Levulinic Acid Market Analysis

Explore In-Depth Levulinic Acid Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2032

Report Code: 10120

Explore In-Depth Levulinic Acid Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2032

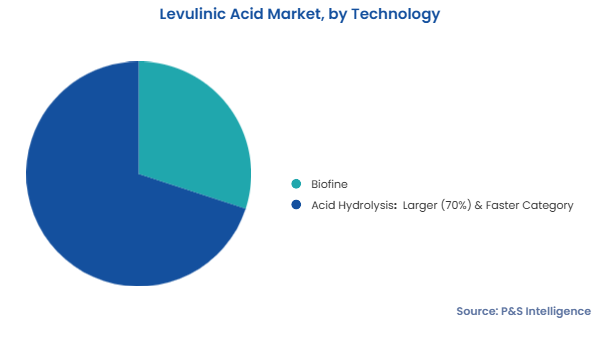

The acid hydrolysis category holds the larger revenue share, of 70%, in 2024, and it will also grow the faster during the forecast period. This can be due to the wide usage of this technology for the production of levulinic acid and its derivatives, and this process allows for a wider range of heterogeneous lignocellulosic feedstock utilization. Also, with the increasing awareness regarding the benefits of the process, its adoption is expected to rise at a rapid pace in the coming years.

Moreover, many concepts for the commercial production of levulinic acid are based on acid hydrolysis technology, wherein the processes are conducted in a continuous manner at high pressures and temperatures. Also, the increasing inclination to derive this acid from biomass and rice husk is surging the need for acid hydrolysis technology. Moreover, the extensive research on the acid hydrolysis of cellulose to make levulinic acid is further propelling the adoption of this approach.

The following technologies have been considered:

Agricultural products hold a significant share in the levulinic acid market. This is due to the increasing use of delta-amino levulinic acid (DALA), a derivative of levulinic acid, in herbicides, insecticides, and fungicides for crop protection. As per forecasts, crop protection chemical sales could be worth USD 117,436.6 million by 2030. This is itself due to population growth, food security, the scarcity of agricultural land, and the growing demand for more crop production to raise crop yields.

Furthermore, farmers are under tremendous pressure to increase the productivity of agricultural farmlands and associated facilities due to the population's rapid growth. Because of this, the use of agrochemicals (such as pesticides, herbicides, and insecticides) and adjuvants, in conjunction with improvements in farming methods, is a crucial way to resolve this dilemma.

The fuel additives application category dominates the market, with around 20% revenue share in 2024, and it is also expected to witness the fastest growth during the market during the forecast period. This can be mainly attributed to the surging usage of levulinic acid and its derivatives in fuel additives, on account of their functionally viable properties, such as low toxicity, high lubricity, stable flash point, and appreciable flow attributes, which make them a suitable additive for gasoline and diesel fuels.

Moreover, such acid derivatives are used to enhance the fuels’ properties. Ethyl levulinate, an ester of levulinic acid, holds a high potential to be used as a blend component in diesel formulations. In addition, the usage of ethyl levulinate in diesel results in lower sulfur emissions than those caused by traditional diesel. This is attributed to the high lubricity of ethyl levulinate blends. Moreover, with the shift toward organic and bio-based fuel additives in view of the growing environmental concerns, the levulinic acid demand will rise in the coming years.

We studied these applications:

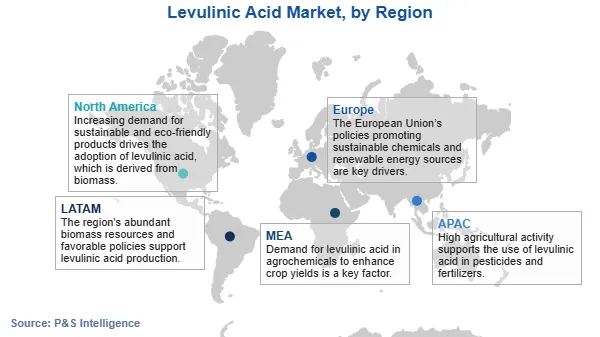

APAC is the largest and fastest-growing market, with a revenue share of around 45% in 2024. This is mainly attributed to the high demand for levulinic acid for the production of fuel additives such as n-butyl levulinate; the high-volumetric adoption of bio-based products for various applications, including agricultural products, drugs, and personal care products, in countries such as China, India, Thailand, and Indonesia; and the surge in disposable income in the region.

Moreover, the demand for the compound is also witnessing strong growth in the agriculture sector in the region. It is widely gaining usage as an additive for environment-friendly herbicides. With the increasing adoption of herbicides with renewable chemicals, the consumption of the compound is expected to further ramp up in the coming times. Furthermore, the depleting fossil fuel reserves and the rising environmental concerns have led to an increased focus on the conversion of biomass into fuels in the region, which, in turn, drives the growth of the market.

China leads the APAC market. This is ascribed to the potential demand for levulinic acid from the personal care and agriculture industries in the country. Agriculture is one of the largest industries in China. Owing to the large-scale agricultural production in the nation, pesticides and herbicides are required in high volumes for the protection of crops. Thus, with the projected growth in the agriculture industry, the demand is expected to increase for its use as an additive in herbicides and pesticides in the country.

The regional breakdown of the market is as follows:

Want a report tailored exactly to your business need?

Request Customization

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages