Report Code: 12883 | Available Format: PDF | Pages: 290

Reverse Logistics Market Size and Share Analysis by Return Type (Recall, B2B and Commercial, Repairable, End of Use, End of Life), End User (Retail & E-Commerce, Automotive, Consumer Electronics, Healthcare), Service (Transportation, Warehousing, Reselling, Replacement Management, Refund Management) - Global Industry Demand Forecast to 2030

- Report Code: 12883

- Available Format: PDF

- Pages: 290

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

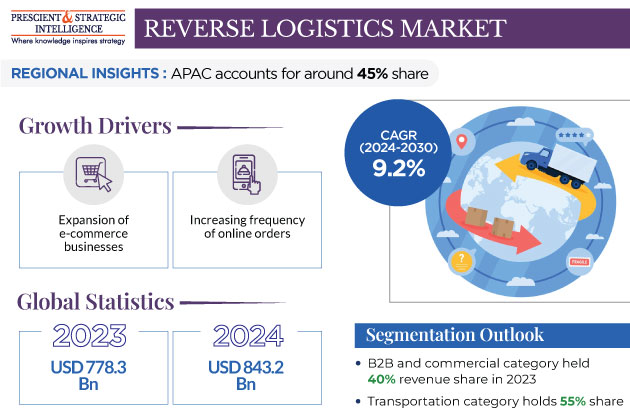

The global reverse logistics market generated revenue of USD 778.3 billion in 2023, and it is projected to witness a CAGR of 9.2% during 2024–2030, to reach USD 1,431.8 billion by 2030. This is attributed to the expansion of e-commerce businesses and the increasing frequency of online orders with the rising number of returns and replacement of products.

- Moreover, due to the growing stringent regulation and safety and product quality concerns, the frequency of product recalls is expected to boost the market growth.

- The growing advancement in the logistics and supply chain and the development of automation technologies are some of the major reasons for the growth of the logistics sector, hence it will create the demand for reverse logistics.

- In addition, the rising initiatives by governments of several countries to establish the transport infrastructure are expected to aid the reverse logistics business.

- For instance, in May 2021, with the planned concession the Brazil’s Infrastructure Minister, the government would invest $50 billion in the modernization of airports, ports, highways, and railways.

- The improvement of transportation infrastructure makes it easier for reverse logistics companies in the specified region.

- Furthermore, the rapid surge in the e-commerce infrastructure of every field, cross-border trades, and globalization are the major growth factors for this market.

- The logistic service provides sectoral connections within the local economy. The connectivity through logistic systems of various inter-dependent production sectors including agriculture, healthcare, manufacturing, and many others, the domestic economy is strengthened.

- So, the growth in cross-border trades and surging import and export amongst countries give a major boost to the need for reverse logistics.

- In addition, with the growing frequency of online orders globally and the surging frequency of returns and replacement of items, the demand for reverse logistic services is rising.

- This is due to companies more offering services such as try and buy and return and replacement policies.

- Moreover, returns are more prevalent when customers purchase online because the fit of the product only can be verified physically.

- According to a report published by the National Retail Federation, in 2021, the retail returns stood at $761 billion in 2021, as a result of overall sales growth.

Advancement & Expansion in the E-Commerce Space

The growth in the demand for connectivity solutions and the rising B2B space are driving the online ecosystem, which, in turn, boosts the market growth. Moreover, this is ascribed to advancements in the technology for e-commerce such as artificial intelligence, augmented reality, and on-site personalization.

In addition, the growing urbanization, the increasing internet penetration, the surging usage of devices, such as smartphones, laptops, and tablets to access e-commerce portals, and the ease of accessibility of e-commerce platforms, are also providing a boost to the market growth.

Furthermore, the growing demand for time-effective shipment and advanced facilities such as return and replacement policies with the aim to improve services to stay competitive in the industry is one of the major factors for the expansion of the e-commerce space.

Thus, the rapid surge in the e-commerce and logistics industry drives the need for time-efficient delivery and after-delivery services such as return and replacement, which, in turn, boost the need for the transportation of products in forward and reverse logistics globally.

For instance, XPO Logistics Inc., a U.S.-based transportation and logistics provider, has deployed an advanced automated solution in France to manage high-volume reverse logistics for online fashion customers.

Also, the high growth in online shopping in recent years has given a boost to the adoption of logistic services and solutions by retail, e-commerce, and third-party logistics companies.

| Report Attribute | Details |

Market Size in 2023 |

USD 778.3 Billion |

Market Size in 2024 |

USD 843.2 Billion |

Revenue Forecast in 2030 |

USD 1,431.8 Billion |

Growth Rate |

9.2% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Return Type; By End User; By Service; By Region |

Explore more about this report - Request free sample

Growing Product Recalls Drive the Industry

- The rising frequency of product recalls, due to the strict government policies and regulations in various sectors, such as automotive, healthcare, and retail, increases the demand for reverse logistic services.

- In the global automotive industry, the installation of lower-quality parts in any automobile can lead to fatal accidents and probably lead to death. Thus, governments have implemented strict laws and regulations for the prevention of such accidents. Thus, it has further created the demand for reverse logistic services.

- For instance, in January 2023, Maruti Suzuki issued an advisory for a second recall for a batch of Grand Vitara to provide a free replacement of rear seatbelt mounting brackets.

- Moreover, in July 2023, Maruti Suzuki recalled 87,599 units of S-Presso and Eeco, due to an issue in the steering setup. The recall was made to rectify the possible defect in the steering tie rod.

- In addition, the growing adoption of electric vehicles across the world drives the demand for electric vehicle batteries. Hence, the recycling of batteries is creating an opportunity for players providing reverse logistic services.

- For instance, in 2021, MG Motor India announced a collaborative partnership with Attero for recycling EV batteries.

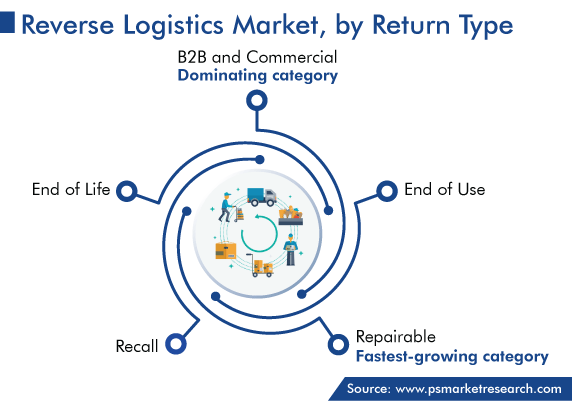

B2B and Commercial Category Accounts for the Largest Market Share

Based on return type, the B2B and commercial category held the largest market share, of 40%, in 2023, and it is also expected to maintain its dominance during the forthcoming period. B2B and commercial returns refer to the return between the retailer and the manufacturer.

Usually, the merchandise is returned in bulk if the defective or damaged product is received, and also commercial platforms offer return services and exchange policies for particular products. Thus, B2B and commercial returns gain significant growth in the market.

Whereas, the repairable category is expected to witness the highest growth rate, of CAGR 10%, during the anticipated timeframe. The growing cross-border trade has enabled the expansion of the market. The connectivity solutions, such as water, air, and land transportation systems, provide delivery and return services across borders. Some consumers and clients only want replacement and return rather than repair. So, the requirement for reverse logistic services is growing in such cases.

Transportation Category Dominates the Industry

- On the basis of service, the transportation category accounted for the largest revenue share, of 55%, in 2023, and it is further expected to maintain its dominance during the analysis period.

- The transportation system is the most important aspect of any logistics and supply chain. The transportation system not only delivers the goods to customers but also handles product returns for material substitutions, re-manufacturing, and repairs.

- The surge in the e-commerce and online shopping industry has led to the increasing frequency of return products, which, in turn, drives the market growth in this category.

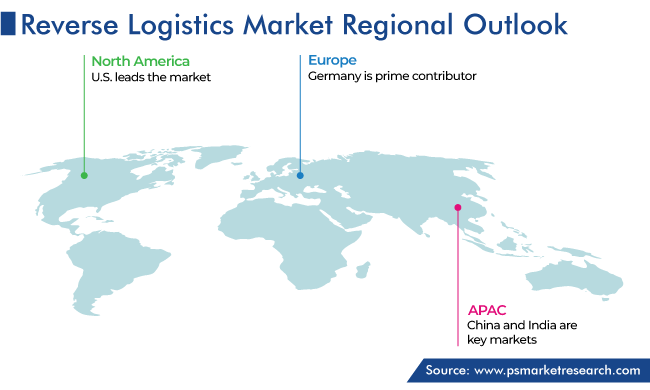

APAC Is Prime Revenue Contributor

Geographically, the APAC region occupied the largest share in the reverse logistics market, of around 45%, in 2023, and the regional industry is expected to experience a strong CAGR during the projection period as well.

This is due to the rising retail sales, increasing launches of innovative electronic products, and growing strong government regulations against the sales of dangerous and fraudulent goods to consumers in the region.

Moreover, India’s e-commerce market is growing at a very high pace. For instance, according to the India Brand Equity Foundation, the country has gained 125 million online shoppers in the past three years, with another 80 million expected to join by 2025.

In addition, the increasing number of startups and funding in this domain drives the market growth. For instance, in May 2021, Delhivery, a logistic startup-based company in Gurgaon, revealed that it raised USD 275 million in a fundraising round. The funding was utilized for the expansion of cross-border trades, B2B and B2C space, express delivery, end-to-end supply chain, and reverse logistic services.

Top Service Providers of Reverse Logistics Are:

- Deutsche Bahn AG

- DHL Group

- FedEx Corporation

- Safexpress Private Limited

- Core Logistic Private Limited

- YUSEN LOGISTICS CO. LTD.

- Reverse Logistics GmbH

- Kintetsu World Express Inc.

- United Parcel Service of America Inc.

Market Breakdown

This report offers deep insights into the reverse logistics market, with size estimation for 2017 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Segment Analysis, By Return Type

- Recall

- B2B and Commercial

- Repairable

- End of Use

- End of Life

Segment Analysis, By End User

- Retail & E-Commerce

- Automotive

- Consumer Electronics

- Healthcare

Segment Analysis, By Service

- Transportation

- Warehousing

- Reselling

- Replacement Management

- Refund Management

Region/Countries Reviewed for this Report

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws