Report Code: 11749 | Available Format: PDF | Pages: 158

Position Sensor Market Research Report: By Type (Rotary [Rotary Encoder, Rotary Potentiometer, Resolver, Rotary Variable Differential Transformer], Linear [Linear Potentiometer, Magnetostrictive Sensor, Laser Sensor, Linear Encoder, Linear Variable Differential Transformer]), Contact Type (Contact, Non-Contact), Industry (Automotive, Aerospace, Consumer Electronics, Packaging, Manufacturing, Healthcare), Geographical Outlook (U.S., Canada, Germany, France, U.K., Italy, Russia, Japan, China, India, Thailand, South Korea, Brazil, Mexico, Turkey, South Africa, Nigeria, Egypt) - Global Industry Analysis and Forecast to 2024

- Report Code: 11749

- Available Format: PDF

- Pages: 158

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Outlook

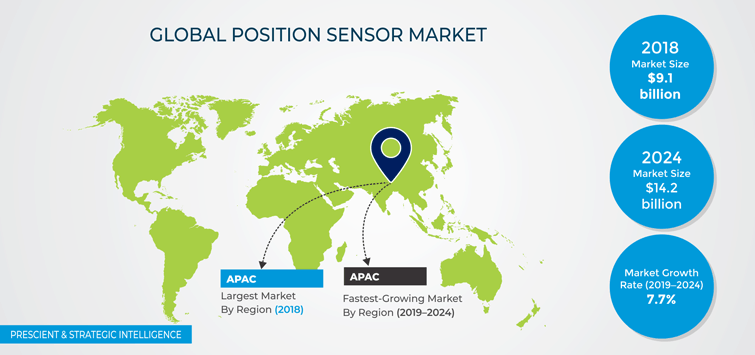

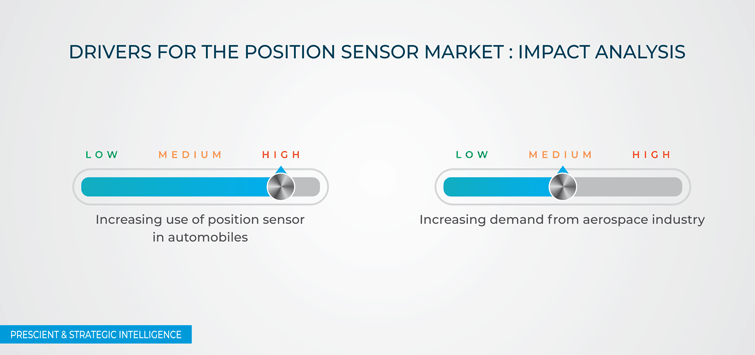

Valuing $9.1 billion in 2018, the position sensor market is expected to advance at a 7.7% CAGR between 2019 and 2024. The key drivers for the industry are the rising demand for such instruments in the automobile and aerospace sectors and rising focus of manufacturers on more-thorough inspections and accurate measurements.

Asia-Pacific (APAC), which dominated the industry in 2018, will witness the fastest growth in the coming years. This will be due to the growing automotive, manufacturing, and packaging industries in the region, especially China. In addition, the surging aircraft production is leading to the rising demand for such instruments in the region.

Smart position sensors are trending across the globe on account of their non-contact-sensing nature, which allows them to calibrate themselves. Additionally, they offer a better control of motion, and they can be used in demand settings, such as in the aerospace and healthcare sectors. With time, key players in the position sensor industry have started launching advanced variants.

For instance, a new position sensor with a rotary configuration was launched by Honeywell International Inc. in 2012. The instrument offers non-contact, 360-degree angular position sensing, which is why it is ideal for determining the articulation and steering angles in automobiles and for detecting the boom arm in windmills and solar panels.

The position sensor market is being primarily driven by the rapid integration of such instruments in vehicles. Here, clutch plates, steering angle sensing, and pedal positioning are the key applications of position sensors. Additionally, these instruments are integrated into parking assistance systems and hybrid engines. Thus, with the increasing automobile production in China, Thailand, and Indonesia, the industry is expanding. For instance, in 2017, China manufactured 29.7 million vehicles, compared to 7.7 million in 2013.

Segmentation Analysis

The higher revenue in the market for position sensors, on the basis of type, was generated by the rotary category in 2018. These variants are used in consumer electronics and for pedal and throttle position detection and control in automobiles. The linear category is set to experience the faster growth till 2024. These variants are required for accurate measurements in the manufacturing and aerospace industries.

The linear potentiometer category held the largest share in the market for position sensors in the past, based on linear sensors, because these instruments have a better temperature stability and lower cost. In the near future, the demand for laser sensors is predicted to burgeon the most rapidly, as they offer accurate and fast measurements, which are prized in the aerospace, electronics, and manufacturing industries.

The position sensor market was dominated in 2018 by the contact bifurcation, under segmentation by contact type. As contact position sensors are less costly compared to non-contact variants, they remain popular in emerging economies, such as India, Indonesia, and China. The demand for non-contact variants will experience the swifter increase between 2019 and 2024 owing to their high accuracy even in nanometer and sub-micron levels. Moreover, the demand for such sensors is rising for applications on surfaces that cannot be touched during measurements.

Geographical Analysis

APAC was the highest revenue contributor to the industry in 2018, and it will also experience the fastest-growing sales of such instruments in the near future. This will be because of the increasing demand for consumer electronics and automobiles in regional countries, due to their burgeoning population. China and Japan are the main engines of industry growth in the region, as they are the two largest automobile producers, especially of electric vehicles (EV).

Both these countries are offering monetary incentives to encourage EV production and adoption considering the high levels of air pollution they struggle with. For instance, China has been offering a subsidy of more than $10,000 on the purchase of EVs since 2017, because of which their sales jumped by 42% from 2016. The position sensor market is essentially being driven in the region by the importance of such instruments in automobiles.

.png)

Competitive Landscape

The position sensor market is highly fragmented in nature, with the presence of numerous players in the market. The key players in the market witnessed an increase in their sales value, primarily in the APAC region, predominantly due to the growing automotive and industrial equipment markets. This growth is further projected to intensify the market competition during the forecast period.

Recent Strategic Developments of Major Position Sensor Market Players

The major players in the global position sensor market are focusing on mergers and acquisitions, partnerships, product launches, and client wins to gain a competitive edge in the market. For instance, in 2018, SICK AG launched AHS/AHM36 IO-link absolute encoder with a single turn resolution of 24 bits, 12 bits for multiturn. The product is compact, cost effective, fully magnetic, and is suitable for harsh environments.

Key Questions Answered in the Report

- What are the emerging technologies that could impact the position sensor market?

- What is the current scenario of the position sensor market?

- What are the key market segments and their market size and future potential?

- What are the major catalysts for the market and their impact during the short, medium, and long terms?

- What are the upcoming opportunities for the players in the market?

- Which are the key regions from the investment perspective?

- What are the key strategies adopted by the major players to expand their market share?

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws