Report Code: 12047 | Available Format: PDF | Pages: 259

IoT in Logistics Market Research Report: By Application (Location Management, Inventory Tracking and Warehousing, Fleet Management, Predictive Analytics, Blockchain for Supply Chain Management, Self-Driving Vehicles), Mode of Transport (Roadway, Railway, Airway, Waterway), Technology (Cellular network , LAN, LPWAN), Organization Type (SME, Large Enterprise), Vertical (Automotive, Retail, Food & Beverage, Real Estate, Healthcare, Oil & Gas, Aerospace & Defense) - Global Industry Analysis and Growth Forecast to 2030

- Report Code: 12047

- Available Format: PDF

- Pages: 259

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Internet of Things (IoT) in Logistics Market Overview

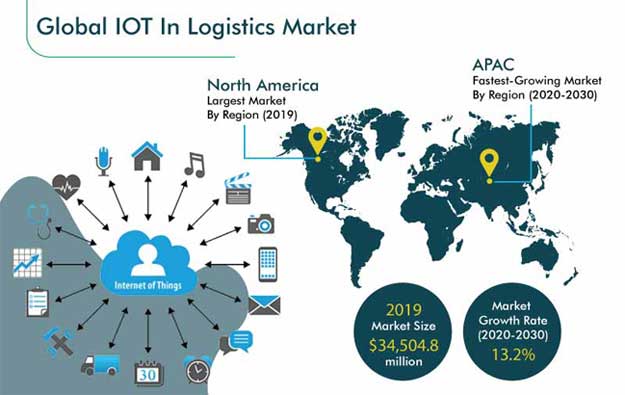

The global internet of things (IoT) in logistics market size was $34,504.8 million in 2019, and it is projected to grow with a CAGR of 13.2% between 2020–2030 (forecast period). The industry growth is significantly driven by the expanding e-commerce industry around the world, coupled with the increase in the demand for more-efficient logistics operations.

However, the ongoing COVID-19 pandemic has resulted in a logistical slowdown. A significant decline in the movement of non-essential goods, shortage of laborers, capacity limitations in global supply networks and regional hubs, and increasing cautiousness among consumers regarding the purchase of several non-essential items have jointly contributed to the decreasing logistics demand and slowing operations across the world. The dip in the logistics demand, in turn, has led to the decline in the IoT in logistics market as well.

Segmentation Analysis

Fleet Management Is Highest-Revenue-Generating Application in Market

During the historical period (2014–2019), the usage of IoT solutions for fleet management, among all other logistics applications, was the highest. The major reasons for the dominance of the category on the IoT in logistics market are that fleet management enables logistics companies to manage fuel and maintenance costs more efficiently, allows for real-time visibility of the fleet, enhances driver safety, eliminates driver frauds, and increases vehicle reliability along with its lifespan. The incorporation of IoT solutions enables logistics firms to carry out these fleet management functions more efficiently.

Roadways Is Largest Category under Mode of Transportation Segment

Roadways was the largest category in the market throughout the historical period, in terms of the mode of transportation. Furthermore, the category is expected to remain the largest during the forecast period. This is buoyed by the fact that North America, led by the U.S., is the largest IoT in logistics market in the world, and in the country, around 80% of the logistics activities are carried out through roadways. Similarly, in Europe, around 88% of the logistics activities are carried out via roadways, which further contributes toward the dominance of the category.

Cellular Network Is Projected To Be Fastest-Growing Technology Category

The fastest growth in the IoT in logistics market is expected to be exhibited by the cellular network category during the forecast period, under segmentation by technology. This is expected to be driven by the 5G network technology, which was introduced in several parts of the world in 2019. The 5G technology is expected to improve the driver experience, by providing real-time traffic updates and better insurance coverage enhancement for the vehicle. Additionally, the 5G technology permits logistics companies to reduce the latency time, thereby ensuring higher efficiency in operations.

Large Enterprise Category Is Expected to Exhibit Faster Growth

During the forecast period, the large enterprise category is expected to grow at a higher rate in the IoT in logistics market, based on organization type. This would be owing to the fact that the penetration of IoT in logistics applications is much higher in large enterprises than small and medium enterprises (SMEs), due to the higher affordability for IoT solutions of the former type of organizations.

Fastest Growth Is Expected To Be Witnessed by Food & Beverage Category

The food & beverage category is projected to exhibit the fastest growth in the IoT in logistics market in the forecast period, on the basis of vertical. The growing demand for last-mile food delivery across the world is a major reason for the growth of the category. These services require increased speed and efficiency to meet the demand in the market, for which IoT solutions enable smooth functioning, along with greater efficiency.

Geographical Outlook

North America Is Largest Regional Market

Geographically, North America was the largest IoT in logistics market throughout the historical period. The region has witnessed the maximum digital transformation in recent years, which has heavily contributed to the growth of the market. Moreover, with dozens of startups entering the region’s IoT landscape, due to the growing internet penetration, including of the 5G network, and rising scope for e-commerce, the adoption rate of IoT solutions in the logistics industry is increasing.

Furthermore, the rising advertising and marketing activities regarding near-field communication (NFC), radio-frequency identification (RFID), robotics, artificial intelligence (AI), and low-power wide-area network (LPWAN) technologies, along with increasing efforts to train and educate professionals about these technologies, boost the scope for new entrants and startups in the IoT in logistics market in the region.

Asia-Pacific (APAC) To Be Fastest-Growing Regional Market

The APAC IoT in logistics market is projected to advance the fastest during the forecast period. This can be because of the changing consumer behavior and growing urbanization rate in developing economies, such as India and China. These factors are leading to technological developments in the regional logistics industry, which include the introduction of numerous high-end technologies, such as AI, RFID, NFC, robotics, radio protocols, low-energy Bluetooth, low-energy wireless, and Wi-Fi-direct.

Moreover, smaller, cheaper, and more-powerful IoT devices are being introduced in the market, which are more customer-engaging and, therefore, are more in demand in the region. With such technological advancements, along with the increasing logistics activities, the APAC region is projected to witness a rising deployment of IoT solutions in its logistics sector.

Trends & Drivers

Rapid Digitization in Logistics Industry Is Major Market Trend

Rapid digitization in the logistics industry is one of the key trends being witnessed in the IoT in logistics market. Data analytics, robotics, telematics, and self-driving technologies are increasingly finding their way in the trucking and logistics sector, with the intention to attain operational efficiency and combat other issues, such as the shortage of truckers. Moreover, the adoption of robotics application in warehousing, supply chain management, machine learning, and data analytics, is also being increasingly implemented, to solve the shortage of general labor and enhance technical efficiency. Such digitization measures in logistics operations are a major market trend.

Booming E-Commerce Industry

The e-commerce industry is growing at a tremendous rate across the globe, and it holds a significant share in the retail market. In 2019, the e-commerce sector accounted for 16.5% of all retail sales, an increase of nearly 17.9% from 2018. Furthermore, it is expected that e-commerce sales will reach around 17% of the total retail sales, worldwide, by 2021. This increasing demand for e-commerce services has been a result of a change in customers’ buying behavior and expectations, as they now expect fast and free shipping, with competitive product pricing. In order to cope with this changing consumer behavior, several companies have begun incorporating IoT services in their logistics activities, with the intent to manage inconsistent shipping and a sudden order rise and time-sensitive needs. Thus, with the growing e-commerce industry, the IoT in logistics market is also expected to witness a surge.

Increasing Logistics Efficiency

IoT solutions enhance the efficiency of logistics operations, which is a major driver for the IoT in logistics market. The success of any logistics company is determined by the efficient management of inventory and warehousing, internal business processes automation, quick delivery of goods, safe storage, and quality of goods. Thus, to accomplish the same, there appears an increasing necessity to implement innovative solutions, such as IoT, in logistics operations. IoT helps in increasing the efficiency, by allowing for smart location management, tracking driver activities, updating delivery status, and inventory tracking and warehousing.

| Report Attribute | Details |

Historical Years |

2014-2019 |

Forecast Years |

2020-2030 |

Base Year (2019) Market Size |

$34,504.8 million |

Forecast Period CAGR |

13.2% |

Report Coverage |

Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Impact of COVID-19 on the Market, Company Share Analysis, Companies’ Strategic Developments, Product Benchmarking, Company Profiling |

Market Size by Segments |

Application, Mode of Transportation, Technology, Organization Type, Vertical, Region |

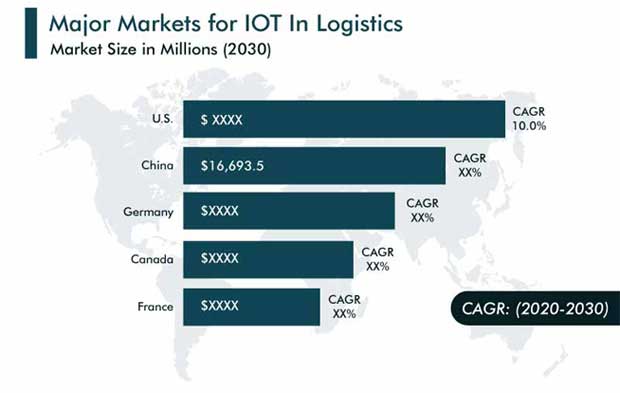

Market Size of Geographies |

U.S., Canada, Germany, France, U.K., Italy, Spain, Japan, China, India, Brazil, Mexico |

Secondary Sources and References (Partial List) |

American Public Transportation Association (APTA), Asia-Pacific Logistics Federation (APLF), Council of Supply Chain Management Professionals (CSCMP), American Trucking Associations (ATA), European Logistics Association (ELA), Freight Transport Association (FTA), Organisation Internationale des Constructeurs d'Automobiles (OICA) |

Explore more about this report - Request free sample

Market Players Are Developing Partnerships and Collaborations to Gain Competitive Edge

The global IoT in logistics market is fragmented in nature, with the presence of giant market players such as Cisco Systems Inc., Robert Bosch GmbH, IBM Corp., and Honeywell International Inc.

In recent years, players in the industry have undergone numerous collaborations and partnerships, in order receive a competitive edge over their competitors. For instance:

- In February 2020, Attivo Networks Inc. partnered with Microsoft Corp. to integrate enhanced detection and response for Azure IoT Edge with its ThreatDefend platform. Through this partnership, the companies intend to address the inherent risk of cyberattacks in the emerging environment.

- In October 2019, AT&T Inc. entered into a partnership with Vodafone Group plc to offer access to AT&T Inc.’s NB-IoT networks, in order to simplify the deployment of IoT for their customers, across European countries and the U.S.

- In May 2019, FedEx Corp. and United Parcel Service Inc. partnered to develop an automated loading and unloading system for trucks. The partnership was intended to keep up with the demands of the growing e-commerce industry.

Some of the Key Players in IoT in Logistics Market include:

-

Cisco Systems Inc.

-

Robert Bosch GmbH

-

IBM Corp.

-

Honeywell International Inc.

-

AT&T Inc.

-

Qualcomm Inc.

-

Intel Corp.

-

Microsoft Corp.

-

SAP SE

-

Oracle Corp.

IoT in Logistics Market Size Breakdown by Segment

The research offers market size of the global internet of things (IoT) in logistics market for the period 2014–2030.

Based on Application

- Location Management

- Inventory Tracking and Warehousing

- Fleet Management

- Predictive Analytics

- Blockchain for Supply Chain Management

- Self-Driving Vehicles

Based on Mode of Transport

- Roadway

- Railway

- Airway

- Waterway

Based on Technology

- Cellular network

- Local Area Network (LAN)

Based on Organization Type

- Small and Medium Enterprise (SME)

- Large Enterprise

Based on Vertical

- Automotive

- Retail

- Food &Beverage

- Real Estate

- Healthcare

- Oil &Gas

- Aerospace &Defense

Geographical Analysis

-

North America

- U.S.

- Canada

-

Europe

- Germany

- France

- U.K.

- Italy

- Spain

-

Asia-Pacific (APAC)

- China

- Japan

- India

-

Latin America, Middle East, and Africa (LAMEA)

- Brazil

- Mexico

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws