Report Code: 12041 | Available Format: PDF | Pages: 159

Mobile Collaborative Robots Market Research Report: By Offering (Hardware, Software, Services), Payload (<5 Kg, 5-10 Kg, >10 Kg), Application (Pick & Place, Material Handling, Welding, Machine Tending, Assembling), End User (Automotive, Agriculture, Retail, Mining & Mineral, Manufacturing, Aerospace & Defense, Healthcare, Electronics)-Global Industry Analysis and Growth Forecast to 2030

- Report Code: 12041

- Available Format: PDF

- Pages: 159

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Mobile Collaborative Robots Market Overview

The global mobile collaborative robots market size was $543.3 million in 2019, and it is projected to witness a CAGR of 26.3% during the forecast period (2020–2030). The growing demand for industrial automation solutions and surging adoption of mobile cobots in the automotive industry are the key factors driving the mobile collaborative robots industry.

The COVID-19 pandemic has negatively impacted the growth of the mobile collaborative robots market across the world, as it has resulted in the disruption of the supply chain of raw materials and components, as well as investments in automation and robotics technologies in several countries, including China and the U.S.

Segmentation Analysis

Services Are Expected to See Fastest Increase in Demand during Forecast Period

In the mobile collaborative robots market outlook, on the basis of offering, the services category incorporates the revenue generated from the sale of aftermarket components, integration/deployment of mobile cobots, and consulting services. With the rising adoption of mobile cobots around the globe, the demand for installation and maintenance services is expected to increase rapidly during the forecast period.

High Adoption of <5-Kg-Payload-Capacity Mobile Cobots is due to their Wide Application

The <5-kg-payload-capacity category held the largest mobile collaborative robots market share in 2019. A payload capacity of up to 5 kg is ideal for pick & place, testing, as well as assembly applications, due to which the demand for <5-kg-payload-capacity mobile cobots is increasing. Moreover, <5-kg-payload mobile cobots are cheaper and take less space as compared to the higher-payload-capacity mobile cobots.

Demand for Assembling Mobile Cobots in Manufacturing Industries Is Increasing due to Rising Automation Level

In the mobile collaborative robots market, the assembling category, among applications, is expected to witness the fastest growth during the forecast period. Assembly operations require mobile cobots on a large scale, as they reduce the time for assembly, thus increasing the speed. Due to this, with the rising automation level in manufacturing industries, the demand for mobile cobots, for assembly purposes, is expected to increase during the forecast period.

Growth in Electronics Sector Are Creating Demand for Mobile Cobots

The rapid adoption of mobile cobots by manufacturers in the continuously growing electronics industry, for increasing the productivity and performing repetitive tasks, would drive the mobile collaborative robots market in this end-user category during the forecast period.

Geographical Outlook

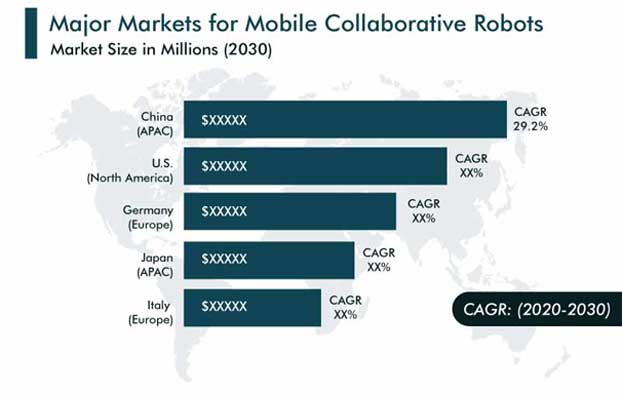

Asia-Pacific (APAC) is Highest-Revenue-Generating Region due to Growing Automotive Industry

The growing automotive industry, due to the rising sale of automobiles, especially electric vehicles, is driving the demand for mobile cobots in the APAC region. China and Japan hold a larger mobile collaborative robots market share in the automotive industry, due to the growing government support to increase the sale of electric vehicles, through subsidies and incentives. For instance, the Government of China announced plans in April 2020 to extend the state subsidies for new-energy vehicles until the end of 2022.

APAC To Witness Fastest Growth due to Rise in Population and Growing Consumer Electronics Industry

The rise in the population, coupled with the growth in the disposable income, is fueling the demand for consumer electronics in the region. As a result, the requirement for mobile cobots is increasing significantly, which would make APAC the fastest-growing region in the mobile collaborative robots market over the forecast period. Additionally, the presence of key consumer electronics manufacturers, such as LG Electronics Pvt. Ltd. and Samsung Electronics Co. Ltd., and inclination toward industrial automation, to reduce human intervention, are augmenting the demand for mobile cobots.

Trends & Drivers

Increasing Use Of Bin-Picking Mobile Cobots in Factories and Warehouses is Key Market Trend

A major trend being witnessed in the mobile collaborative robots industry is the use of bin-picking mobile cobots. Market players are focused on launching these mobile cobots because of their high accuracy in placing the products as well as lesser time taken to operate, thereby making them desirable among manufacturers across major industry verticals. They also allow manufacturers to quickly achieve high machine uptime and enable accurate placement of parts, with less human intervention. For instance, in April 2020, Teradyne Inc. launched an autonomous bin-picking kit, ActiNav, for machine tending applications. It can easily and autonomously locate and pick the parts from the bins and place them on a machine, thereby leading to an accurate placement and picking of products. Hence, the growing use of such bin-picking variants is augmenting the mobile collaborative robots market growth.

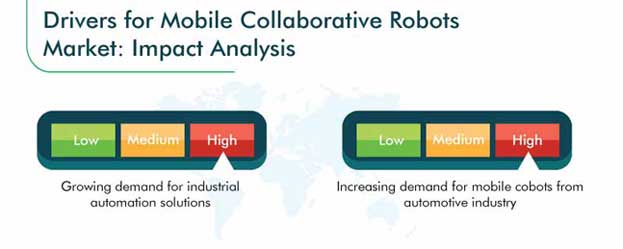

Growing Demand for Industrial Automation Solutions Is Driving Demand for Mobile Cobots

One of the key factors driving the mobile collaborative robots market is the growing demand for industrial automation solutions. The increasing complexity of production processes, labor shortage, and high labor costs, combined with the rising focus on higher productivity, have led to a dramatic increase in the demand for industrial automation solutions around the globe. In addition, companies in emerging economies, such as China and India, are heavily adopting automation solutions to offset labor shortage and improve productivity, thereby increasing their ability to compete in the international market.

| Report Attribute | Details |

Historical Years |

2014-2019 |

Forecast Years |

2020-2030 |

Base Year (2019) Market Size |

$543.3 million |

Forecast Period CAGR |

26.3% |

Report Coverage |

Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, COVID-19 Impact, Company Share Analysis, Companies’ Strategical Developments, Product Benchmarking, Company Profiling |

Market Size by Segments |

By Offering; By Payload; By Application; By End User; By Region |

Market Size of Geographies |

U.S., Canada, Germany, France, Italy, U.K., Spain, Japan, China, India, Australia, South Korea, Brazil, Mexico, Saudi Arabia, South Africa, U.A.E. |

Secondary Sources and References (Partial List) |

Arab Robotics Association, Association for Advancing Automation, Australian Robotics and Automation Association (ARAA), British Automation & Robot Association (BARA), Council For Robotics & Automation, European Engineering Industries Association, IACSIT Automation and Robotics Society (ARS), Israeli Robotics Association (IROB), Japan Robot Association, Korea Association of Robot Industry (KAR), Malaysia Robotics and Automation Society (MYRAS), Robotic Industries Association (RIA), Russian Association of Robotics (RAR), Taiwan Automation Intelligence and Robotics Association (TAIROA), The International Association for Automation and Robotics in Construction (IAARC), Wearable Robotics Association (WearRA) |

Explore more about this report - Request free sample

A Surge in Demand for Mobile Cobots from Automotive Industry Is Boosting Market

The rising demand for mobile cobots from the automotive industry is another key factor propelling the mobile collaborative robots market growth. The advantages offered by mobile cobots such as high-quality output and standardization in the production process are making them an obvious choice for automotive manufacturing. Added benefits over human operators are handling multiple tasks, such as welding, assembling, and material handling, owing to which the demand for mobile cobots is increasing. Moreover, mobile cobots are playing an important role due to the increasing level of automation, combined with the strong presence of various automotive original equipment manufacturers (OEMs) in countries such as Germany, China, the U.S., and South Korea.

Huge Focus of Cobot Manufacturers on Geographical Expansion to Increase Market Presence

In recent years, players in the mobile collaborative robots industry have expanded to various high-growth locations, to stay ahead of their competitors. For instance:

- In October 2019, Doosan Robotics Corporation announced the expansion of its sales and distribution network in the U.S., with the establishment of its first office in the country. It will be the company’s headquarters for sales, marketing, customer service, and training, for the Americas region.

- In September 2019, ABB Ltd. started the construction of a new robotics manufacturing and research and development (R&D) facility near Shanghai, China, with an investment of $50 million. The factory, utilizing advanced digital and automated manufacturing processes, will open in early 2021. In 2019, it was listed in the top 10 projects under the 'Manufacturing in Shanghai' initiative.

- In April 2019, Yaskawa Electric Corporation opened its new European robotics development center and robot production facility in Slovenia, which was constructed with an investment of $28 million. It is supplying the company’s Motoman robots to Europe and supporting the company’s production facilities in China and Japan.

- In March 2019, Bosch Rexroth Corporation announced the expansion of its manufacturing facility in China, with an investment of more than $67 million. Known as the ‘Factory of the Future’, it will develop connected solutions, to help Asian factory owners automate their operations.

Some of the Key Market Players Listed in Mobile Collaborative Robots Market Report are:

-

Teradyne Inc.

-

Aubo Robotics

-

Fanuc Corporation

-

Kawasaki Heavy Industries Ltd.

-

Yaskawa Electric Corporation

-

Fetch Robotics Inc.

-

OMRON Corporation

-

TECHMAN ROBOT INC.

-

Doosan Robotics Inc.

-

ABB Ltd.

-

Bosch Rexroth Corporation

-

Locus Robotics

-

Diligent Robotics Inc.

-

IAM Robotics

-

Comau S.p.A.

-

ISYBOT SA

-

Nachi Robotic Systems Inc.

-

Siasun Robot & Automation Co. Ltd.

-

Stäubli International AG

-

Shenzhen Yuejiang Technology Co. Ltd. (DOBOT)

-

F&P Robotics AG

-

Robotnik Automation S.L.L.

-

Neobotix GmbH

-

PAL ROBOTICS SL.

Mobile Collaborative RobotsMarket Size Breakdown by Segment

The mobile collaborative robots market report offers comprehensive market segmentation analysis along with market estimation for the period 2014–2030.

Based on Offering

- Hardware

- Robotic Arm

- End Effector

- Sensor

- Motor

- Software

- Services

Based on Payload

- <5 Kg

- 5–10 Kg

- >10 Kg

Based on Application

- Pick & Place

- Material Handling

- Welding

- Machine Tending

- Assembling

Based on End User

- Automotive

- Agriculture

- Retail

- Mining & Mineral

- Manufacturing

- Aerospace & Defense

- Healthcare

- Electronics

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- South Africa

- U.A.E.

- Saudi Arabia

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws