Report Code: 11423 | Available Format: PDF | Pages: 654

Industrial Lubricants Market by Product (Process Oil, General Oil, Metalworking Fluid, Engine Oil), Application (Metalworking, Textiles, Chemical Manufacturing, Food Processing, Hydraulic Machinery), Geographical Outlook - Industry Trends and Growth Forecast to 2024

- Report Code: 11423

- Available Format: PDF

- Pages: 654

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Outlook

The industrial lubricants market revenue stood at $48,860.7 million in 2016, and it is expected to advance at a CAGR of 4.3% during 2016–2024. The spurring demand for industrial lubricants from the metalworking, textile, and chemical manufacturing industries is fueling the market growth.

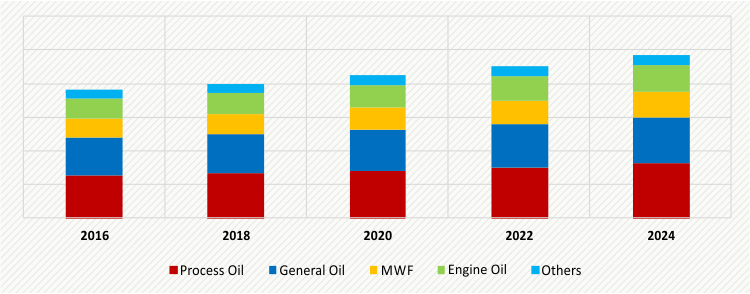

The process oil category dominated the market in 2016, with an over 30.0% volume share, within the product segment. Process oils are used for a wide range of applications, for instance, as a processing aid and raw material, in several end-use industries, including rubber, plastic, and chemical. The burgeoning demand for chemicals, especially in Asia-Pacific (APAC), will, therefore, boost the sales of process oils in the coming years.

The chemical manufacturing category, under the application segment, held the largest sales volume share in the market for industrial lubricants, of over 20.0%, in 2016, and it is expected to retain its dominance in the foreseeable future. Manufacturing units use chemical oils to optimize the performance and life of machines that withstand stress. For instance, the machines used in the production of nitrogen fertilizers must withstand extreme temperature and pressure and be compatible with ammonia and the catalyst.

In the coming years, the APAC region is expected to dominate the industrial lubricants market, primarily on account of the rapid industrialization in the emerging economies of India and China and those in Southeast Asia. Moreover, the modernization of the industrial machinery will play a vital role in the growth of the market in the region. Additionally, the restarting of industrial activities in developed countries is expected to drive the demand for lubricants in APAC.

GLOBAL INDUSTRIAL LUBRICANTS MARKET, BY PRODUCT, KILOTONS (2016-2024)

Market Dynamics

The surging industrial output in developing countries, including India, Russia, Brazil, China, and Indonesia, has become a key trend in the industrial lubricants industry. Industrial production has significantly surged in the metal forming, mining, plastics, and consumer appliance industries of these nations. This has led to the increasing use of lubricants, such as industrial oils, metalworking fluids, engine oils, and process oils.

The progress of the manufacturing sector has a direct impact on the demand for industrial lubricants. Industrial output across the world dipped in 2008 and 2009 due to the North American economic recession and European debt crisis. However, the manufacturing industry in developing nations, such as Brazil, India, South Africa, China, and Russia, did not suffer a major setback. The rapid surge in industrial production in these countries is, therefore, boosting the industrial lubricants market growth. Lubricants are widely used in the metal forming, food and beverages, paper and mill, quarrying, plastic, machining, mining, and energy sectors.

The bolstering food and beverage industry is also attributing to the market growth. The dynamics of the industry are changing due to the emergence of commodity branding, low cost of technology, and advent of multinationals. The food processing industry uses lubricants in blenders, mixers, sifters, packaging machinery, knives, wrappers, slicers, labelers, bottle washers, slides, and conveyors. The growth of the sector, primarily on account of the booming population and changing lifestyle of the people in APAC and Latin America (LATAM), is amplifying the demand for processed food, thereby boosting the industrial lubricant demand.

Apart from this, the growth of the wind turbine industry, owing to the increasing focus on renewable energy, is expected to have a positive impact on the market. Lubricants are used in the wind turbine industry as the production of turbines requires oils with low viscosity. Moreover, the mounting consumption of such fluids in the mining sector is propelling the demand for such products.

The rising concerns and regulations regarding contamination in synthetic lubricants, especially those with a mineral oil base, and the pollution caused by them are obstructing the industrial lubricants market growth. Moreover, the dwindling crude oil reserves have resulted in the development of substitutes. Vegetable oils appear to be a potential substitute for mineral oils, as they are a renewable and biodegradable resource. The proper disposal of used lubricants is another reason for concern because most of the materials added to lubricants are derived from petrochemicals, thereby posing the threat of water pollution.

Competitive Landscape

Amsoil Inc., Phillips 66, Klüber Lubrication München SE & Co. KG, Calumet Specialty Products Partners L.P., Houghton International Inc., Quaker Chemical Corporation, PETRONAS Lubricants International, Blaser Swisslube AG, Exxon Mobil Corporation, BP PLC, Chevron Corporation, FUCHS PETROLUB SE, The Lubrizol Corporation, Total S.A., Idemitsu Kosan Co. Ltd., Royal Dutch Shell PLC, and Clariant AG are some of the major players operating in the global industrial lubricants market.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws