Report Code: 12880 | Available Format: PDF | Pages: 290

Laboratory Informatics Market Size and Share Analysis by Product (LIMS, ELN, CDS, EDC & CDMS, LES, ECM, SDMS), Delivery Mode (On-Premises, Web-Hosted, Cloud-Based), Component (Services, Software), Industry (Life Sciences, Chemical) - Global Industry Demand Forecast to 2030

- Report Code: 12880

- Available Format: PDF

- Pages: 290

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Laboratory Informatics Market Size & Share

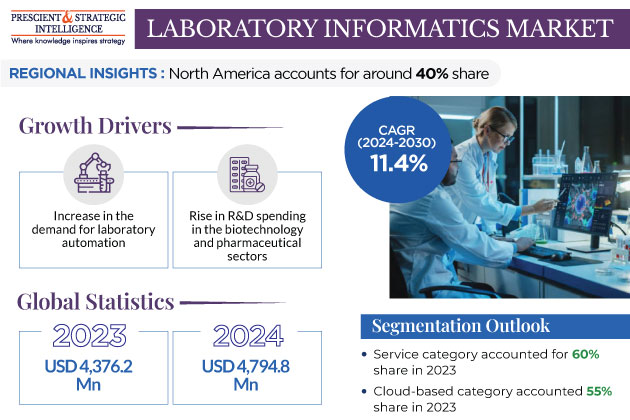

The global laboratory informatics market generated revenue of USD 4,376.2 million in 2023, which is expected to witness a CAGR of 11.4% during the forecast period (2024–2030), reaching USD 9,176.6 million by 2030. The growth of this market is mainly driven by the increase in the demand for laboratory automation, as well as for biobanks/biorepositories and a rise in R&D spending in the biotechnology and pharmaceutical sectors.

The rise in the demand for laboratory automation is expected to fuel the adoption of these systems in the future.

- Due to the rapid improvements in molecular genomics and genetic testing techniques, the amount of data produced by laboratories has rapidly increased over the last few decades.

- Additionally, the need for automated laboratory systems is set to increase due to the shift in the preference toward personalized care, rise in the number of cancer genomics investigations, and growth in patient engagement requirements.

Moreover, with an unprecedented rise in the need for COVID-19 tests around the world, clinical labs expanded the degree of their operations. In turn, the large patient volume led to challenges in developing, standardizing, and validating new methods for testing patients, as well as gathering, storing, analyzing, and rapidly and accurately reporting massive volumes of patient test data. LIM is crucial for meeting the growing demand for COVID-19 tests in clinical labs, which prompted the acceptance of the product during the pandemic.

- Furthermore, this market is expected to benefit from the regulatory authorities' increasing pressure for the deployment of lab automation systems.

- Healthcare procedures have become repeatable and reproducible with the growing adoption of process automation and robotics.

- It is now possible to conduct experimental planning, testing, and analysis more swiftly.

- The increasing use of high-throughput technologies has made it possible to evaluate experimental results more efficiently, which improves the overall effectiveness of lab operations.

Rising Demand for Laboratory Automation

The rising need for laboratory automation is expected to propel the growth of the laboratory informatics market during the forecast period. The high prevalence of human error in laboratory operations has prompted a shift toward automated solutions. For instance, research has found that human error accounts for 30 to 86% of all the pre-analytical errors in laboratories. This is why these entities have begun to use automated equipment and advanced analytical software to produce precise results for a large volume of tests. The aim is to improve the accuracy and reliability of the data by reducing the involvement of humans in the whole process.

- Laboratory automation is emerging as an effective solution for tackling the issues of the shortage of laboratory specialists and eliminating manual intervention in lab processes.

- By automating routine lab processes with the help of devoted workstations and using software to program instruments, lab productivity increases, and researchers are freed to concentrate on crucial tasks.

- By implementing automation, high-quality data is produced and better documentation is facilitated.

- Additionally, the demand for efficient data storage, processing, and sharing techniques has arisen due to the exponential increase in the amount of data generated by lab equipment.

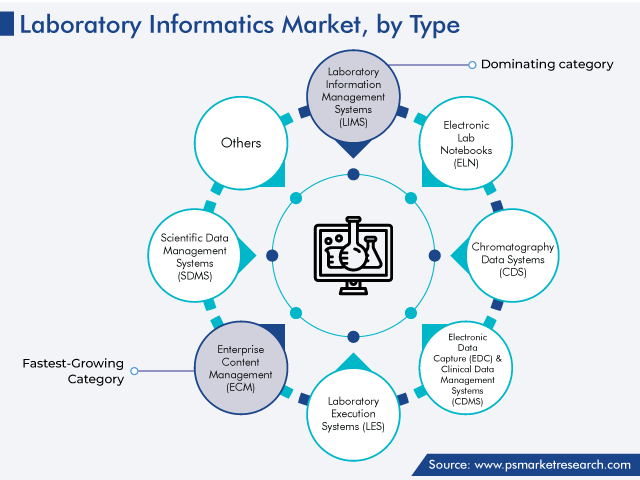

Laboratory Information Management System (LIMS) Accounted for Largest Share

Based on product, LIMS accounted for the largest share, of 30%, in 2023, and it is expected to maintain its dominance during the forthcoming period. These systems offer functionalities for master data management, system & security administration, sample lifecycle reporting, stability study, scheduling, instruments, inventory, storage capacity, analytical workflow, and logistics. In the coming years, the demand for completely integrated services will rise to reduce data management errors and enhance the qualitative analysis of research findings. Moreover, owing to its advantages including inventory tracking without losses, efficient sample management, streamlined workflows, automatic reporting, and automated data exchange, industries are adopting this management system widely.

The enterprise content management (ECM) category is set to witness the fastest growth during the projected period, with a CAGR of 12%.

- The adoption of ECM is increasing as it offers integrated and comprehensive solutions to meet the escalating issues in the healthcare industry.

- ECM offers a centralized approach for capturing, creating, organizing, accessing, and analyzing the complete ecosystem of knowledge assets, media, and electronic documents in an organization.

- Additionally, companies in the market offer several services related to ECM, including consultation, design, installation, and maintenance of these software solutions.

Cloud-Based Category Dominates Industry

By delivery mode, the cloud-based category accounted for the largest revenue share, of 55%, in 2023, and it is further expected to maintain its dominance during the forthcoming period. This is because cloud-deployed LIMs free up space on on-premises computer devices, by storing vast amounts of data offsite, which also makes it easier to retrieve it whenever the client needs. Cloud-based LIMs can be availed of in three ways: platform as a service (PaaS), infrastructure as a service (IaaS), and software as a service. On the SaaS platform, IBM provides its Watson Analytics services. Further, LabVantage Solutions Inc. and Core Informatics offer cloud-based services for LIMS.

- The rise in CROs’ adoption of cloud-based platforms is because of their lower purchase and operational costs, time- and space-saving benefits during system implementation, and secure access to clinical data.

- Other advantages of cloud-based systems include real-time data tracking, remote access to data, and an open ecosystem.

Furthermore, the on-premises delivery mode is showing the fastest growth. It involves the installation of software on computers located within the organization.

Further, users of web-based LIMS solutions receive them from web servers via the internet protocol. Four components of web-based solutions are internet access, a web server, a data administrator, and a software coding system. The advantage of using the internet and web-based services is access to data from the most-remote locations, using just a computer or monitoring equipment in labs.

Service Category Held Larger Share

The service category accounted for the larger share, of 60%, in 2023, and it is further expected to maintain its dominance in the future.

- The category is expanding as a result of the outsourcing of LIMS operations by an increasing number of users.

- Large pharmaceutical research labs often lack the resources and expertise needed for analytics deployment, which is why they outsource these operations.

- CROs provide packages of laboratory informatics services that include promotional activity spending, manufacturing process monitoring, social media analytics, preventive maintenance, benchmarking tools, and predictive analytics to prevent medical device failure.

- In the upcoming years, the demand for these services will increase as people become more aware of the benefits outsourcing laboratory informatics operations offers.

The software category is expected to witness lucrative growth over the forecast period due to the launch of technologically advanced software via the SaaS delivery model for efficient information management for laboratories. The software available for laboratory informatics is capable of carrying out crucial tasks, such as data collection, archiving, interpretation, and analysis. Moreover, this program must be periodically updated to keep up with the most-recent analytics techniques, which would offer IT companies another source of revenue.

| Report Attribute | Details |

Market Size in 2023 |

USD 4,376.2 Million |

Market Size in 2024 |

USD 4,794.8 Million |

Revenue Forecast in 2030 |

USD 9,176.6 Million |

Growth Rate |

11.4% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Product; By Delivery Mode; By Component; By Industry; By Region |

Explore more about this report - Request free sample

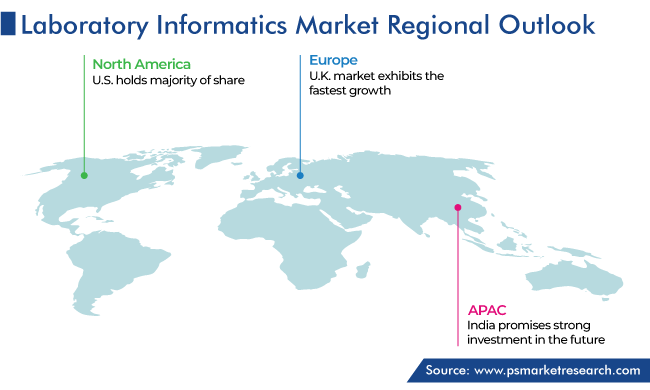

North America Is Prime Revenue Contributor

Geographically, North America held the largest share, of around 40%, in 2023, and it is set to grow at a robust CAGR during the review period.

- The availability of advanced IT infrastructure, coupled with high levels of digital literacy and legislations encouraging the adoption of laboratory information systems, is the main driver for the market growth.

- In addition, the rising healthcare expenses and the need to stem this increase have led to the use of LIMSs across industries.

- Further, the presence of well-established pharmaceutical businesses and the growing need to control operational costs related to information management and analysis are key drivers for the regional market expansion.

In the same vein, Canada’s market advance is attributed to its strong economy, which allowed for significant investment in new technologies. Moreover, the advancement of the healthcare IT infrastructure, rapid digitalization of laboratory workflows across industries, and technological advancement can be attributed for this growth.

Moreover, Europe is the as second-largest market due to the presence of prominent research institutions and market players in this region. Additionally, Europe is home to several growing economies, which allows for investments in new technologies for laboratories. Moreover, the growth in the number of biobanks, easy availability of lab informatics products and services, and stringent regulatory requirements for product safety and efficacy across industries propel the market.

- The market in Germany is growing rapidly.

- This is due to the rise of the healthcare budget in the country, adoption of advanced data analytics solutions, increase in the number of CROs offering LIMS support, and need for laboratories to improve their operational efficiency.

The market in France is also expected to witness notable growth during the forecast period.

- This can be attributed to the high prevalence of chronic diseases in the country, which is why diagnostic and research laboratories are adopting technologically advanced solutions for disease detection, result interpretation, and data gathering, storage, and sharing.

- The growth of the pharmaceutical and biotechnology industries is also supporting the progress of the market in the country.

Top Providers of Laboratory Informatics Solutions Are:

- LabVantage Solutions Inc.

- Thermo Fisher Scientific Inc.

- STARLIMS Corporation

- PerkinElmer Inc.

- LABWORKS LLC

- Autoscribe Informatics

- Dassault Systèmes SE

- Agilent Technologies Inc.

- Cerner Corporation

- McKesson Corporation

Market Breakdown

This fully customizable report gives a detailed analysis of the laboratory informatics market from 2017 to 2030, based on all the relevant segments and geographies.

Segment Analysis, By Product

- Laboratory Information Management Systems (LIMS)

- Electronic Lab Notebooks (ELN)

- Chromatography Data Systems (CDS)

- Electronic Data Capture (EDC) & Clinical Data Management Systems (CDMS)

- Laboratory Execution Systems (LES)

- Enterprise Content Management (ECM)

- Scientific Data Management Systems (SDMS)

Segment Analysis, By Delivery Mode

- On-Premises

- Web-Hosted

- Cloud-Based

Segment Analysis, By Component

- Services

- Software

Segment Analysis, By Industry

- Life Sciences

- Chemical

Region/Countries Reviewed for this Report

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws