Report Code: 11463 | Available Format: PDF | Pages: 162

Medical Display Monitor Market by Technology (LED-Backlit LCD, CCFL-Backlit LCD, OLED), by Resolution (5MP-8MP, Up to 2MP, Above 8MP, 3MP-4MP), by Display Color (Colored, Monochrome), by Panel Size (23.0-26.9 Inches, 27.0-41.9 Inches, Under 22.9 Inches, Above 42 Inches), by Application (Diagnostic, Clinical, Surgical), by Geography (U.S., Canada, Germany, France, U.K., Italy, Spain, Japan, China, India, Brazil, Mexico, Saudi Arabia, U.A.E.) - Global Market Size, Share, Development, Growth, and Demand Forecast, 2013-2023

- Report Code: 11463

- Available Format: PDF

- Pages: 162

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Medical Display Monitor Market Overview

The global medical display monitor market generated $2.1 billion revenue in 2017 and is projected to showcase a CAGR of 4.9% during the forecast period. Increasing prevalence of chronic diseases, rising adoption of hybrid operating room (OR) technologies, growing demand for minimally invasive treatments, and short replacement cycle of medical display technologies are the key factors driving the market growth.

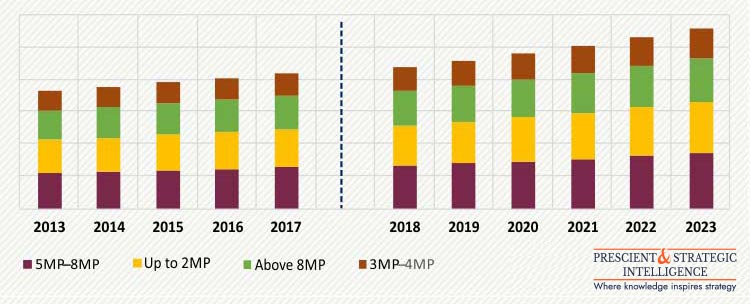

GLOBAL MEDICAL DISPLAY MONITOR MARKET, BY RESOLUTION, $M (2013-2023)

On the basis of technology, the medical display monitor market has been categorized into into LED-backlit LCD, CCFL-backlit LCD, and OLED, among which, LED-backlit LCD leads the market. Monitors based on this technology are more compact, offer more brightness, and have better contrast ratio as compared to those based on other technologies. Besides, the easy availability of these monitors and high consumer preference are contributing to their high demand. The technology contributed 75.7% share to the market in 2017.

Based on resolution, the medical display monitor market has been categorized into 5MP–8MP, up to 2MP, above 8MP, and 3MP–4MP displays. During the forecast period, the market for monitors of 5MP–8MP resolution is expected to witness the fastest growth, with a CAGR of 5.2%. This can be attributed to the fact that these monitors provide better-quality images, as compared to other monitors, for various surgical and diagnostic purposes.

Colored medical display monitors are more preferred than the monochrome ones for surgical and diagnostic purposes, as they offer better visualization effects. Colored display monitors held a larger share, amounting to 68.5%, in the market in 2017.

Based on panel size, the medical display monitor market has been categorized into 23.0–26.9-inch, 27.0–41.9-inch, under 22.9-inch, and above 42-inch displays. Among these, the market for monitors of 23.0–26.9-inch panel sizes witnessed the highest growth, at a CAGR of 3.9%, during the historical period, which is expected to increase to 5.4% during the forecast period. Display monitors are used for diagnostic, clinical, and surgical applications. Among these, diagnostic display monitors held the largest share, of 47.5%, in the market in 2017, due to their increasing adoption in several imaging applications, such as X-ray, magnetic resonance imaging, and computed tomography.

Geographically, North America contributes the largest share to the medical display monitor market. The market growth in the region is mainly due to the rising preference for minimally invasive surgeries, advanced healthcare infrastructure, and increasing prevalence of chronic diseases. According the American Society of Plastic Surgery (ASPS), 17.5 million surgical and minimally invasive cosmetic procedures were performed in the U.S. in 2017.

The National Health Expenditure Accounts (NHEA) reported that healthcare spending in the U.S. reached $3.3 trillion in 2016 and accounted for 17.6% of the GDP. Thus, rising healthcare spending is increasing the affordability for the diagnosis and treatment of diseases, which, in turn, is contributing to the growth of the medical display monitor market in the region.

Medical Display Monitor Market Dynamics

Growth Drivers

The increasing prevalence of chronic diseases, such as heart diseases and cancer, is one of the key drivers for the growth of the medical display monitor market. According to the American Cancer Society (ACS), the number of cancer cases diagnosed in the U.S. would stand at 1,688,780 for the year 2017. It was also estimated that in 2017, almost 13% of young population (20 years and above) would be affected by rare cancer in the ratio of 6 cases per 100,000.

Hybrid OR technologies allow physicians to perform activities by using a real-time image guidance system and ascertain the effectiveness of the procedure. In November 2017, the Getinge Group, a provider of medical technology, installed its 1,000th hybrid OR. In addition, advancements in hybrid OR technologies, such as wireless C-arm, surgical robots, and electrosurgical technologies, are expected to create a more efficient work environment for surgeons and back the growth of the medical display monitor market in the coming years.

The technology used in medical display monitors has migrated from cathode ray tube (CRT) monitors to flat-panel LCDs over the last decade. The drawback of LCD screens is that, they do not produce any light by themselves, so surgeons need a backlighting source to illuminate an image and make it visible. Thus, the need for replacing older display monitoring technologies is offering growth opportunities to the players in the medical display monitor market.

Opportunities

Increasing investments in medical imaging devices and rising awareness on these monitors in emerging economies are the factors providing immense growth opportunities to the players operating in the medical display monitor industry. For instance, in September 2017, SDIC Fund Management Company Ltd., a private equity firm majorly owned by China’s State Development & Investment Corporation (SDIC) and China Life Insurance Co. Ltd., provided $500 million to Shanghai United Imaging Healthcare Co. Ltd, a medical imaging equipment developer, for the development of medical imaging devices.

Medical Display Monitor Market Competitive Landscape

Continuous research and development in medical imaging technology has led to the introduction of technologically advanced systems by players in the medical display monitor market. In April 2018, EIZO Corporation launched the RadiForce MX194, a 19-inch clinical review monitor designed for viewing digital subtraction angiography (DSA), computed tomography (CT), and magnetic resonance imaging (MRI) medical charts and images.

In June 2017, LG Display Co. Ltd. launched a 77-inch flexible and transparent OLED display. It a large-sized OLED display with a UHD resolution of 3840 x 2160 with 40% transparency and 80 mm radius of curvature.

Some of the other major players in the global medical display monitor industry are Steris plc, Siemens AG, Sony Corporation, Novanta Inc., Barco NV, Advantech Co. Ltd., Jusha Medical, and JVCKENWOOD Corporation.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws