Report Code: 11569 | Available Format: PDF | Pages: 169

Latin America Software Defined Wide Area Network (SD-WAN) Market by Offering (Solution [WAN Infrastructure, SD-WAN Control & Overlay], Service [CSP SD-WAN Managed Services, Cloud-Managed SD-WAN]), by Appliance (Physical, Virtual, Hybrid), by Implementation Type (Outsourced, In-House), by Industry (IT & Telecom, BFSI, Healthcare, Government), by Geography (Brazil, Mexico, Argentina, Chile, Colombia, Peru) -Market Size, Share, Development, Growth, and Demand Forecast, 2013-2023

- Report Code: 11569

- Available Format: PDF

- Pages: 169

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Latin America SD-WAN Market Overview

The Latin American SD-WAN market was valued at $29.7 million in 2017 and is forecasted to witness a CAGR of 38.1% during 2018–2023. Factors such as growing adoption of cloud-based applications, need for effective network management, and demand for end-to-end network security and visibility, are driving the market growth.

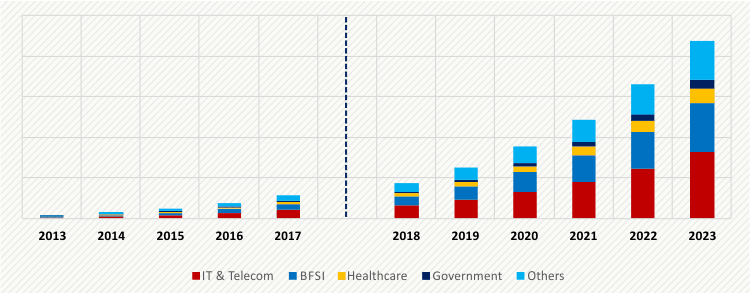

LATIN AMERICA SD-WAN MARKET, BY INDUSTRY, $'000 (2013-2023)

SD-WAN service category includes communication service provider (CSP) SD-WAN managed and cloud-managed SD-WAN services. Among the two, CSP SD-WAN managed services category generated 62.3% revenue in the SD-WAN service market in 2017. It is also projected to be largest revenue generator during the forecast period. This can be attributed to factors such improved security, smooth interoperability, and increased traffic visibility, which are essential for telecommunication providers who transfer their information electronically.

Based on appliance, the Latin American SD-WAN market is categorized into virtual, physical, and hybrid appliances. Among these, virtual SD-WAN appliances held the largest share in the market, accounting for over 55% share in 2017. This is attributed to growing demand for virtual appliance over physical appliance as it does not require hardware components, thus reducing the installation and configuration costs associated with it. Further, companies like Junto Telecom, Telefonica Brazil, are offering voice and data services in the region by using virtual WAN optimization appliances to improve the performance of their online applications in Latin America.

On the basis of implementation type, the Latin American SD-WAN market is classified into in-house and outsourced; out of these, in-house SD-WAN implementation type held a larger share in 2017. However, during the forecast period, the market for outsourced implementation type is estimated to witness faster growth, as it reduces the risk of failure and complexity as well as operational cost associated with in-house solution deployment.

Based on industry, the Latin American SD-WAN market is categorized into information technology (IT) and telecom; banking, financial services, and insurance (BFSI); government; healthcare; and others (defense, retail, and manufacturing). IT and telecom industry was the largest deployer of SD-WAN solutions in 2017, accounting for 38% revenue share of the market and is anticipated to be the largest revenue generator throughout the forecast period. This can be ascribed to the increasing advancements in IT and telecom industry, and demand for higher bandwidth for high performance applications.

Latin America SD-WAN Market Dynamics

Trends

Increasing adoption of various cloud services, such as on-premises private cloud, public cloud, hosted private cloud, and SaaS, has resulted in hybrid IT architecture within the enterprise network infrastructure. Therefore, to meet the demand for agile, cost effective, reliable, and high performing business, networks connecting the hybrid IT environment need to be in pace with current IT infrastructure.

The growth in hybrid cloud connectivity is a trend observed in the Latin American SD-WAN market. The advanced software defined solutions provide more network uptime, cost reduction, secure connection from branch locations to applications in enterprise data center, and dynamic multi-path optimization for enterprise grade performance and scalability to public and private organizations.

Drivers

The growth of data intensive applications with emergence of cloud technology is making SD-WAN technology a promising solution for geographically distant offices, which need reliable and higher bandwidth. Companies transitioning into cloud-based, software-as-a-service (SaaS), and infrastructure as a service (IaaS) applications, have started focusing on new WAN solutions to increase productivity and business execution. As a result, enterprises are planning to update their legacy network infrastructure. Therefore, rise in cloud migration is a major factor driving the Latin American SD-WAN market.

Traditional WANs are becoming challenging and resource intensive, especially in countries such as Colombia, Chile, and Peru, where the market is still in developing stage in terms of technology advancements and associated investments. WAN architecture creates difficulty in managing a large number of network endpoints as it requires complex setup with firewalls and routers. SD-WAN simplifies the network complexity by easing installation and management of many branch offices effectively. It enables zero-touch deployment, cloud-based centralized configuration through templates, and automatic monitoring of bandwidth and link performance, hence driving the Latin American SD-WAN market.

Restraints

SD-WAN promises seamless and risk-free technology up-gradation; however, with outdated network infrastructure and limited expertise, there may be a risk of execution failure. Such unanticipated execution failure results in high cost and may even affect business processes. Risk of deployment and overlaying new technology on weak infrastructure, particularly in small and medium enterprises (SMEs), is expected to pose a challenge to the Latin American SD-WAN market.

Opportunities

While availability and maintenance of bandwidth is costly, enterprises are heading toward new technology solutions for economical bandwidth expansion. SD-WAN solution provides businesses with independence and flexibility of data transfer by aggregating all available bandwidth, maximizing its usage, while ensuring high network performance.

Since all data transfer options are not equal or incur the same cost and therefore, using SD-WAN technology, any protocol can be rendered to combine the available technologies such as 3G, 4G LTE, internet, MPLS, serial, Wi-Fi or ethernet, and provide maximum benefit with lower wastage and cost. The need for improved data transfer independence would create a huge opportunity for the players in the Latin American SD-WAN market.

Latin America SD-WAN Market Competitive Landscape

The Latin American SD-WAN market continued to grow, owing to the advantages offered by SD-WAN technology such as bandwidth optimization, improved application performance, and reduced cost. Mergers and acquisitions were the key recent activities observed in the market in 2017. For instance, Cisco Systems Inc. and VMware Inc. acquired Viptela Inc. in August 2017 and VeloCloud Networks Inc. in December 2017, respectively, which enhanced their SD-WAN offering significantly, intensifying competition in the market.

Some of the other key players operating in the Latin American SD-WAN market are CITRIX Systems Inc., Silver Peak Systems Inc., CloudGenix Inc., Ecessa Corporation, Riverbed Technology Inc., Mushroom Networks Incorporated, Gluware Inc., Elfiq Networks, and Aryaka Networks Inc.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws