Report Code: 11774 | Available Format: PDF | Pages: 164

Interactive Display Market Research Report: By Product (Interactive Kiosk, Interactive Whiteboard, Interactive Video Wall, Interactive Flat Panel, Interactive Table, Interactive Monitor), Technology (LCD, LED), End User (BFSI, Education, Hospitality & Healthcare, Corporate & Government, Transportation, Industrial), Geographical Outlook (U.S., Canada, U.K., Germany, France, Italy, Russia, Spain, The Netherlands, China, India, Japan, South Korea, Australia, Brazil, Mexico, Turkey, U.A.E, Saudi Arabia, South Africa) - Industry Opportunity and Growth Forecast to 2024

- Report Code: 11774

- Available Format: PDF

- Pages: 164

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Outlook

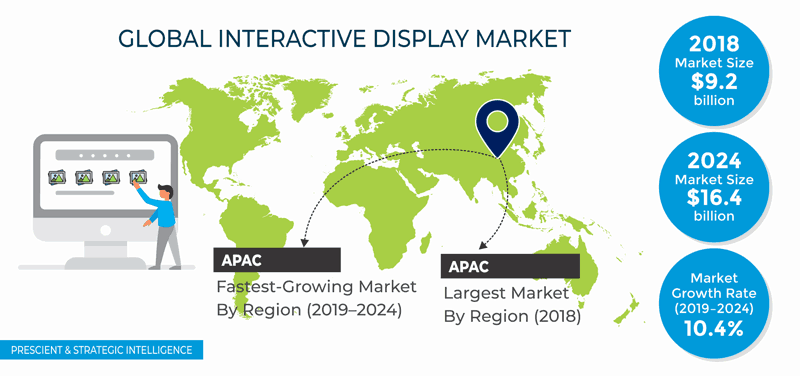

The interactive display market revenue stood at $9.2 billion in 2018, and it is expected to surpass $16.4 billion by 2024, exhibiting a CAGR of 10.4% during 2019–2024. Globally, the Asia-Pacific (APAC) region will witness the fastest growth in the coming years due to the rising investments in the transportation and education sectors in India, Australia, and China.

Market Dynamics

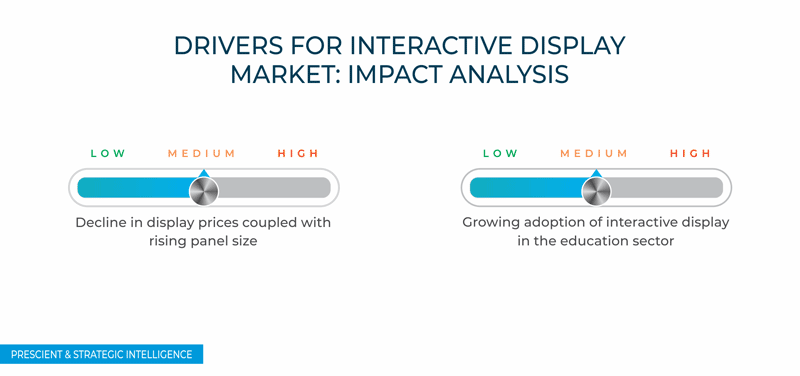

The rising penetration of interactive display products, such as interactive whiteboards, monitors, and kiosks, has reduced the cost of display screens. The declining prices of light-emitting diode (LED) displays and touch-screen panels are having a positive impact on the interactive display industry. Between 2019 and 2024, the cost of LED displays is projected to decline by 20%. Increasing the panel size and using upgraded resolutions, including full high definition (FHD), 4K, and 8K, enhance the overall performance of the display and provide an improved view. Thus, the spurring demand for a better picture and video quality will augment the sales of 4K, 8K, and FHD displays globally.

Interactive Display Market Segmentation Analysis

In 2018, the 33–65 inches category generated the highest revenue within the panel size segment due to the high penetration of 33–65-inch displays in the retail, transportation, healthcare, and hospitality sectors of APAC and North America. These products offered by interactive display market players enhance the overall visual experience in signage, wayfinding, and several other self-service applications.

The liquid crystal display (LCD) category, under the technology segment, was the larger contributor to the market in 2018. This can be owed to the growing adoption of LCD interactive displays in the educational institutes of the U.A.E., the U.S., Germany, the U.K., and China, as they consume lesser power than conventional LCDs, owing to the lack of a backlit screen. In 2018, the largest number of LCD interactive displays were sold in the APAC region because of their increasing adoption in the education, hospitality, and retail sectors.

Geographical Analysis

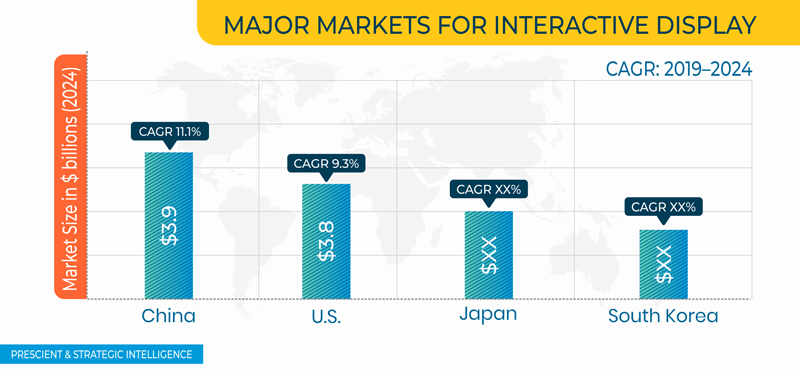

The APAC market for interactive displays generated the highest revenue in 2018, and it is projected to register the fastest growth between 2019 and 2024. These displays are becoming quite popular in the retail sector as they provide product information while improving the in-store environment. The value of the APAC retail industry is predicted to spike from $720 billion in 2017 to $1.38 trillion by 2025. Southeast Asia is expected to showcase strong growth in the APAC retail sector.

At present, the regional interactive display market is observing a dip in the product prices due to their large-scale production in South Korea, Japan, and China. Additionally, a soaring number of manufacturing units in the region are offering perimeter-based technologies, including optical and infrared detection, and surface-based touch technologies, including capacitive and resistive detection, which will keep driving the sales of such displays.

Competitive Landscape

The global interactive display market is highly competitive in nature, characterized by the presence of companies such as Samsung Electronics Co. Ltd., LG Electronics Inc., and others. Apart from this, NEC Corporation, Panasonic Corporation, Sharp Corporation, Crystal Display Systems Ltd, ELO Touch Solutions Inc., Gesturetek Inc., Seiko Epson Corporation, and Koninklijke Philips N.V., are the other prominent players operating in the interactive display market.

Recent Strategic Developments of Major Interactive Display Market Players

Major players in the global interactive display market were involved in various activities, such as partnerships and product launch to gain a competitive edge in the market. For instance, in November 2019, LG Electronics Inc. introduced IR-based UHD interactive digital boards that are available in 65, 75, and 86-inch models. All the boards are equipped with IPS panels and IR touch technology for a responsive HD experience. These boards can be connected up to 30 users and support interactive meetings offering specialized tools such as literature-sharing, questionnaires, and voting.

Key Questions Addressed/Answered in the Report

- What is the current scenario of the interactive display market?

- What are the emerging technologies that could be incorporated with the interactive display?

- What is the historical and the present size of the market segments and their future potential?

- What are the major product types for the market and their impact during the short, medium, and long terms?

- What are the evolving opportunities for the players in the market?

- Which are the key geographies from the investment perspective?

- What are the key strategies adopted by the major players to expand their market share?

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws