Report Code: 11353 | Available Format: PDF | Pages: 163

Osseointegration Implants Market by Product (Bone-Anchored Prostheses (Spinal Fusion, Auditory, Upper and Lower Limb), Dental Implants (Crown, Implant, Abutment)), by Material Type (Metallic, Ceramic, Polymeric), by End User (Hospitals, Dental Clinics, ASCs), by Geography (U.S., Canada, Germany, France, U.K., Japan, Australia, India, China) - Global Market Size, Share, Development, Growth, and Demand Forecast, 2013-2023

- Report Code: 11353

- Available Format: PDF

- Pages: 163

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

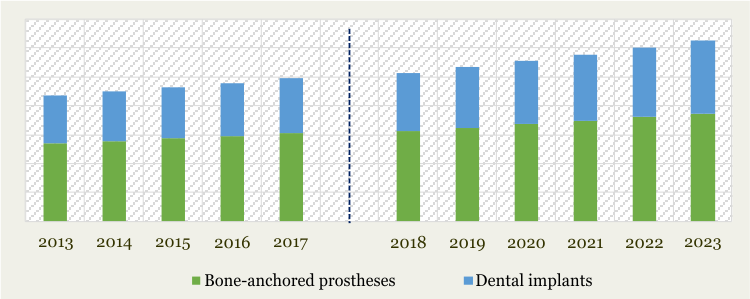

The global osseointegration implants market size was valued at $9.9 billion in 2017. It is expected to grow at a CAGR of 4.0% during the forecast period. In terms of size, the growth of the market was led by the increasing adoption of bone-anchored prostheses products. Bone-anchored prostheses held the largest share of the global osseointegration implants market in 2017 and the category is expected to lead the market in the coming years as well. This leading position of the category is mainly due to the increasing prevalence of spinal disorders, rising number of amputations, and growing aging population with hearing loss.

GLOBAL OSSEOINTEGRATION IMPLANTS MARKET, BY PRODUCT, $M (2013 - 2023)

Some of the materials used for manufacturing osseointegration implants include metallic, ceramic, polymeric, and other hybrid materials. Metallic biomaterial is most commonly used material by the manufacturers as compared to other materials and is estimated to generate revenue of $5.3 billion revenue in 2017. This is mainly attributed to the biochemical properties of the metallic osseointegration implants, since metallic implants provide good finishing and are easy to process and sterilize.

Hospitals, ambulatory surgical clinics (ASCs), and dental clinics are the key end users in the global osseointegration implants market. Hospitals were the largest end users for osseointegration implants, with an estimated share of 66.4%, which is expected to reach 67.8% by 2023. The high consumption of these products in hospitals is mainly attributed to increasing number of spinal fusion surgeries in hospitals as compared to other end users.

Globally, North America was the the largest contributor to the osseointegration implants market in 2017, mainly because of growing aging population, rising number of tooth loss and amputations, increasing number of spinal disorders such as stenosis, and increasing healthcare expenditure in the region. According to the UN publication “An Aging World 2017”,22% population was aged 60 years and over in North America and is expected to shift to 28% by 2050.

Osseointegration Implants Market Dynamics

Trends

Increasing use of titanium in osseointegration implants, surge in new product launches in the market, and increasing research on mini dental implants are the key trends observed in the global market. Major players in the osseointegration implants market are focusing on enhancing their product portfolio with new and innovative products to retain their foothold in the market. For instance, in September 2017, Henry Schein, Inc. launched the Dental Ratio implant system, and gained exclusive distribution rights in the U.K for the same.

Growth Drivers

Factors driving the growth of the osseointegration implants market include increasing prevalence of spinal cord injuries (SCIs), growing number of dental implant surgeries, and rising number of trauma incidents. According to the National Spinal Cord Injury Statistical Center at the University of Alabama at Birmingham (UAB), SCIs increased drastically from 2010 to 2015, with a 38% increase in injuries from vehicles alone. As of 2015, around 12,500 new SCIs occur each year and between 240,000 and 337,000 people suffer with SCI in the U.S. Thus, increasing prevalence of SCIs globally will lead to the growth of the market.

Reciprocating this demand, the government and other organizations in various countries provides reimbursement support for surgeries. For instance, Osseointegration Group of Australia (OGA) provides Australian Private Health Insurance, that covers most of the cost involved with OGAP-OPL prostheses surgery. Also, in July 2015, the USFDA authorized the use of the first prostheses marketed in the U.S. for adults who have amputations above the knee and who have rehabilitation problems with, or cannot use, conventional socket prostheses. Further, the increasing number of hearing loss cases in the geriatric population, and rise in the funding for osseointegration research, are some of the other key factors that would drive the overall growth of the osseointegration implants market.

Opportunities

Transfemoral amputee implant approval and spur in the disposable household income in the emerging economies are expected to provide ample opportunities to the manufacturers operating in the osseointegration implants market. For instance, National Bureau Statistics (NBS) of China stated that the disposable personal income in China increased from $5,001.8 in 2015 to $5,016.6 in 2016. The increasing household incomes in developing countries is expected to create immense opportunities for the providers to invest in the market as the population in these countries can now easily adopt these implants.

Osseointegration Implants Market Competitive Landscape

Some of the key players in the osseointegration implants Industry are Zimmer Biomet Holdings, Inc., Dentsply Sirona Inc., Danaher Corporation, The Straumann Group, Henry Schein, Inc., Integrum AB, Stryker Corporation, NuVasive, Inc., William Demant Holding A/S, Cochlear Ltd., Medtronic plc, and DePuy Synthes Companies.

Major players are focusing on the acquisition of other osseointegration implants manufacturers in order to expand their product portfolio, which is further expected to increase their market share in the coming years. For instance, in December 2017, The Straumann Group announced the acquisition of Same Day Solutions (SDS), Lisbon based dental distribution company engaged in marketing and selling of competitor dental implants, biomaterials and whitening products in Portugal. The acquisition is expected to benefit SDS’s customers to access Straumann Group’s product portfolio; enhancing the group sales in Portugal; and creating opportunities to expand the Group’s digital and orthodontic business.

Further, in January 2017, DePuy Synthes Products, Inc. announced the asset purchase and development agreement with Interventional Spine, Inc., a manufacturer of expandable cage and minimally invasive surgery (MIS) technology, to accelerate the growth of spine fusion. The acquisition added the family of expandable cages used in spinal fusion surgery, to the DePuy Synthes portfolio of products.

In March 2016, Zimmer Biomet Holdings, Inc. acquired Colorado-based Ortho Transmission, LLC. The acquisition included Ortho Transmission's transcutaneous osseous integrated skeletal implant technology, which complements Zimmer Biomet's ongoing collaboration with the U.S. Department of Defense for the development of a transcutaneous system for anchoring external prosthetic limbs, to restore the mobility of amputee patients.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws