Report Code: 10052 | Available Format: PDF

Bariatric Surgery Devices Market Size and Share Analysis - Global Development & Demand Forecast to 2030

- Report Code: 10052

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

Bariatric Surgery Devices Market Size & Share

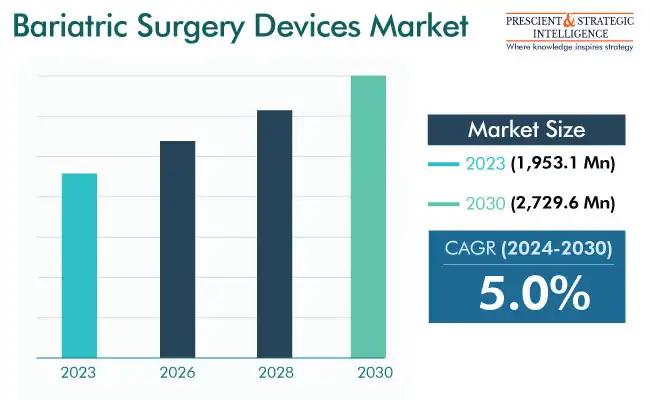

The bariatric surgery devices market valued an estimated USD 1,953.1 million in 2023, and it will grow at a rate of 5% during 2024 and 2030, reaching USD 2,729.6 million by 2030. The increasing acceptance of bariatric surgeries because of their ability to advance the physical appearance is the key factor powering the industry growth. Apart from appearance, obesity causes real-life problems, such as issues in mobility, dependence on others, and more-serious conditions, such as stroke, which is strongly associated with high cholesterol levels.

Moreover, the NICE recommends bariatric surgery over lifestyle changes and medication for people who have diabetes mellitus. Therefore, the growing obesity occurrence rate in adults is impelling healthcare centers to adopt cutting-edge robotic technologies for operational excellence. In addition, the increasing repayment coverage for bariatric surgeries by governments across developed nations will further boost the industry revenue.

The substantial body dissatisfaction, chiefly with the belly and thighs, has led a considerable count of patients to opt for a bariatric surgery. Apart from the hips, arms, and legs, people have an inordinate desire to change the appearance of the lower body, including the thighs and waist, and. Additionally, the preferred body contouring procedures following substantial weight loss are upper arm lifts, tummy tucks, thigh lifts, and lower body lifts.

With the increasing obese population at a global level, the acceptance of anti-obesity surgery devices will rise. Additionally, the launch of awareness programs promoting a healthy body image is driving the revenues for companies offering the related medical devices.

For example, in March 2022, ISPOR, in partnership with Medtronic plc, conducted the Bariatric Surgery Reimbursement Seminar to spread consciousness on the advantages of surgery for the treatment of obesity. Another important driver for the growth of the industry is the increase in the requirement for MISs. Moreover, the increase in the number of medical students specializing in this field will aid this advance.

The acceptance of AI in bariatric surgeries and the increment in the level of automation in such procedures, in addition to the increasing R&D efforts to fashion better approaches, is the biggest market trend currently. Further, gastric bypass and gastric sleeve surgeries are rising popularity among patients and surgeons, which is responsible for a substantial increase in the revenue of the industry.

Minimally Invasive Procedures Category Leads Industry

The minimally invasive category is the leader of the industry under the procedure segment. The fast recovery and reduced scarring with such devices are the key factors powering the category growth. To limit the intake of food or quicken up digestion, to avert weight gain, minimally invasive bariatric surgeries are done on the intestines or stomach. Furthermore, the notable peri-operative efficiency of such procedures because of the use of a small optical fiber tube with a video camera at one end is a key factor driving their acceptance.

Moreover, within the minimally invasive procedures category, the sleeve gastrectomy category holds the largest share. The requirement for sleeve gastrectomy is powered by the growing popularity of effective, safe, and reasonably priced surgeries. Moreover, the FDA has accepted the incision-free sleeve gastrectomy and approved various associated devices designed by numerous healthcare technology companies.

Furthermore, this process has a shorter hospital stay, of around two days post-surgery, and a lot fewer complications than other procedures. Additionally, it involves a smaller incision, thereby making it easier for patients to have the surgery without any fear. It also leads to less scarring, and since appearance is one of the biggest factors impelling people to lose weight, this advantage continues to make the minimally invasive sleeve gastrectomy popular.

| Report Attribute | Details |

Market Size in 2023 |

USD 1,953.1 Million |

Revenue Forecast in 2030 |

USD 2,729.6 Million |

Growth Rate |

5.0% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

APAC To Have Fastest Growth

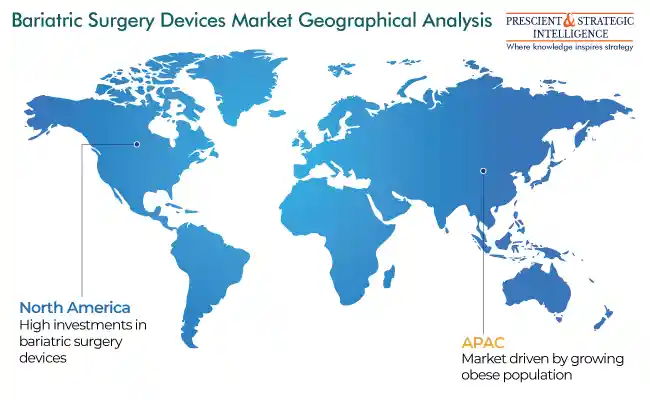

North America generated the highest revenue in the market over the historical period, as a lot of players are investing in bariatric surgery devices, marketing them vehemently to end users. Additionally, the frequency of product introductions will experience a rapid surge with market players placing more focus on R&D.

Furthermore, the increasing count of grants from numerous government and non-government bodies in North America drives innovations in anti-obesity surgery. For example, in March 2022, the Canadian government released USD 2 billion to introduce the latest surgical devices in hospitals, research institutes, and bioscience facilities.

APAC is observing the fastest growth in the market as a result of the enormous obese population and growing medical tourism sector. The procedure, offered at USD 25,000 in the U.S., is priced at USD 12,000 in APAC, on average. Even the players of the industry have extended their research facilities in India to examine the factors related to obesity. For example, Covidien has established a novel research facility in Hyderabad to comprehend the key risk factors for obesity in India.

Shift from Minimally Invasive to Non-Invasive Methods

While minimally invasive surgeries continue to be preferred over the traditional open surgeries, many people have already begun preferring non-invasive methods. In this regard, gastric electrical stimulation is among the key trends in the industry. This procedure involves the usage of an electrical device, which is known as a gastric pacemaker. The device triggers mild electrical stimulations in the stomach nerves. This creates a feeling of satiety after eating, thus encouraging people to decrease their food intake and result in weight loss. This factor will propel the demand for electrical probes, wires, and generators and, thus, drive the market.

Hospitals Are Largest End Users of Obesity/Bariatric Surgery Devices

On the basis of end user, hospitals lead the industry because of the massive increase in obese population and its rising awareness of treatment approaches. Moreover, hospitals offer all-inclusive care to morbidly obese people, which other individual clinics are not always able to.

Apart from this, the demand for the associated devices at ambulatory surgery centers (ASCs) will also grow at a significant rate because of the rising popularity of minimally invasive and non-invasive surgeries. Since these procedures are not as complex or risky as open surgeries, ASCs can easily perform them. Additionally, these centers have shorter waiting times and lower service charges, which is why their popularity among patients is increasing.

Major Companies Offering Obesity/Bariatric Surgery Devices

- Standard Bariatrics

- Medtronic plc

- Johnson and Johnson Services Inc.

- TransEnterix

- USGI Medical

- Apollo Endosurgery Inc.

- Olympus Corporation

- Mediflex Surgical Product

- EnteroMedics

- Intuitive Surgical Inc.

- CONMED Corporation

- Integra Life Sciences Holdings Corporation

- B. Braun Meslungen AG

- Cousin Biotech S.A.S.

- Cook Group Incorporated

- ReShape Lifesciences Inc.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws