Report Code: 12881 | Available Format: PDF | Pages: 320

Pumped Hydro Storage Market Size and Share Analysis by Type (Open-Loop, Closed-Loop) - Global Industry Demand Forecast to 2030

- Report Code: 12881

- Available Format: PDF

- Pages: 320

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

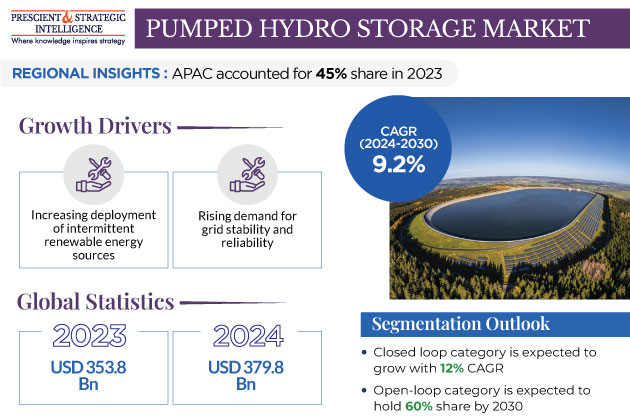

The global pumped hydro storage market was valued at USD 353.8 billion in 2023, and the market size is predicted to reach USD 643.9 billion by 2030, advancing at a CAGR of 9.2% between 2024 and 2030. The key factors driving the growth are the increasing deployment of intermittent renewable energy sources, such as wind and solar power; rising demand for grid stability and reliability; and stringent government regulations that aim to reduce carbon emissions. In addition to this, the long operational lifetimes and a relatively low environmental impact compared to other energy storage technologies make them a sustainable option for power grids.

- One of the most dependable and oldest forms of renewable energy is hydropower, and PSH is a vital component of the energy transition and grid resilience.

- For communities facing water scarcity and power access issues, generating electricity from running water without compromising the quantity or quality of water is a great solution.

- The flexibility and storage of water make it much more efficient and affordable for communities to incorporate into the grid.

Moreover, PSH expands the availability of clean, independent, and renewable energy by enhancing grid stability and power access as variable renewables, such as solar and wind account for an increasing share of global grids. By taking advantage of excess grid electricity outside of peak demand, water is moved from a source of lower elevation to a higher elevation. The water follows the same route through a turbine to produce electricity during periods of high demand. The process's ability to offset the power cost of desalination facilities, which account for half of their operating costs, makes the process particularly attractive.

Rising Electricity Demand

- With the increasing urbanization and growing population across the world, global energy demand has seen an exponential increase over the last few years.

- According to a UN report, the world population in 2022 of 8 billion is projected to increase and reach 9.8 billion by 2050. Moreover, most of the energy across the globe is produced from fossil fuels, which emits harmful GHGs into the atmosphere upon being burned.

- As per the International Energy Agency (IEA), the global electricity demand is projected to grow at a rate of 2.1% per annum by 2040.

Pumped hydro storage is a technology used to store and manage electrical energy, and it plays a crucial role in meeting the increasing electricity demands. The rising electricity demand often leads to the need for additional capacity, to supply power during peak periods. Pumped hydro storage facilities are well-suited for this purpose. When electricity demand drops, the extra power available is used to pump water from a lower reservoir to an upper reservoir. When demand is high, the stored water is released, flowing downhill through turbines to generate electricity.

- Moreover, this technology can enhance the resilience of the electrical grid.

- In the event of a sudden increase in electricity demand or unexpected power plant outages, these storage facilities can rapidly supply electricity to stabilize the grid.

- Therefore, with the rising demand for electricity is likely to boost the market growth in upcoming years.

| Report Attribute | Details |

Market Size in 2023 |

USD 353.8 Billion |

Market Size in 2024 |

USD 379.8 Billion |

Revenue Forecast in 2030 |

USD 643.9 Billion |

Growth Rate |

9.2% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Type; By Region |

Explore more about this report - Request free sample

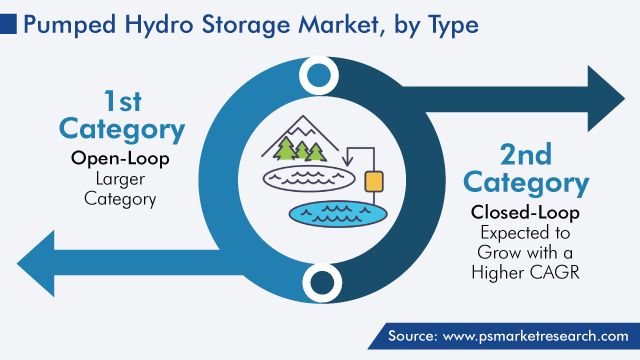

Closed Loop Projected to Grow with Faster CAGR Market

Based on type, the closed loop category is expected to grow with faster growth rate, around 12% CAGR, during the forecast period. This is mainly due to the high flexibility, reliability, and power output of this technology. Moreover, it has a lower environmental impact, as it does not consume water from rivers or lakes. These systems can be set up where grid support is required; therefore, they need not be located near a river. In addition to this, they are more efficient, as there is no need to evaporate water from the lower reservoir. According to the National Renewable Energy Laboratory (NREL) analysis, closed-loop pumped storage has the lowest Global Warming Potential.

- Closed-loop pumped hydro storage (CL-PHS) does not require a connection to a natural body of water.

- Instead, it uses two artificial reservoirs, one at a higher elevation than the other, to store water.

- When extra energy is generated or available, water is pumped to the upper reservoir from the lower reservoir.

- During periods of high electricity demand, water is allowed to flow from the upper reservoir to the lower reservoir, generating electricity as it passes through a turbine.

Moreover, CL-PHS can store large amounts of energy for long periods, making it ideal for storing excess renewable energy and providing grid balancing services. Moreover, closed-loop systems have a reduced environmental impact compared to open-loop systems as they minimize water usage and avoid disrupting natural water bodies.

Open-loop hydro storage systems category is expected to hold larger share in 2030.

- This is mainly due to the ongoing government initiatives for renewable energy generation.

- Open-loop systems involve directing a stream of water to either the upper or lower reservoir.

- The primary benefit of open-loop systems is their capacity to leverage the already-existing infrastructure and water resources, thus reducing the need for substantial land and construction.

However, because of their effects on local ecosystems, aquatic life, and water quality, these systems may raise environmental concerns. In addition, they are reliant on the availability of water resources and could be impacted by drought and seasonal variations. If the lower reservoir has an existing dam, there is no need for excavation because the powerhouse can be built downstream of the dam.

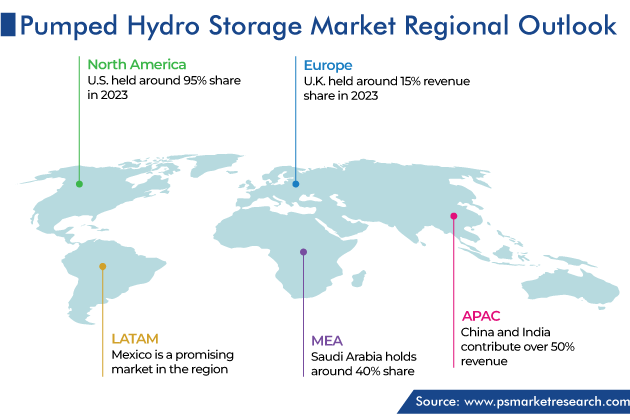

Asia-Pacific Is Prime Revenue Contributor

Asia-Pacific captured the largest revenue share in the market, of around 45%, in 2023, attributed to the increasing installation of pumped hydro storage capacity. Further, the rapid economic development has led to increased energy consumption, which PHS can help meet, as well as supporting industrial development. This is because this storage technology is the most-scalable kind of energy storage solution compared to other solutions, such as battery storage, hydrogen fuel cells, and gravity battery storage.

- India has a significant potential for pumped hydro storage as there are numerous locations across the nation that are ideal for pumped storage projects, such as river valleys, lakes, and dams.

- The Indian government has set a goal to install 20 GW of pumped storage capacity by 2030.

- Additionally, India experienced a rise in installed capacity, with approximately 434 MW new capacity added over the period, with one of the largest projects being the 180-MW run-of-river Bajoli Holi in Himachal Pradesh.

- Due to the significant increase in monsoon rains, the nation also witnessed a huge increase in generation.

Moreover, China has the largest hydropower capacity, followed by the European Union, Brazil, and the U.S. As of May 2023, China had 50 GW of operational pumped-storage capacity.

Similarly, the South Korean Hydropower Industry Association has announced the construction of three new projects with a total capacity of 1.8 GW, in Pocehon, Hongcheon, and Yeongdong, which are set to be completed by 2034.

Competitive Landscape

- With strategic initiatives, such as mergers, collaborations, and acquisitions, the market players are looking forward to strengthening their market position.

- Additionally, Tata Power has signed an agreement for the development of two pumped hydro storage projects with a combined capacity of 2,800 MW with the Government of Maharashtra.

The company is targeting to start work on both the plants by middle of 2024.

Top Pumped Hydro Storage Companies Are:

- The Dow Chemical Company

- Siemens AG

- Enel S.p.A.

- Duke Energy Corporation

- Voith GmbH & Co. KGaA

- General Electric Company

- Tokyo Electric Power Company Holdings Inc.

- Black & Veatch Holding Company

- ANDRITZ AG

- Stantec Inc.

- ABSAROKA ENERGY LLC

Market Breakdown

The report analyzes the impact of the major drivers and restraints on the pumped hydro storage market, to offer accurate market estimations for 2017 –2030.

Segment Analysis, By Type

- Open-Loop

- Closed-Loop

Region/Countries Reviewed for this Report

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws