Pages: 180

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

RF Transceiver Market Overview

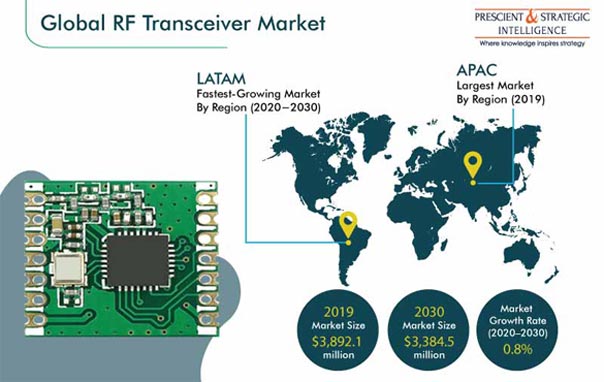

The global radiofrequency (RF) transceiver market size was $3,892.1 million in 2019, and it is projected to witness a CAGR of 0.8% during the forecast period (2020–2030). The growing adoption of mobile communication technologies, such as 4G and 5G, and rising demand for the internet of things (IoT) technology have been observed as the primary drivers for the market. Falling prices of RF transceivers, attributed to increase in economies of scale pertaining to manufacturing and anticipated drop in demand for communication technology such as 2G and 3G in coming years, are expected to lead to decrease in the overall market size during the forecast period.

The COVID-19 pandemic has impacted the RF transceiver market, with key economies, including China, India, the U.S., and European countries, witnessing a temporary shutdown of industries due to the lockdown implemented by the governments. The pandemic has also impacted the supply chain of electronic components for original equipment manufacturers (OEMs), which, in turn, has impacted the manufacturing and market growth of RF transceivers. Asia-Pacific (APAC) countries, including China, Vietnam, South Korea, Taiwan, Japan, and India, are the major manufacturers of RF transceivers, and intermittent lockdowns in these countries have severely impacted production and trade activities.

Proliferation in Demand for Single-Chip Transceivers Driving Market Growth

In the RF transceiver market outlook, on the basis of design, the single-chip transceiver category generated the highest revenue in 2019. Single-chip transceivers are witnessing an increasing demand owing to their widespread usage in mobile devices, routers, and modems. These variants consume low power and can work with low voltage in a wireless system.

Growing Demand for 5G Technology To Accelerate Market Growth

Within the type segment of the RF transceiver market, 5G transceivers are projected to exhibit the fastest growth during the forecast period. The market opportunities for 5G technology are vast; regions such as North America and Europe would witness a rapid deployment of 5G in the coming years, with several government initiatives and plans regarding the deployment of the technology in various industries having already been implemented.

Mobile Devices To Continue as Major Application Area for RF Transceivers

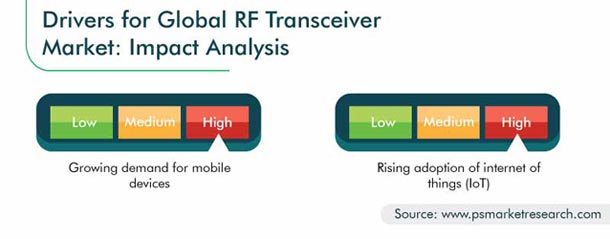

In the RF transceiver market, the mobile devices category, among applications, is generating a huge demand, owing to the massive production of mobile phones worldwide. With the growing population across the globe and rising dependence on the mobile communication technology, the market has seen a proliferation of mobile devices and adoption of 3G and 4G.

Growing Product Demand from Consumer Electronics Vertical Driving Market Growth

The consumer electronics vertical was the highest-revenue-generating category in the RF transceiver market in 2019. The consistent growth in the adoption of smartphones, tablets, laptops, gaming consoles, surveillance systems, networking equipment, and IoT, along with the rapid infrastructure developments, is catalyzing the RF transceiver market advance in the consumer electronics category.

APAC Is Highest-Revenue-Generating Region due to Growing Demand from Consumer Electronics

The Asia-Pacific (APAC) RF transceiver market is growing at a steady rate, owing to the surging demand for smartphones and deployment of 5G in China, Japan, and South Korea. The 5G deployment rate would accelerate in China owing to the ‘Made in China 2025’ roadmap, which envisages 5G as playing a transformative role in China’s ambition to gain a worldwide lead in a range of new technologies, such as industrial IoT, cloud computing, and AI.

Latin America (LATAM) To Witness Fastest Growth due to Proliferation of 4G and 5G Technologies

Owing to the rising internet penetration and massive adoption of smartphones and 4G and 5G technologies, the LATAM region is expected to demonstrate the fastest market growth during the forecast period. It has been projected that the 5G network would cover more than half the region by 2030. Moreover, mobile operators are heavily investing in their content and media capabilities, along with 5G services and IoT applications. The growth in the market can also be attributed to the upgradation of large and ultra-large data centers from 10 G transceivers to new 40 G and 100 G transceivers, for higher digital signal transmission speed.

Growing Demand for Wideband Transceivers Key Market Trend

Due to the increasing technological advancements and growing demand for reliable, seamless, and secure communication, there is a high demand for wideband transceivers across the world. Wideband transceivers help prevent architecture redesigning issues, besides offering long-range wireless connectivity. In view of this, several market players are increasingly focusing on the launch of new, improved products. For instance, in 2018, Analog Devices Inc., under its RadioVerse technology platform, launched ADRV9009, a wideband RF transceiver. With this transceiver, the company aimed at accelerating the deployment of 5G and offering sustainable 2G, 3G, and 4G coverage.

Growing Demand for Mobile Devices Is Driving Market Growth

A key factor contributing to the growth of the RF transceiver market is the surging usage of smartphones across the world. Besides developed economies, their penetration has grown rapidly in developing countries too. According to the Global System for Mobile Communications Association’s (GSMA) State of Mobile Internet Connectivity Report 2019, there are currently 3.5 billion smartphone users across the world, with these devices being the primary medium for internet access.

| Report Attribute | Details |

Historical Years |

2014-2019 |

Forecast Years |

2020-2030 |

Base Year (2019) Market Size |

$3,892.1 Million |

Forecast Period CAGR |

0.8% |

Report Coverage |

Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, COVID-19 Impact, Company Share Analysis, Companies’ Strategic Developments, Product Benchmarking, Company Profiling |

Market Size by Segments |

Design, Type, Application, Vertical, Region |

Market Size of Geographies |

U.S., Canada, Germany, France, Italy, U.K., Spain, Russia, Japan, China, India, South Korea, Brazil, Mexico, Israel, South Africa |

Secondary Sources and References (Partial List) |

International Society of Automation (ISA), International Telecommunication Union, International Telecommunications Society (ITS), International Trade Union (ITU), Internet of Things Association (IOTA), American Electronics Association (AEA), China Consumers Association (CCA), Consumer Electronics & Technologies Industry Association (CETIA), Consumer Electronics Association (CEA), Control System Integrators Association (CSIA), Industrial Internet Consortium, International Association of Computer Science and Information Technology (IACSIT), GSM Association, Organisation for Economic Co-operation and Development (OECD) |

Explore more about this report - Request free sample

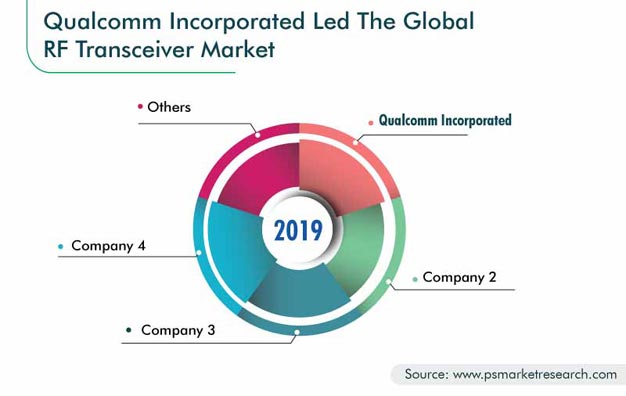

RF Transceiver Manufacturers Are Focused on Product Launches to Increase Market Presence

The RF transceiver industry is highly competitive and consolidated, with the presence of several global players. In recent years, players in the RF transceiver industry have focused on product innovations to stay ahead of their competitors. For instance:

- In April 2020, Qualcomm Incorporated launched a 212 LTE IoT modem integrated with an NB2 IoT chipset. It is a single-chip solution, which consists of a modem baseband, application processor, memory, RF transceiver with fully integrated RF front end, and power management unit.

- In February 2020, Huawei Technologies Co. Ltd. launched the 800 G tunable ultra-high-speed optical module. The module is compatible with line rates that can be tuned from 200 Gigabits per second (Gbps) to 800 Gbps and can transmit bandwidths of as much as 48 terabits per second (Tbps) on a single fiber.

Some of the Key Market Players Listed in the RF Transceiver Market Report are:

-

Infineon Technologies AG

-

Texas Instruments Incorporated

-

Analog Devices Inc.

-

STMicroelectronics N.V.

-

Qorvo Inc.

-

Broadcom Inc.

-

Qualcomm Incorporated

-

Telefonaktiebolaget LM Ericsson

-

Skyworks Solutions Inc.

-

Samsung Electronics Co. Ltd.

-

ON Semiconductor Corporation

-

NXP Semiconductors N.V.

-

Nokia Corporation

-

Murata Manufacturing Co. Ltd.

-

Huawei Technologies Co. Ltd.

-

ZTE Corporation

-

Fujitsu Limited

RF Transceiver Market Size Breakdown by Segment

The RF transceiver market report offers comprehensive market segmentation analysis along with market estimation for the period 2014–2030.

Based on Design

- Single-Chip Transceiver

- Standalone-Chip Transceiver

Based on Type

- 5G Transceiver

- 4G Transceiver

- 3G Transceiver

- 2G Transceiver

Based on Application

- Mobile Devices

- Routers

- Add-On Cards

- Embedded Modules

Based on Vertical

- Consumer Electronics

- Telecommunications

- Cable/Broadcasting

- Aerospace

- Military & Defense

- Healthcare

Geographical Analysis

- Asia-Pacific (APAC)

- China (By Vertical)

- Japan (By Vertical)

- India (By Vertical)

- South Korea

- Australia

- North America

- U.S. (By Vertical)

- Canada

- Europe

- Germany (By Vertical)

- U.K.

- France

- Russia

- Italy

- Latin America (LATAM)

- Brazil

- Mexico

- Middle East & Africa (MEA)

- Turkey

- South Africa

- U.A.E.

- Saudi Arabia

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws