Report Code: 12068 | Available Format: PDF | Pages: 240

Medical Glove Market Size and Share Analysis by Raw Material (Latex, Nitrile, Vinyl, Neoprene), Application (Examination, Surgical), Sterility (Non-Sterile, Sterile), Type (Non-Powdered, Powdered), Distribution Channel (Indirect, Direct), End User (Hospitals, Clinics, and Diagnostic Centers, Ambulatory Surgery Centers) - Global Industry Revenue Estimation and Demand Forecast to 2030

- Report Code: 12068

- Available Format: PDF

- Pages: 240

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Medical Glove Market Outlook

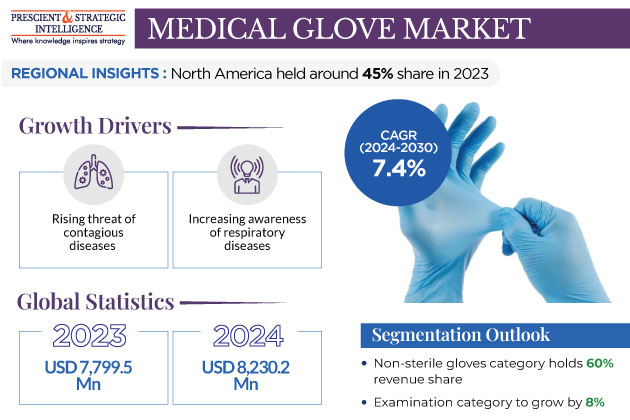

The medical glove market generated revenue of USD 7,799.5 million in 2023, which is expected to grow at a CAGR of 7.4% during the forecast period (2024–2030), to reach USD 12,601.2 million by 2030. This is attributed to the increasing healthcare spending globally to ensure proper infection control among workers and patients.

- Furthermore, factors like the increasing cases of contagious diseases and the growing geriatric population propel the requirement of highly prominent medical care including surgeries and diagnostic procedures, leading to an increased demand for medical gloves in healthcare facilities.

- These innovative gloves not only offer better barrier protection but are also equipped with features like tactile sensitivity and improved fit and finish, enhancing their contribution to their overall adoption in these settings.

Rising Threat of Contagious Diseases Drives the Market

- The outbreak of the COVID-19 pandemic was the major thriving force involved in upscaling the industry. This phase led to an unprecedented high surge in the demand for medical gloves, especially disposable gloves.

- Outbreaks of many new diseases such as SARS-CoV-2, severe acute syndrome, Zika, and Middle East syndrome have generated a huge demand for medical gloves.

- The sudden surge of these diseases globally has forced medical authorities to take extensive measures to curb the spread of diseases.

- Furthermore, manufacturers have been producing more and more personal protection equipment to meet the rising needs in the medical sector. In order to strive for the scale of production, they are adopting advanced technologies and increasingly investing in this sector.

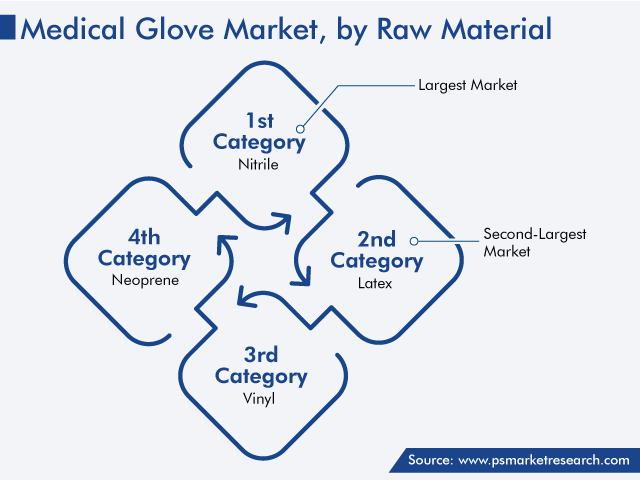

Nitrile Gloves Hold the Largest Market Share

The nitrile glove category, within the raw material segment, accounts for the largest market share. Nitrile gloves are latex-free, which help prevent both the general people and healthcare professionals from various latex allergies thus promoting hygiene.

Moreover, constant technological advancement in nitrile gloves is further shaping the industry, resulting in the development of enhanced nitrile glove products with improved finish and tactile sensitivity, further boosting their applications in varied sectors. Nitrile gloves are widely used in varied industries like food care and healthcare, automotive, chemicals, pharmaceuticals, and manufacturing.

Examination Category Witnessed the Highest CAGR

- The examination category, based on the application segment, is projected to record the highest CAGR, of 8%, during the precast period.

- This can be ascribed to the increasing number of patients with infectious and contagious diseases, which drives the need to incorporate a large number of examination procedures in healthcare facilities.

- These gloves are generally used for a wide range of medical procedures, such as physical examinations, venipuncture, injections, and other therapeutic interventions.

- Examination gloves are generally designed for a single use only to prevent cross-contamination among patients. This is one of the main reasons for their large production and usage.

- In the upcoming period, it is also been estimated that with the increasing employee safety concerns, the dependence on examination gloves may also rise in varied sectors like food processing, construction, and petrochemicals.

Non-Sterile Gloves Grasp Higher Revenue

The non-sterile glove category, within the sterility segment, accounted for a larger market share, of USD 4.6 billion, in 2023. This is because these gloves are generally made up of latex-free materials and therefore can be used for multiple uses, needing resistance to chemicals and protection against various bacteria.

Furthermore, non-sterile gloves are generally effective in maintaining hygiene and establishing barriers against potential risk. Thus, these factors make them an important part of personal protective equipment in various non-sterile environments, and their demand is rising in various prominent industries like healthcare laboratory and research, food service, and cleaning and maintenance.

Moreover, it has also been estimated that the non-sterile glove category is expected to witness faster growth in the upcoming period, due to the surging need to maintain sanitation and prevent the transmission of pathogenic elements.

Non-Powdered Medical Gloves To Register Rapid Growth in Demand

- The non-powdered category within the type segment dominates the global market. The driving force for this specific category is its powder-free design, which is generally manufactured to reduce the risk of allergic reactions in patients.

- Non-powdered medical gloves are made up of various materials such as vinyl, latex, and nitrile and are available for both medical and surgical settings.

- These are generally manufactured with strict guidelines and quality standards to ensure the safety of respected individuals.

- These gloves are generally used for diversified treatments and examination purposes such as routine checkups and non-surgical procedures.

- Additionally, the non-powdered category is gaining more significance, due to its cost-effectiveness and repetitive-use characteristics.

- In 2017, the U.S. Food and Drug Administration (FDA) underwent a ban on the production, sale, and distribution of powdered patient gloves, powdered surgical gloves, and absorbable powder in order to safeguard individuals from allergies.

| Report Attribute | Details |

Market Size in 2023 |

USD 7,799.5 Million |

Market Size in 2024 |

USD 8,230.2 Million |

Revenue Forecast in 2030 |

USD 12,601.2 Million |

Growth Rate |

7.4% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Raw Material; By Application; By Sterility; By Type; By Distribution Channel; By End User; By Region |

Explore more about this report - Request free sample

Direct Distribution Channels Conquering the Market

Based on distribution channel, the direct category holds a higher revenue share in the medical glove market. This is because this channel allows manufacturers to directly sell their products to consumers without involving any intermediaries. In this type of distribution channel, there is a single line of distribution where manufacturers control all operations from customer interactions to brand distribution to modeling sales process.

Many glove manufacturers develop specific company websites to transport medical gloves with easy accessibility and cost-effective ways. Some may also engage in ethical practices of owning their specific stores to engage directly with the needs of customers and do the needful. Also, direct distribution channels help manufacturers build long-term relationships with customers avoiding additional costs by removing third-party distributors.

Moreover, indirect distribution channels hold significant shares in the market. These channels include wholesale distributors, retailers, group purchasing organizations (GPOs), and agents, which together form a supply chain system to make medical gloves available to the respective market. This distribution channel is quite expensive than the direct distribution pathway. However, accessibility to the market is generally higher for this category.

Hospitals, Clinics, and Diagnostic Centers Dominate the Market

Hospitals, clinics, and diagnostic centers are dominating the market under the end-user segment, and the category is expected to witness the same trend in the coming years as well.

- These healthcare facilities are the largest among the group, due to the extensive use of medical gloves in treating patients and reducing the spread of pathogenic agents further.

- Some of the other key factors that are responsible for the rapid bloom in this category include the growing geriatric population and the increasing volume and value of the healthcare and medical segment with constantly evolving healthcare and compliance standards.

Whereas, the ambulatory surgical centers (ASCs) category is expected to witness significant growth in the coming years. This can be because these facilities offer highly precise outpatient surgical operations.

- Medical gloves prove to be important in maintaining a sterile environment to ensure the safety of both patients and healthcare professionals.

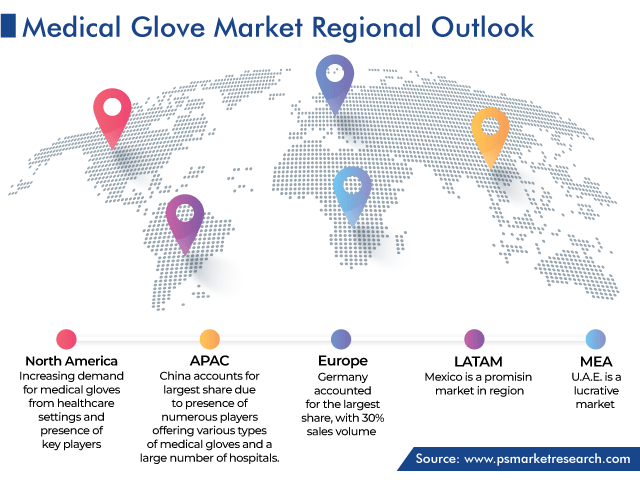

North America Is the Market Leader

North America holds the largest market share, due to the rise in government expenditure on evolving healthcare facilities and increasing medical supplies, including medical gloves.

- Additionally, stringent regulations and standards are other factors that set the compliance to ensure and enhance the quality and safety of human gloves.

- The outbreak of COVID-19 was a key factor that significantly shaped and increased the revenue of the market.

- Moreover, as per the National Ambulatory Care Reporting System (NACRS), there were around 14.0 million unscheduled emergency visits by patients to emergency departments. The rise in the sudden surge of emergency visits can be seen as an effective factor propelling the demand for medical gloves in the region.

Whereas, the APAC (Asia Pacific) market is expected to witness the fastest growth during the forecast period. This can be due to the growing geriatric population, resulting in the mounting of a large number of diagnostic examinations and surgical procedures.

- In addition, the surging sanitation concerns about the spreading of deadly viruses and pathogens significantly drive the need for bio-safety gear in APAC countries.

Key Players Shaping the Competitive Landscape

A high degree of integrity and collaboration among different participants is uplifting the market and shaping operations at different levels of the value chain. For example, Kossan Rubber Industries Bhd. and other top glove market players are highly integrated and involved in the production and distribution of medical gloves.

In addition, in January 2023, the Medicom Group announced to build a nitrile glove factory via its subsidiary Kolmi-Hopen, which specializes in the manufacture of single-use medical devices.

Top medical Gloves Manufacturers:

- Top Glove Corporation Bhd.

- Supermax Corporation Berhad

- Owens & Minor

- Hartalega Holdings Berhad

- Kossan Rubber Industries Bhd.

- Cardinal Health Inc.

- Paul Hartmann AG

- B. Braun Melsungen AG

- Medline Industries Inc.

- Kimberly-Clark Corporation

- McKesson Corporation

- Mölnlycke Health Care

- Semprit AG Holding

- Ansell Ltd.

- Cypress Medical Products LLC

- Robinson Healthcare Ltd.

- Riverstone Holdings Limited

- SHIELD Scientific B.V.

- Dynarex Corporation

Market Size Breakdown by Segment

This report offers deep insights into the medical glove market, with size estimation for 2017 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Raw Material

- Latex

- Nitrile

- Vinyl

- Neoprene

Based on Application

- Examination

- Surgical

Based on Sterility

- Non-Sterile

- Sterile

Based on Type

- Non-Powdered

- Powdered

Based on Distribution Channel

- Indirect

- Direct

Based on End User

- Hospitals, Clinics, and Diagnostic Centers

- Ambulatory Surgery Centers (ASCs)

Region/Countries Reviewed for this Report

- North

- U.S.

- Canada

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Netherlands

- Switzerland

- Belgium

- Sweden

- Austria

- Denmark

- Asia-Pacific

- Japan

- China

- Australia

- India

- South Korea

- Hong Kong

- Philippines

- Indonesia

- Latin America

- Brazil

- Mexico

- Colombia

- Argentina

- Chile

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E, Qatar

- Israel

The industry for medical glove will reach USD 8,230.2 million in 2024.

The medical glove market value will reach USD 12,601.2 million in 2030.

The North American market for medical glove is the largest.

Increasing contagious ailments threat and rising consciousness of respiratory disorders are the major medical glove industry drivers.

Hospitals, clinics, and diagnostic centers hold the larger medical glove market share.

Direct distribution channels is the leading distribution channel in the medical glove industry.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws