Report Code: 10129 | Available Format: Excel

Pressure Sensitive Adhesives Market Research Report: By Formulation (Acrylate, Rubber, Silicon), Application (Tapes, Labels, Graphics, Laminations), Industry (Packaging, Automotive, Electrical & Electronics, Healthcare & Hygiene, Construction), Geographical Outlook (U.S., Canada, Germany, U.K., France, Italy, Spain, China, Japan, India, Australia, South Korea, Brazil, Mexico, Saudi Arabia, Turkey, South Africa) - Global Industry Trends Analysis and Growth Forecast to 2024

- Report Code: 10129

- Available Format: Excel

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Outlook

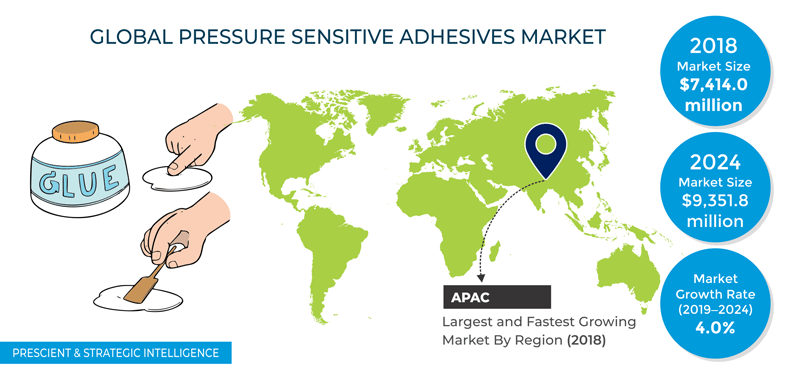

The pressure sensitive adhesives market revenue stood at $7,414.0 million in 2018. Furthermore, the market is predicted to exhibit a CAGR of 4%, in terms of volume, between 2019 and 2024.

The market registered the highest CAGR in the Asia-Pacific (APAC) region, in terms of both value and volume, during the last few years. This is credited to the growth in the packaging industry and other allied industries, such as electrical and electronics, healthcare, automotive, and construction. Pressure-sensitive adhesives are heavily required in all these industries for labels, tapes, graphical films, floor tiles, and wall coverings.

Market Dynamics

In recent years, players operating in the market for pressure sensitive adhesives announced various strategic growth activities, such as product launches and facility expansion. Such steps have been taken due to the growth of various end-use industries, which is now offering business opportunities to market players. For example, BASF SE announced in 2019 that it has doubled its production capacity of ultraviolet (UV) acrylic hotmelts that it sells the acResin brand.

This move is predicted to strengthen the position of the company in the premium adhesives sector. Furthermore, several small and medium-sized industry players are announcing mergers and acquisitions for consolidating their position and gain higher revenue.

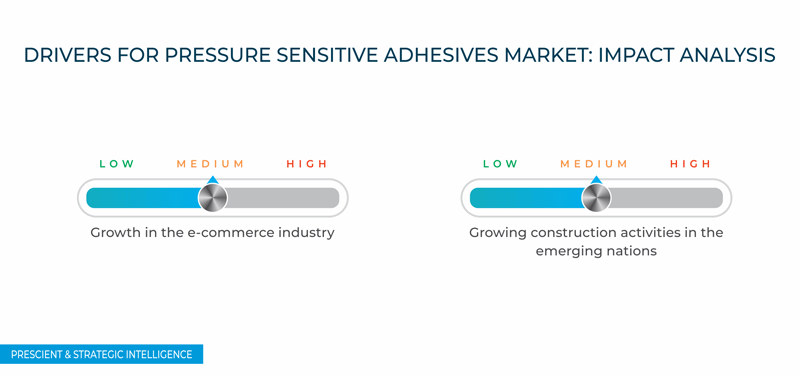

One of the major pressure sensitive adhesives market growth drivers is the booming e-commerce industry across the globe due to the surging purchasing power of people and their changing preferences. This is subsequently pushing up the demand for packaging, especially paperboard packaging, which is, in turn, fueling the requirement for cartons and, ultimately for pressure-sensitive adhesives. According to an article published by RetailNews Asia in 2019, the global online grocery industry is recording rapid advance, with the APAC industry predicted to expand by 196% by 2023 alone.

Developing countries, such as China, Brazil, and India, hold an enormous growth potential for the players operating in the pressure sensitive adhesives industry. Due to the expansion of the construction, electronics, fast-moving consumer goods (FMCG), and various other end-use industries, the demand for pressure-sensitive adhesives is climbing in these countries. Moreover, many industry players are setting up their production units here to leverage this surging requirement. For example, in December 2017, Bostik India Private Limited, which is the specialty adhesives business line of Arkema Group, inaugurated a new production facility in Gujarat, India.

Segmentation Analysis of Pressure Sensitive Adhesives Market

The silicone category is predicted to exhibit the fastest growth under the formulation segment of the pressure sensitive adhesives market in the forthcoming years due to the advance of the hygiene product and healthcare industries. Silicone-based adhesives are heavily used in various hygiene and healthcare products, such as baby diapers, sanitary napkins, and medical tapes.

The tapes category is predicted to lead the market, within the application segment, in the coming years. The extensive utilization of pressure-sensitive tapes in automobiles, electronics, construction, packaging, and numerous other applications is pushing up the requirement for them.

The packaging division held the largest share in the market during the last few years, under segmentation by industry. This was because of the large-scale usage of these adhesives on cartons, the demand for which has been bolstered by the emergence of e-commerce. The expansion of the e-commerce industry is predicted to keep propelling the demand for these adhesives in the upcoming years.

Geographical Analysis

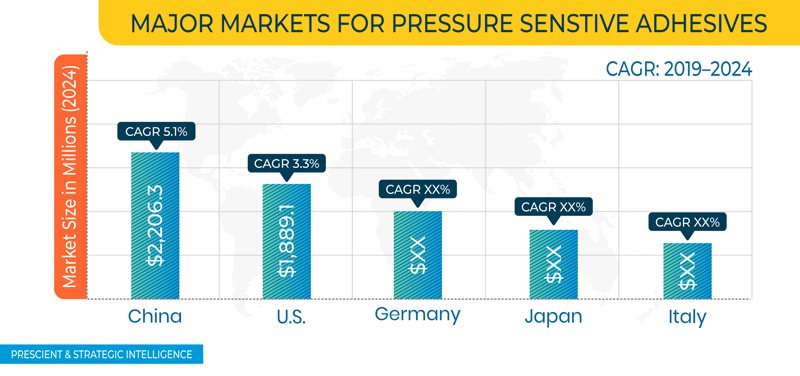

Globally, the APAC region dominated the market in the past, and this trend is predicted to continue in the forthcoming years. This is ascribed to the growth of the packaging, construction, automotive, and electronics industries in the region. Japan, South Korea, and China are the global leaders in electronics manufacturing, while China and India are two of the largest FMCG consumers in the world. Furthermore, China held a more than 55.0% share in the APAC pressure sensitive adhesives market 2018, and the dominance of the country will likely be maintained in the upcoming years.

Competitive Landscape

The global pressure sensitive adhesives market is highly fragmented, wherein top 10 market players accounted for nearly 50% and remaining market share is shared by hundreds of global and domestic manufacturers. The key players in the global manufacturing and sales operations are Henkel AG & Co. KGaA, 3M Company, Arkema Group, H.B. Fuller Co., Avery Dennison Corp., Sika AG, The Dow Chemical Company, Ashland Inc., Huntsman Corporation, and Mapei SPA.

Some of the other market players in the pressure sensitive adhesives market are Exxon Mobil Corporation, BASF SE, TOYOCHEM CO. LTD., Toagosei Co., Ltd., Wacker Chemie AG, Jowat SE, Adhesives Research Inc., Hitachi Chemical Company Ltd., Pidilite Industries Ltd., and Franklin Adhesives & Polymers.

Recent Strategic Developments of Major Pressure Sensitive Adhesives Market Players

In recent times, major players in the pressure sensitive adhesives market have taken several strategic measures such as product launches and geographical expansions to gain a competitive edge in the industry. For instance, in April 2019, 3M Company announced that it added 3M Extended Wear Medical Transfer Adhesive, 4075 to its product line of advanced adhesives for medical devices. This product features an extended wear pressure sensitive transfer adhesive and various backing materials. The introduction of 3M Extended Wear Medical Transfer Adhesive, 4075 is going to strengthen the product line of 3M’s advanced adhesives for medical devices.

In addition, Ashland Inc. had launched Aroset 2100 PSA in May 2018, which is a coater-ready and self-crosslinking adhesive. This adhesive had developed to provide specialty tape and label manufacturers with the capability to manufacture extremely robust tapes for performance design spaces that were previously not available to solvent-based acrylate pressure sensitive adhesives.

Key Questions Addressed in the Report

- What is the current scenario of the pressure sensitive adhesives market?

- What are the emerging formulations for the development of pressure sensitive adhesives?

- What is the historical and the present size of the market segments and their future potential?

- What are the major applications of pressure sensitive adhesives and their impact on the market during the short, medium, and long terms?

- What are the evolving opportunities for the players in the market?

- Which are the key geographies from the investment perspective?

- What are the key strategies adopted by the major players to expand their market share?

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws