Report Code: 11469 | Available Format: PDF | Pages: 148

Methionine Market Research Report: by Form (Powder, Liquid), by Application (Animal Feed Additives, Pharmaceuticals, Food Processing, Aquaculture), Type (DL-Methionine, L-Methionine, Methionine Hydroxy Analog) - Global Market Size, Share, Development, Growth, and Demand Forecast, 2013-2023

- Report Code: 11469

- Available Format: PDF

- Pages: 148

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

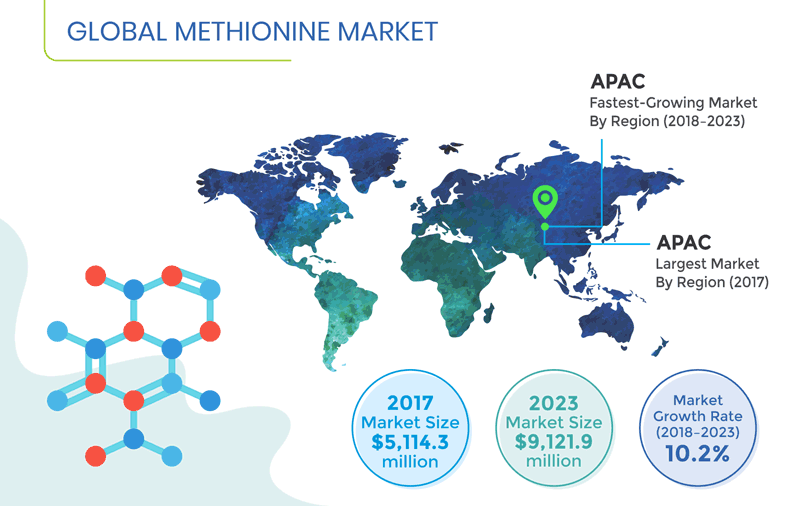

The global methionine market generated revenue of $5,114.3 million in 2017, and is projected to reach $9,121.9 million by 2023, registering a CAGR of 10.2% during the forecast period (2018–2023).

The Asia-Pacific (APAC) methionine market is expected to witness the fastest growth during the forecast period. This can be mainly attributed to the presence of key players in the region and increase in methionine production capacity in order to cater to the high demand for animal feed in the region.

Fundamentals Governing Methionine Market

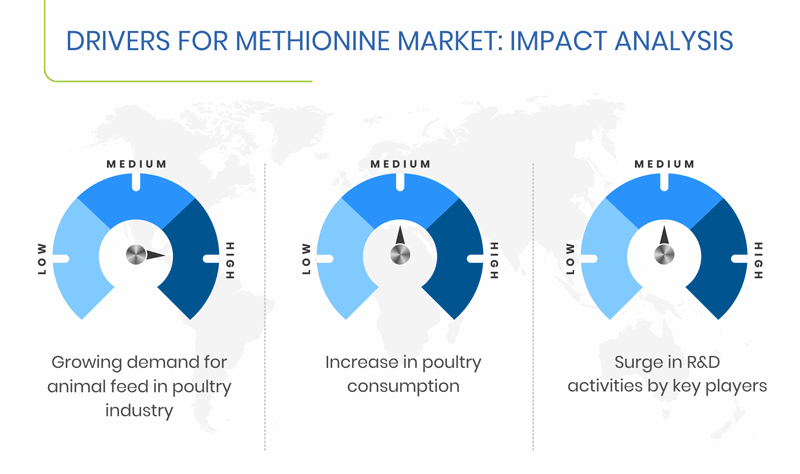

Emergence of bio-methionine is one of the major trends witnessed in the methionine market. Methionine is majorly derived from petrochemical sources, where raw materials are hard-to-handle and hazardous. Thus, companies are adopting new innovative biochemical process to manufacture methionine from essential raw materials, owing to their environment-friendly nature and sustainability benefits over petrochemical sources.

Growing demand for animal feed in the poultry industry is one of the key factors driving the methionine market. The demand is increasing at an exponential rate due to the increasing consumption of meat and egg. Methionine helps in the growth and development of the digestive tract of animals that plays a key role in increasing muscle mass and improving egg production of poultry animals.

The use of methionine in pharmaceuticals application is increasing, owing to its therapeutic advantages in treating liver cirrhosis, toxic hepatitis, pneumonia, and copper poisoning. It is used as a buffering agent in analgesics and antacids to treat aforementioned diseases, which is expected to provide lucrative opportunities in the methionine market.

Segmentation Analysis of Methionine Market

The liquid category is expected to exhibit faster volumetric growth during the forecast period, with a CAGR of 32.2%, on the basis of form. This can be attributed to the increasing production capacity of liquid form by key players, such as Bluestar Adisseo Company and Novus International Inc., in the methionine market.

The DL-methionine category held the largest volume share in 2017, among all types, in the methionine market. This is ascribed to its wide applications in food processing, pharmaceuticals, and animal husbandry.

The animal feed additives category held the largest volume share in 2017, based on application, in the methionine market. This is attributed to the growing consumption of meat and egg worldwide. This leads to increase in demand for more poultry production, which prompts farmers to use methionine in animal diet to increase productivity.

| Report Attribute | Details |

Historical Years |

2013-2017 |

Forecast Years |

2018-2023 |

Market Size by Segments |

Form, Application, Type |

Market Size of Geographies |

U.S., Canada, Germany, U.K., France, Russia, Italy, China, India, Japan, South Korea, Singapore, Brazil, Mexico, Saudi Arabia, Egypt, Iran |

Explore more about this report - Request free sample

Geographical Analysis of Methionine Market

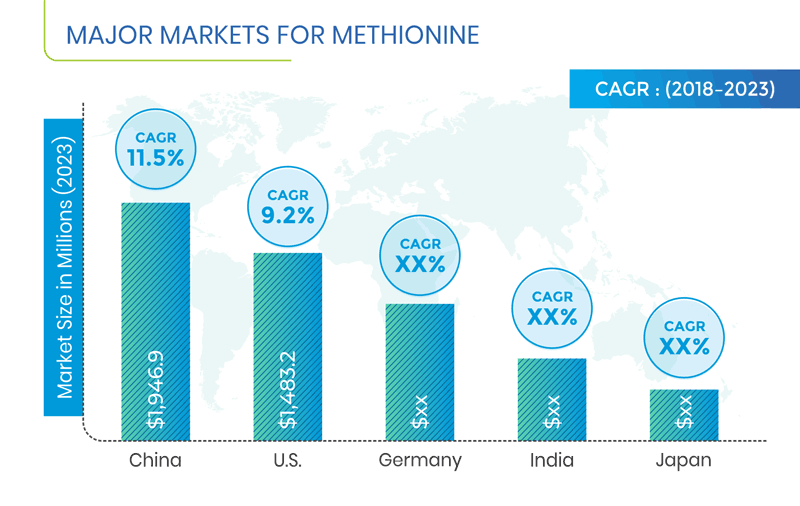

Globally, APAC was the largest as well as the fastest-growing market for methionine during the historical period and is expected to maintain the trend during the forecast period as well. This can be mainly attributed to the presence of established players, and growing demand for animal feed. Considering the future industry scenario, China is expected to lead the APAC market, generating revenue worth $1,946.9 million, by 2023.

Competitive Landscape of Methionine Market

The methionine market is consolidated in nature, characterized by the presence of established companies, such as Evonik Industries AG Corporation, Bluestar Adisseo, and Novus International Inc. Some other players in the market include Sumitomo Chemical Company Limited, Arkema Group, Archer Daniels Midland (ADM) Company, Ajinomoto Co. Inc., and BASF SE.

Recent Strategic Developments of Major Methionine Market Players

In recent years, major players in the global methionine market have taken several strategic measures, such as product launches and geographical expansions, to gain a competitive edge in the industry. For instance, in March 2018, Bluestar Adisseo Company started the construction of new liquid methionine factory in Nanjing, China. This factory is designed to produce 180,000 tons of liquid methionine every year. After the completion of the new factory, Adisseo will be able to double its total capacity in Nanjing. The new factory is be expected to come into operation by the middle of 2021.

Moreover, in May 2016, Sumitomo Chemical Company Limited expanded its production capacity for the feed additive methionine by adding a new production line in Japan. With this expansion, the company will increase its methionine production capacity by approximately 100,000 metric tons per year.

Market Size Breakdown by Segment

The Methionine Market report offers comprehensive market segmentation analysis along with market estimation for the period 2013–2023.

Based on Form

- Powder

- Liquid

Based on Application

- Animal Feed Additives

- Pharmaceuticals

- Food Processing

- Aquaculture

Based on Type

- DL-Methionine

- L-Methionine

- Methionine Hydroxy Analog (MHA)

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- Russia

- France

- U.K.

- Italy

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Singapore

- Latin America (LATAM)

- Brazil

- Mexico

- Middle East & Africa (MEA)

- Iran

- Egypt

- Saudi Arabia

Key Questions Addressed in the Report

- What is the current scenario of the global methionine market?

- What are the emerging technologies for the development of methionine?

- What are the historical size and the present size of the categories under market segments and their future potential?

- What are the major applications of methionine and their impact on the market during the short, medium, and long terms?

- What are the evolving opportunities for the players in the market?

- Which are the key geographies from the investment perspective?

- What are the key strategies adopted by the major players to expand their market shares?

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws