Report Code: 11384 | Available Format: PDF

Medical Lasers Market: Historical Size and Share Analysis, Future Growth Potential, Key Regions, Forecast till 2030

- Report Code: 11384

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

Market Overview

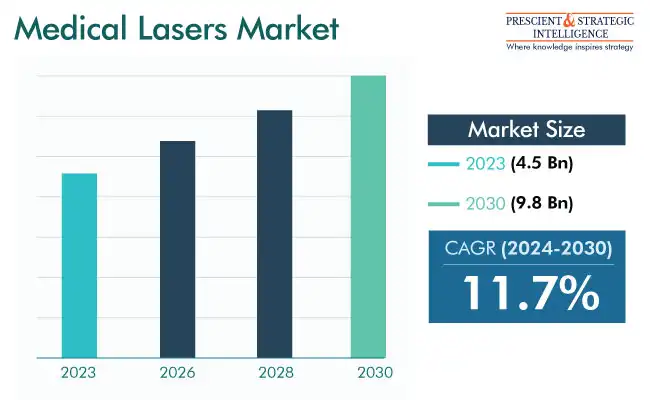

The global medical lasers market was valued at USD 4.5 billion in 2023, and it will grow at a rate of 11.7% during 2024–2030, to reach USD 9.8 billion in 2030.

The advancement of the industry is boosted by the increasing requirement for enhanced and less-invasive treatment options, significant technical improvements, growing patient awareness, and supportive reimbursement rules. Essentially, the increasing popularity of cosmetic procedures and the growing occurrence of chronic illnesses are projected to contribute to the market's expansion in the projection period.

In the same way, they aid in removing kidney stones and bladder tumors and carry out prostate operations. Apart from this, these devices are used in dentistry for soft tissue operations, teeth whitening, periodontal treatments, and laser-aided cavity detection.

Amid the pandemic, there was an expanded adoption of remote consultations and telemedicine to decrease in-person doctor visits and lower the hazard of infection transmission. Dermatologists and different healthcare practitioners, at certain times, integrated telemedicine to educate patients to conduct light amplification procedures in-house with handheld devices. This led to a stronger emphasis on transportable and patient-focused laser systems.

Further, in the face of pandemic-related challenges, research and improvement efforts persisted within the area. The emphasis shifted toward pioneering improvements, which include the contactless beam technology, progress in radiation-based diagnostics, and the addition of light amplification to imaging and robot principles. Notably, researchers from CU Boulder and the National Institute of Standards and Technology explored and proved a laser-driven breathalyzer, powered by AI, capable of real-time and distinctly correct detection of COVID-19.

Surge in Demand for Lasers for Advanced Therapies and Age-Related Conditions

The rising occurrence of chronic illnesses, including cancer, cardiovascular problems, and ophthalmic conditions, is boosting the need for enhanced treatment alternatives. Thus, clinical lasers have grown to be vital equipment offering minimally invasive methods.

Furthermore, the constant advancements in the laser technology have encouraged the creation of more-effective and dedicated systems. Such breakthroughs have contributed to better patent results, faster recoveries, and an increased variety of techniques of laser-based interventions.

Further, a visible trend being observed among patients is the active pursuit of less-invasive treatments to reduce scarring and pain and accelerate the recovery procedure. Medical lasers are turning into a viable solution by providing detailed and targeted energy delivery, which causes no harm to surrounding tissues. Furthermore, the growing aging populace worldwide has resulted in a heightened incidence of cataracts, skin disorders, and macular degeneration,. As a result, there has been a substantial surge in the usage of medical lasers for treating these conditions, thus propelling the market.

Diode Lasers Are Growing Fastest in Market, Based on Product

On the basis of product, the diode category is witnessing the highest CAGR in the market. This can be credited to the diverse applications of these variants in photodynamic treatment and aesthetic procedures. This is also because they are cost-effective and energy-efficient over other types of medical lasers. They are favored for dermatological and dental treatments as they are short in length and perform at a lower power than the majority of the other lasers on the market.

Solid-State Category Holds Largest Share

The solid-state category is expected to hold the largest share during the projection period because of the high acceptance rates of these variants in the dermatology. These systems, which include Ho:YAG, Nd:YAG, Er:YAG, and those using rubies, alexandrite, and potassium−titanyl phosphate, are preferred for skin treatment, tattoo removal, periodontology, and vein removal. This is because they have a simple design, cost-effectiveness, and high efficiency over many other types.

| Report Attribute | Details |

Market Size in 2023 |

USD 4.5 Billion |

Revenue Forecast in 2030 |

USD 9.8 Billion |

Growth Rate |

11.7% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

On The Basis of Application, Dermatology Category Is Largest

The dermatology category is leading the market on the basis of application. Medical lasers have found various applications in aesthetics and dermatology, including hair removal, skin resurfacing, tattoo elimination, scar revision, fat reduction, addressing age-related skin problems, dermal contraction, and treating vascular lesions. As the world globalizes, people are becoming increasingly conscious of their appearance, which continues to fuel the volume of laser cosmetics procedures.

Cardiovascular Category Is Projected To Grow at Highest CAGR

During the projection period, the cardiovascular category is projected to advance at the fastest pace. This can be credited to the increasing occurrence of heart illnesses, age-linked coronary infarctions, macular edema, cardiac arrest, and other arterial diseases. Already, heart diseases are among the largest killers in the world, and patients are now seeking minimally invasive treatments.

The ophthalmology category also held a substantial revenue share in recent years. Medical lasers are extensively utilized for vision improvement operations (PRK and LASIK) and the treatment of numerous eye conditions, such as glaucoma and diabetic retinopathy.

During the projection period, the gynecology category is projected to advance at a significant pace. Laser treatments are increasingly being used for curing problems associated with fertility, as well as for vaginal illnesses and radiation-aided operations.

Hospitals Continue To Use Medical Lasers Most Extensively

Hospitals dominate the end user segment of the market, because they are self-sufficient facilities equipment with all the necessary equipment for all medical subspecialties. Therefore, they carry out the highest number of laser procedures under the guidance of trained professionals. This is why most patients prefer them over dedicated clinics and ambulatory centers. Further, most of the severe diseases, especially cancer and CVDs, can be addressed the best by these healthcare establishments.

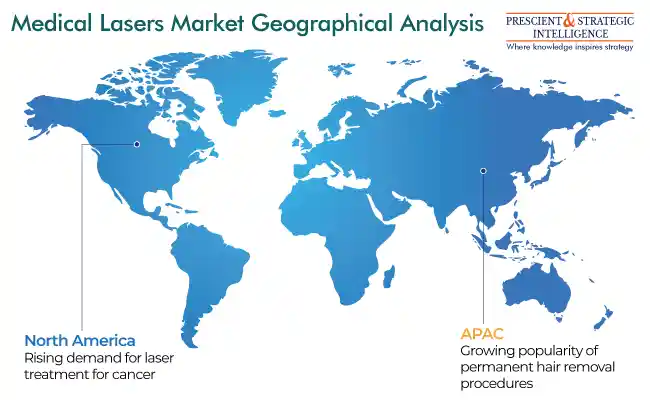

North America Is Dominant Region

In recent years, the North American region led the industry. The continent has enhanced healthcare infrastructure, high healthcare investments, and major medical device companies, such as Philips Healthcare, Boston Scientific Corporation, Stryker Corporation, IRIDEX Corporation, Bausch & Lomb Incorporated, and BIOLASE Inc. The continent also showcases a substantial occurrence of chronic illnesses, such as cancer, heart diseases, and eye diseases. Lasers provide effective treatment choices characterized by negligibly invasive procedures, targeted treatment, and quicker recoveries.

Further, the highest market CAGR is expected in the APAC region, because of the increasing disposable wealth, heightening focus on aesthetic procedures, and increasing healthcare infrastructure in China, South Korea, Japan, India, and Australia. Additionally, APAC is home to the largest geriatric population on earth, which is a key reason for the high incidence of cancer, CVDs, vision loss, dental problems, and other age-associated diseases.

Key Companies Offering Medical Lasers:

- Lumines Ltd.

- Photomedex

- Koninklijke Philips N.V.

- BIOLASE Inc.

- IRIDEX Corporation

- BioForm Medical Inc.

- biolitec AG

- Cutera Inc.

- Candela Corporation

- Cynosure Inc.

- Sisram Medical Ltd.

- Boston Scientific Corporation

- S.E. Lumibird

- Bausch Health Companies Inc.

- Alcon AG

- Carl Zeiss AG

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws