Report Code: 12030 | Available Format: PDF | Pages: 140

Low strength Proppants Market Research Report: By End Use (Shale Gas, Crude Oil, Coal-Bed Methane) - Global Industry Analysis and Demand Forecast to 2030

- Report Code: 12030

- Available Format: PDF

- Pages: 140

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Low Strength Proppants Market Overview

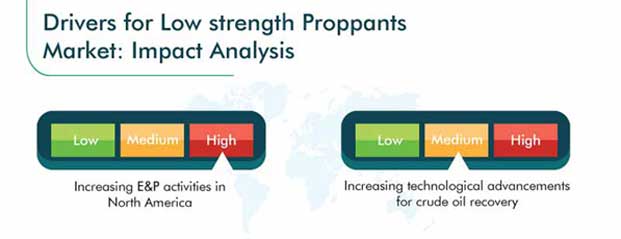

Valued at $3,713.3 million in 2019, the global low strength proppants market size is projected to witness a CAGR of 9.8% during the forecast period (2020–2030). Increasing exploration & production (E&P) activities and technological advancements for crude oil recovery are some of the major factors driving the low strength proppants industry.

The COVID-19 pandemic has impacted the global market to a great extent with the shutdown of rigs and halt in oil & gas operations, across the globe. The total rig count witnessed a steep fall from 2,073 rigs in January 2020 to 1,514 rigs in April 2020. In addition, oil & gas exploration activities are at a standstill across the globe, which, in turn, has impacted the crude oil prices at a global level.

Segmentation Analysis

Crude Oil Is Expected to Account for the Largest Share by End Use

The crude oil category held the largest market size in the low strength proppants industry in 2019 based on end use. This is majorly attributed to the increasing consumption of crude oil and the presence of a large number of unconventional oil reserves across the world. Countries including the U.S., the U.K., Saudi Arabia, and Russia are putting an immense focus on production of unconventional oil in high volumes, which, in turn, is boosting the consumption of low-density proppants.

According to International Association of Energy Economics, unconventional oil is projected to account for 3.0% of the global crude oil production in 2020. In addition, this production volume of unconventional oil is expected to increase from 3.05 million barrels per day (mbpd) in 2020 to 3.75 mbpd by 2030. Owing to such factors, crude oil is projected to retain a large share in the low strength proppants market. With the increase in E&P activities across the globe, the consumption of low-density proppants is projected to increase during the forecast period.

Geographical Outlook

North America to Witness the Highest Consumption

During the historical period (2014–2019), North America held largest low strength proppants market share, which is ascribed to the increase in the number of drilled wells, along with discoveries of unconventional oil and gas reserves, in the region. In addition, the region has availability of both conventional and unconventional resources in abundance, and in order to extract these resources, low-density proppants are required in high volumes.

Hence, with large-scale oil & gas exploration activities in the North American region, the consumption of low-strength proppants increases significantly. In addition, increasing investment in the regional market in order to increase production activities is also expected to drive the low strength proppants market.

North America to Demonstrate the Fastest Growth

The North American region is expected to demonstrate the fastest growth on account of rapid increase in E&P activities, along with the increasing investments in the sector by large players. In addition, the region is home to some of the largest players involved in the global market, which include Royal Dutch Shell plc, ConocoPhillips, and Chevron Corporation. Further, North America is one of the largest producers of coal-bed methane and accounted for around 20% share in the global coal-bed methane production in 2019. Hence, such factors are expected to continue fueling the growth of the low strength proppants market.

Trends & Drivers

Increasing E&P Activities in North America

Over the years, the North American region has significantly contributed in conventional as well unconventional oil & gas production. U.S. accounts for nearly 80% of the newly drilled wells in the region. Canada too is garnering pace with the opening up of its shale reserves for commercial exploration. With the increasing E&P activities in the region, the consumption of low-strength proppants is projected to increase, owing to its ability to increase the flow of oil or gas during hydraulic fracturing process. All these factors are expected to drive the growth of the low strength proppants market in the North American region in the forecast period.

Increasing Technological Advancements for Crude Oil Recovery

Market players across North American and APAC regions are making hefty technological investments in order to enhance exploration of new oil & gas reserves. In addition, energy production, particularly in the U.S., is projected to witness massive growth, on account of which new and improved technologies are being developed to ensure high business growth and easy recovery processes. This, in turn, is expected to ramp up consumption of low-density proppants and thereby boost the low strength proppants market.

| Report Attribute | Details |

Historical Years |

2014-2019 |

Forecast Years |

2020-2030 |

Base Year (2019) Market Size |

$3,713.3 million |

Forecast Period CAGR |

9.8% |

Report Coverage |

Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Company Share Analysis, Companies’ Strategical Developments, Product Benchmarking, Company Profiling |

Market Size by Segments |

End Use, Geography |

Market Size of Geographies |

U.S., Canada, Russia, Norway, U.K., Denmark, Romania, China, India, Australia, Indonesia, Thailand, Vietnam, Kazakhstan, Brazil, Mexico, Venezuela, Argentina, Saudi Arabia, Iran, Kuwait, Nigeria, U.A.E., South Africa |

Secondary Sources and References (Partial List) |

BP Statistical Review of World Energy, Council on Foreign Relations Gas Exporting Countries Forum, Independent Oil and Gas Association, Independent Petroleum Association of America, International Association for Energy Economics, International Association of Oil & Gas Producers |

Explore more about this report - Request free sample

Market Players Expand Geographical Presence

The low strength proppants industry is consolidated in nature with the presence of a few large-scale market players, which include Black Mountain Sand LLC, Fairmount Santrol Holdings Inc., Hi-Crush Inc., Atlas Sand Company LLC, Superior Silica Sands LLC (subsidiary of Emerge Energy Services LP), U.S. Silica Holdings Inc., and Carbo Ceramics Inc.

In recent years, players in the market are putting immense focus on facility and geographic expansion in order to gain a competitive edge in the low strength proppants market. For instance:

- In August 2018, Black Mountain Sand LLC, which is one of the leading in-basin frac sand provider, announced its expansion into Western Oklahoma’s Mid-Continent. The 1,290-acre Blaine County facility will have a production capacity of 3 million tons of sand annually.

- In June 2018, Alpine Silica, a provider of premium frac sand from the West Texas sand deposits located near Kermit, Texas, announced two new projects in Van Horn, Texas, and Fay, Oklahoma. With the expansion of these two plants, the company has secured nearly 51 million tons of reserves for the Oklahoma initiative.

Some of the key market players in Low Strength Proppants Market include:

-

Black Mountain Sand LLC

-

Fairmount Santrol Holdings Inc.

-

Hi-Crush Inc.

-

Atlas Sand Company LLC

-

Superior Silica Sands LLC (subsidiary of Emerge Energy Services LP)

-

U.S. Silica Holdings Inc.

-

Carbo Ceramics Inc.

-

Wisconsin Proppants LLC

-

Covia Holdings Corporation

-

High Roller Group

-

Badger Mining Corporation

-

Signal Peak Silica LLC

-

Aequor Mgt LLC

Low Strength Proppants Market Size Breakdown by Segment

The low strength proppants market report offers comprehensive market segmentation analysis along with market estimation for the period 2014–2030.

Based on End Use

- Share Gas

- Crude Oil

- Cole-Based Methane

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Russia

- Norway

- U.K.

- Denmark

- Romania

- Asia-Pacific (APAC)

- China

- Australia

- India

- Indonesia

- Thailand

- Vietnam

- Kazakhstan

- Latin America (LATAM)

- Brazil

- Mexico

- Venezuela

- Argentina

- Middle East & Africa (MEA)

- Saudi Arabia

- Iran

- Kuwait

- U.A.E.

- Nigeria

- South Africa

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws