Report Code: 12873 | Available Format: PDF | Pages: 310

PCR Technologies Market Size and Share Analysis by Product (Reagents and Consumables, Instruments, Software and Services), Technique (Conventional PCR, Real-Time PCR, Digital PCR, Reverse Transcription PCR, Multiplex PCR), Application (Gene Expression Analysis, Genetic Sequencing, Genotyping, Nucleic Acid Detection, Diagnostics), End User (Hospitals and Diagnostic Centers, Academic Institutions and Government Organizations, Pharmaceutical Biotech Companies, Applied Industries) - Global Industry Demand Forecast to 2030

- Report Code: 12873

- Available Format: PDF

- Pages: 310

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

PCR Technologies Market Size & Share

The global PCR technologies market size was USD 13,709.3 million in 2023, and it is expected to reach USD 23,672.5 million in 2030, with a growth rate of 8.4% during 2024–2030. This is attributed to the rise in infectious disease and genetic disorder incidence and increase in investments to enhance diagnostic technologies.

Moreover, the increasing awareness of early disease diagnosis and innovations in products are expected to add fuel for the growth of this market.

In January 2023, F. Hoffmann-La Roche Ltd. and TIB Molbiol, its subsidiary, launched a COVID-19 PCR test that can detect and differentiate the XBB.1.5 variant, which is highly prevalent in the U.S. Test results will help and provide insights into the epidemiology of this variant and its impact on public health.

COVID-19 is a major driver for the uptake of the PCR technology because it was made a mandatory test for flyers in many countries.

- In December 2022, the Indian government made RT-PCR testing for COVID-19 mandatory for passengers arriving from Japan, China, Hong Kong, Singapore, Thailand, and South Korea from January 2023 onward.

- In January 2023, France extended its mandate for COVID-19 tests for travelers from China. France has urged the 26 other European Union member states to test Chinese travelers for COVID.

- The U.S. has too imposed mandatory COVID-19 tests for people flying in from China. Further, the Centers for Disease Control and Prevention said that U.S. citizens should put plans to travel to China, Hong Kong, and Macau on hold indefinitely.

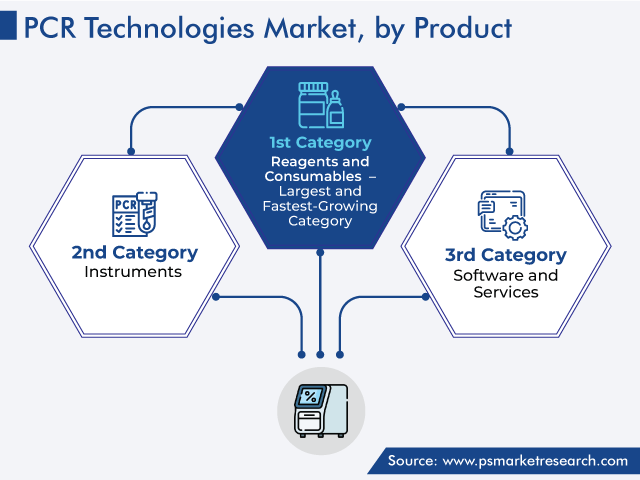

Reagents and Consumables Category Accounted for Largest Revenue Share

Reagents and consumables held the largest share in 2023, of 70%, and this category is expected to dominate the product segment throughout the forecast period. This is because of the frequent use of consumables and reagents for PCR testing. Essentially, the increasing prevalence of infectious disease, especially COVID-19, drives the market in this category.

Moreover, companies are announcing the availability of enhanced reagents for more virus groups, such as monkeypox.

- In October 2022, BioGX Inc. announced the availability of Xfree PCR reagents for sample-to-answer direct sampling on multiple RT-PCR platforms, including its rapid pixl platform.

- In November 2022, PCR Biosystems Ltd. launched new qPCR reagent mixes, including Clara Probe 1-Step Mix, Clara Probe Mix, and Clara HRM Mix, for researchers

Furthermore, companies are signing agreements to supply reagents to governments, medical organizations, and other end users. For instance, in November 2022, Seegene Inc. won a tender worth EUR 45 million to supply reagents for diagnostic purposes with the Government of Tuscany in Italy.

Additionally, the FDA is offering Emergency Use Authorizations (EUAs) for an increasing number of diagnostic tests. For instance, in January 2023, Becton, Dickinson and Company and CerTest Biotec Received the FDA’s EUA for a molecular PCR assay for monkeypox. The VIASURE reagents are now available for entities using BD’s MAX System.

Instruments also held a significant share in the market in 2023 due to the technological advancement in them, which have expanded their usage area.

- In January 2023, Visby Medical Inc. received the EUA from the FDA for its point-of-care respiratory test. The Respiratory Health Test is a fast PCR device that detects upper respiratory infections and differentiates between influenza A & B and COVID-19.

- In June 2022, Bio-Rad Laboratories Inc. unveiled the CFX Opus Deepwell RT-PCR detection system for researchers working on developing and enhancing nucleic acid detection assays.

Real-Time PCR Held Largest Market Share

Real-time polymerase chain reaction accounted for the largest share in 2023, and this category is expected to have a significant CAGR, of 8%, during 2024–2030. This is because it is one of the most-widely used techniques across the world in a wide range of applications, such as cancer phenotyping, species abundance quantification, gene expression analysis, and diagnostic test development.

- In December 2022, BioGX Inc. released its portable pixl qPCR RT-PCR platform on commercial scale. The product complements Xfree COVID-19 direct RT-PCR, which has received the recent U.S. FDA Expanded Access approval. The benchtop, 16-well, 4-channel, RT-PCR device enables rapid turnarounds for up to 16 samples in a batch with integrated result interpretation on a touchpad, which has a small size footprint.

- In May 2022, Anitoa Systems LLC launched an RT-PCR solution for dengue. This includes a family of 4–6 channel RT-PCR instruments with a small footprint, named Maverick. The product comes with a lyophilized, one-step, multiplex RT-PCR reagent.

- In December 2022, Molbio Diagnostics Private Limited launched a chip-based RT-PCR test for Clostridium difficile. The CDSCO-approved test provides results in one hour. It works on the existing Truelab infrastructure and does not require any device, which makes it apt for PoC settings.

- In January 2023, NeoDx Biotech Labs Pvt. Ltd. launched an RT PCR detection kit for chronic myelogenous leukemia.

- In July 2022, Genes2Me Pvt. Ltd. unveiled an RT-PCR-based kit for the monkeypox virus. The kit has a turnaround result time of less than 50 minutes, is available in both the standard variant for multiple RT-PCR instruments and the PoC variant for the Genes2Me Rapi-Q HT Rapid device.

Growing Popularity of Digital PCR Tests

The growing demand for digital PCR kits and assays, reagents, and consumables is one of the key drivers for the market, especially since the pandemic. As the epidemic broke out, the demand for digital PCR tests from biotechnology and life sciences companies rose substantially. polymerase chain reaction tests were conducted at all kinds of places, from hospitals and airports to stadia and shopping malls, to detect and isolate patients with the infection.

Based on Application, Diagnostics Holds Largest Share

The diagnostics category holds the largest share, by application because PCR tests are a highly accurate way to diagnose certain genetic changes and infectious diseases. The tests work by finding the DNA or RNA of a pathogen or abnormal cells in a sample.

Hospitals and Diagnostic Centers Account for Highest Revenue

Hospitals and diagnostic centers dominated the market, with a share of 35%, in 2023, which is attributed to the advancements in the healthcare infrastructure in developing countries. Hospitals and diagnostic centers extensively use PCR consumables and instruments for the diagnosis of viruses and for genetic testing. In this regard, the high prevalence of infectious disease and the growing awareness of early diagnosis are driving the market growth in this end user category.

Mergers & Acquisitions among Companies Are New Trend

Companies in the market are entering into mergers & acquisitions to advance the technology of their products, reach more people, and augment their revenue.

- In August 2022, Bio-Rad Laboratories Inc. signed an agreement to acquire all of Curiosity Diagnostics Sp. Z. o. o.’s outstanding shares for USD 170 million. The deal gave Bio-Rad access to Curiosity Diagnostics’ under-development sample-to-answer, rapid PCR system for molecular diagnostics.

| Report Attribute | Details |

Market Size in 2023 |

USD 13,709.3 Million |

Market Size in 2024 |

USD 14,605.5 Million |

Revenue Forecast in 2030 |

USD 23,672.5 Million |

Growth Rate |

8.4% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Product, By Technique, By Application, By End User, By Region |

Explore more about this report - Request free sample

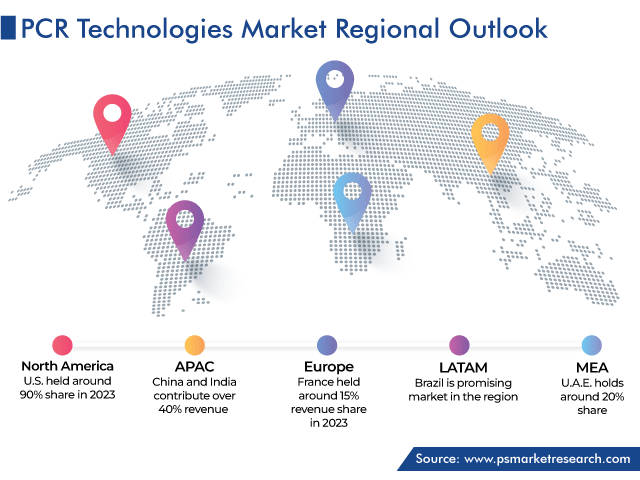

North America Held Largest Share in PCR Technologies Market

North America accounted for the largest share, of 40%, in 2023, and it is set to remain dominant throughout the forecast period. This is attributed to rise in the incidence of infectious disease, advancement in the healthcare infrastructure, and launch of enhanced PCR instruments and consumables by the major players.

- In July 2022, Neelyx Labs Inc. announced that it was processing 8,000 monkeypox tests per day. Neelyx delivers stat tests with a one-hour turnaround, using the XDiveTM ultrafast RT-PCR instrument.

Some Key Players in the Market Are:

- F. Hoffmann-La Roche AG

- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories Inc.

- QIAGEN N.V.

- Takara Bio USA Inc.

- Agilent Technologies Inc.

- Standard BioTools Inc.

- Danaher Corporation

- Abbott Laboratories

- Merck Life Science Private Limited

- Becton, Dickinson and Company

- Eppendorf AG

Market Breakdown

This fully customizable report gives a detailed analysis of the PCR technologies market from 2017 to 2030, based on all the relevant segments and geographies.

Segment Analysis, By Product

- Reagents and Consumables

- Instruments

- Software and Services

Segment Analysis, By Technique

- Conventional PCR

- Real-Time PCR

- Digital PCR

- Reverse Transcription PCR

- Multiplex PCR

Segment Analysis, By Application

- Gene Expression Analysis

- Genetic Sequencing

- Genotyping

- Nucleic Acid Detection

- Diagnostics

Segment Analysis, By End User

- Hospitals and Diagnostic Centers

- Academic Institutions and Government Organizations

- Pharmaceutical Biotech Companies

- Applied Industries

Region/Countries Reviewed for this Report

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws