Report Code: 11745 | Available Format: PDF | Pages: 85

Italian Electric Bus Charging Station Market Research Report: By Type (Overnight Charger, Opportunity Charger), Power (<22 kW, 22-50 kW, 51-150 kW, >150 kW), Charger (On-Board, Off-Board) - Industry Analysis and Forecast to 2025

- Report Code: 11745

- Available Format: PDF

- Pages: 85

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

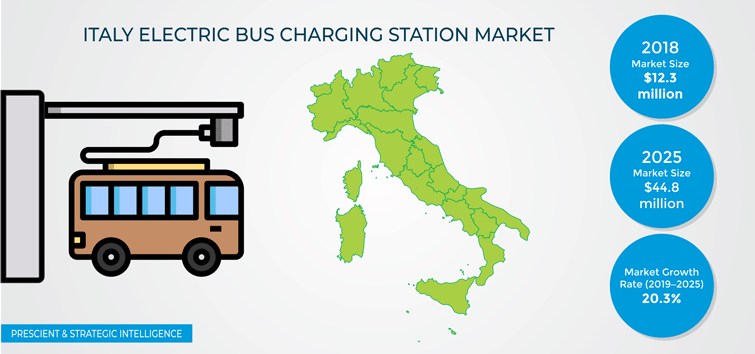

The Italian electric bus charging station market was valued at $12.3 million in 2018, and is estimated to surpass $44.8 million by 2025, witnessing a CAGR of 20.3% between 2019 and 2025.

Fundamentals Governing Italy Electric Bus Charging Station Market

The key trend observed in the Italian electric bus charging station market is the growing preference for opportunity charging buses. In the country, the preference for opportunity charging system-based electric buses is increasing significantly. This is majorly due to the advantages offered by such buses over depot charging system-based buses. In depot charging buses, overnight charging is required, and hence the battery is bigger. The large battery makes up for a significant part of the weight and requires considerable space in an electric bus. Such factors increase the preference for opportunity charging system-based buses.

Government push for electric buses is one of the major factors driving the growth of Italian electric bus charging station market. The government of Italy is taking strategic measures for increasing the rate of adoption of new-energy buses. For instance, the Italian government allocated $4,371.6 million for the period 2019–2033, to migrate to electric and other new-energy-fueled buses in urban and sub-urban areas. Driven by such initiatives, all the conventional buses in the urban areas of the country are predicted to be ultimately replaced by electric buses.

.png)

The introduction of fast-charging stations holds huge opportunities for players operating in Italian electric bus charging station market. The rising interest in electric buses over the last two years has led private companies and public-owned utilities alike to focus on accommodating fast-charging infrastructure. With the installation of fast-charging stations, battery electric buses will be able to provide uninterrupted service, without carrying a large battery. Due to this, many bus manufacturers are introducing fast-charging technology in electric buses. Fast charging ensures maximum availability, as the charging occurs in two to five minutes, while passengers board and disembark.

Italian Electric Bus Charging Station Market Segmentation Analysis

When segmented on the basis of type, the overnight charger category dominated the Italian electric bus charging station market, with over 65% volume share in 2018. The dominance of this category was driven by the increasing preference of public and private agencies for overnight charging buses, as they have more similar operational characteristics to a diesel bus.

On the basis of power, the 22–50 kW category held the largest volume share in the Italian electric bus charging station market in 2018. This can be attributed to the fact that various electric bus manufactures are launching DC fast charging buses, which offer fast charging in less time and at an optimum cost.

In terms of charger, the off-board charger category is expected to see the faster growth during the forecast period. An off-board charger allows bus makers to curb the weight of the vehicle, which helps in rapid charging at higher power levels. Furthermore, the new electric buses are supported by the DC fast-charging facility, which further boosts its market growth.

Competitive Landscape of Italian Electric Bus Charging Station Market

The Italian electric bus charging station market is still in its nascent phase, with only a few players operating in the country. Key players in this market includes BYD Co. Ltd., and Ekoenergetyka-Polska Sp. z o.o. Besides, ABB Ltd., Siemens AG, Heliox B.V., JEMA Energy S.A., Powerdale NV, Schunk Carbon Technology, Solaris Bus & Coach S.A., and Bombardier Inc. are other players operating in the electric bus charging station market in the country.

Recent Strategic Developments of Major Italian Electric Bus Charging Station Market Players

In recent years, the major players in the Italian electric bus charging station market have taken several orders and contracts for the deployment of electric buses and related charging stations in different cities. For instance, in August 2019, Solaris Bus & Coach S.A. won an order for the supply of zero-emission buses in Italy. Transport operator Azienda del Consorzio Trasporti Veneziano (Actv S.p.A.) in Venice placed the order to the company for 30 Solaris Urbino 12 electric buses and related charging infrastructure. The contract included nine fast pantograph battery chargers, six fix plug-in battery chargers, and a mobile plug-in charger.

Key Questions Addressed/Answered in the Report

- What is the current scenario of the Italian electric bus charging station market?

- What is the historical and the present size of the market segments and their potential in the future?

- What are the major factors boosting the market and their impact during the short, medium, and long terms?

- What are the evolving opportunities for the players in the market?

- What are the key developments adopted by the major players to expand their market share?

- What are the government policies and regulations for electric bus charging stations in the country?

- What are the electric bus charging business model in the market?

- What are the potential strategies for charging electric buses?

- What is the cost structure analysis of different charging stations?

- What is the historical and the present size of the European electric bus charging station market and its future potential?

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws