Project Portfolio Management Market Analysis

Explore In-Depth Project Portfolio Management Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2030

Report Code: 12386

Explore In-Depth Project Portfolio Management Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2030

Thes solutions bifurcation dominates the market with 60% share in 2024. This is attributed to the expansion of companies around the world and the widening of their product and service lines. Each day, these projects generate huge amounts of data related to their progress, which needs to be carefully stored, analyzed, and shared, to make informed decisions for business growth.

The services bifurcation will have the higher CAGR, of 7.2%, over the forecast period. This is attributed to the growing demand for PPM software, which, in turn, creates a requirement for an array of professional and managed services. PPM being an emerging operational workflow, companies are not well versed in it, which is why they require training and consulting services to choose the right software for their firm. The next step is system integration, which is another key aspect of PPM. Once the solutions have been deployed, the need for regular upgrades, periodic data backup and recovery, operational support, and other services arises.

We have studies the following components of the market:

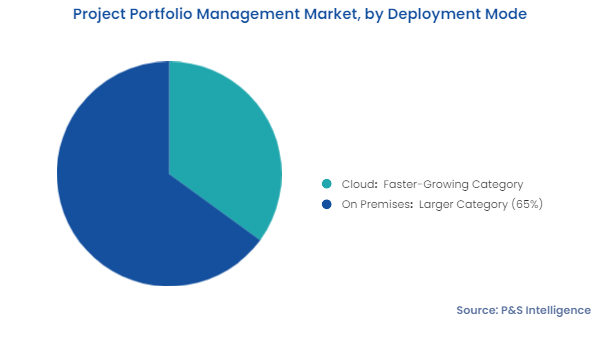

The on-premises category holds 65% share in 2024%, thus dominating the market. This is because project data is mostly confidential as it directly impacts business growth prospects. This creates the need for complete control over software that gathers, stores, analyzes, and shares such information within the company and with third parties. Additionally, the stringent data protection laws around the world compel companies to ensure its safety, which is better accomplished with on-premises solutions. Further, since these solutions are deployed on onsite systems and directly governed by the user, they are easier to customize.

The cloud category is growing at the higher CAGR, of around 7.5%, in the forecast period. This can be mainly due to the major practical business applications, such as remote access and monitoring, real-time data analytics, and automated scheduling, which could be realized by combining cloud PPM systems. Furthermore, advances in the field of cloud and cloud-based applications, as well as an increase in modern businesses and companies’ operations' reliance on cloud technology, have paved the way for the market to continue growing at a stable rate in the coming years.

The report offers insights into the following deployment modes:

Currently, large enterprises dominate the market, in 2024. This is credited to the wide project portfolios and geographically dispersed operations of multinational corporation. They generate high volumes of data related to their projects every day, which, as their portfolios expand further, becoming hard to manage manually. This is why they require agile PPM solutions to keep track of all their projects and make the required modifications. Large companies also have the financial resources to spend on such expensive software, which continues to drive their dominance on the market.

The SMEs bifurcation is the faster-growing, during the forecast period. This is because of these companies’ rapid acceptance of digitized operational technologies, which has compelled them to used advanced methods to manage project-related data. Moreover, amidst the growing competition with large enterprises, SMEs are enhancing their operations to achieve better productivity and cost-effectiveness. This is why they are gravitating toward cloud-based PPM solutions, which many IT vendors especially tailor to SMES’s needs.

Enterprises of the below-mentioned sizes are covered:

The BFSI category holds the largest market share, of around 40%, in 2024. One of the primary factors driving the growth of the project portfolio management market in this category is the increase in complexities in banking operations. Financial services and institutions are undergoing various transformations at a quick pace, including big data management, digital business enablement, and legacy overhaul, all of which are resulting in complex project portfolios. This element has a considerable positive impact on the global adoption of advanced project operations and resource management solutions.

The healthcare vertical is growing at the highest CAGR, during the forecast period, in the project portfolio management market. This can be ascribed to the rapid digitization and the surge in the requirement for efficient handling of patient data and medical history. The solution saves paperwork and offers information to healthcare businesses, allowing them to respond quickly to emergency circumstances. Moreover, healthcare organizations may guarantee that the valuable resources they need get on time to succeed by combining PPM with an earned value measurement system. Also, projects that provide less benefit are rescheduled or scaled back accordingly with the help of this solution.

The segment is categorized as follows:

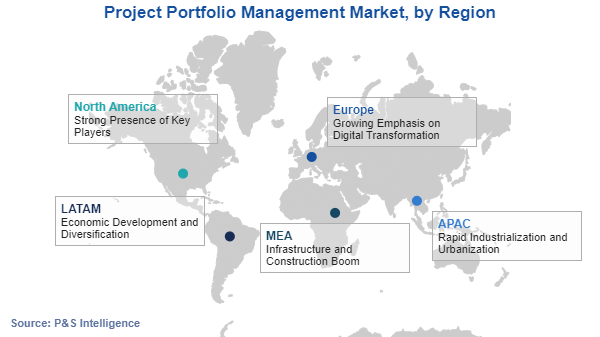

Below is the regional breakdown of the market:

Want a report tailored exactly to your business need?

Request Customization

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages