Report Code: 12052 | Available Format: PDF | Pages: 336

India E-Rickshaw and On-Demand Ride Hailing Market - In-Depth Analysis of Industry Sizing and Dynamics till 2030

- Report Code: 12052

- Available Format: PDF

- Pages: 336

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

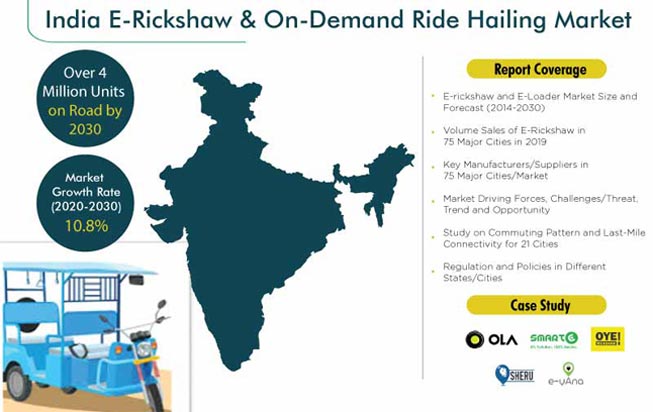

India E-Rickshaw and On-Demand Ride Hailing Market

E-rickshaws gained prominence in India in early 2010 when these vehicles started operating in suburban and urban areas of Delhi–NCR, towns of Uttar Pradesh, Bihar, and West Bengal. E-rickshaws are zero tailpipe emission modal option used as first-/last-mile connectivity in these cities. Majority of e-rickshaw operation in these areas are unplanned inclusion or a pilot-planned inclusion, later expanding in an unplanned way. With sales of around 4.5 lakh units in 2019, currently there are over 10 lack e-rickshaws in operations in India. Delhi was the largest market for e-rickshaws during the historical period with over 20% volume share in the India e-rickshaw and on-demand ride hailing market in 2019.

Fundamentals Governing India E-Rickshaw and On-Demand Ride Hailing Market

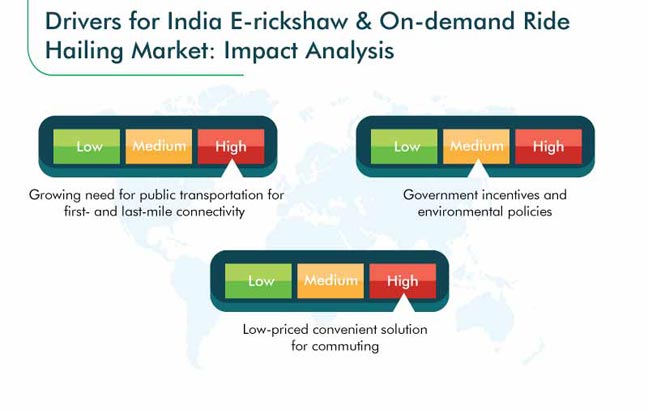

Increasing partnerships between government authorities and public bodies is a major trend for the India e-rickshaw and on-demand ride hailing market. As Government of India (GOI) and state authorities regularize use of e-rickshaws, numerous projects are launched under public–private partnership arrangement. For instance, in June 2017, with a view to provide convenience to its commuters by ensuring last-mile connectivity from the metro stations, the first E-Rickshaw service was formally flagged-off by Delhi Metro Rail Corporation (DMRC). After this, DMRC has been continuously partnering with other aggregators to expand its services for its different stations.

Structural Analysis of India E-Rickshaw and On-Demand Ride Hailing Market

The ownership pattern is of 3 tiers. At some occasions, the well-off drivers buy the rickshaws in complete lumpsum payment; second, they get their vehicles financed either through banks, non-banking financial companies (NBFC), or local unregulated lenders, which makes them suspectable to high loan rates and eventually debt traps. The third one is taking rickshaw on daily rent basis.

Charging infrastructure and subsequently charging is a major challenge for all the rickshaw operators in the India e-rickshaw and on-demand ride hailing market, since it hinders their mobility on large trips and longer working hours. A battery usually takes 7–10 hours to fully charge for operational strength of 80–110 km depending upon the load and age of battery. Due to unavailability of regulated and fast-charging stations, drivers are forced to use services of unorganized players where they face theft, vehicle vandalism, hefty charges, voltage fluctuations, and longer wait time.

Geographical Analysis of India E-Rickshaw and On-Demand Ride Hailing Market

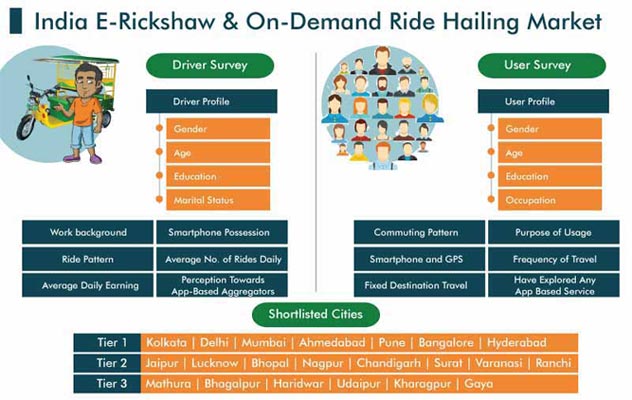

The India e-rickshaw and on-demand ride hailing market research report touches extensive geographical area, covering entire urban framework, that is, tier 1, 2, and 3 cities. The list of cities includes Kolkata, Delhi, Mumbai, Ahmedabad, Pune, Bangalore, and Hyderabad, in tier 1 category; Jaipur, Lucknow, Bhopal, Nagpur, Chandigarh, Surat, Varanasi, and Ranchi in tier 2; and Mathura, Bhagalpur, Haridwar, Udaipur, Kharagpur, and Gaya in tier 3.

The distribution of cities across framework is included keeping in mind equitable distribution of research across northern, southern, eastern, and western zones of India.

In-Depth User Analysis

The India e-rickshaw and on-demand ride hailing market research report covers user’s geographical profile analysis in tier 1, 2, and 3 cities, based on user profiling; scope of e-rickshaw services for short-distance travel, metro connectivity, carrying school children, work trip, and others; preference of e-rickshaws for general purpose and first-/last-mile connectivity; existing mode of last-mile transport in tier 2 and tier 3 cities; average distance traveled and average expenditure on last-mile transportation; average distance and expenditure of transportation from nearby tier 3 cities/towns to villages; user’s current commuting patterns; hurdles associated with existing last-mile transportation; and challenges, motivation, and recommendations for ride hailing services.

In-Depth Driver Analysis

The study tries to touch upon driver profile analysis in tier 1, 2, and 3 cities, based on educational background, work background, driver’s professional and personal aspirations, willingness to work with transportation network companies (TNC), gender and age, motivation factors, and expectations and loyalty. Additional analysis includes number of drivers to be acquired for the services, challenges associated with the acquisition of the drivers in targeted cities, addressal of drivers’ hidden needs, various sources/channels to acquire the drivers, current challenges being faced by the drivers, demand and opportunities available in the India e-rickshaw and on-demand ride hailing market.

Competitive Landscape of India E-Rickshaw and On-Demand Ride Hailing Market

The India e-rickshaw and on-demand ride hailing market is fragmented in nature, characterized by the presence of various domestic players, such as Ola Electric Mobility Pvt. Ltd., SmartE (Treasure Vase Ventures Private Limited), Oye! Rickshaw (Khati Solutions Private Limited), Sheru, e-yAna (VGARCEDO Technologies Private Limited), and Mauto Electric Mobility Pvt Ltd.

Recent Strategic Developments of Major India E-Rickshaw and On-Demand Ride Hailing Market Players

In recent years, the key players in the India e-rickshaw and on-demand ride hailing market are majorly engaged in product launches and several other business activities to gain the competitive edge. For instance, in June 2017, with a view of providing convenience to its commuters by ensuring last mile connectivity from the metro stations, the first e-rickshaw service was formally flagged-off by Delhi Metro Rail Corporation (DMRC). DMRC has extended the facility of e-rickshaw services by SmartE to 12 more stations across the Delhi Metro network. As of February 2020, more than 800 SmartE e-rickshaws are operational in 17 stations ferrying approximately 100,000 passengers per day.

Similarly, Hyderabad-based ETO Motors, an Electric Mobility as a Service (EMaaS) provider, commenced e-rickshaw first-mile and last-mile services at selected metro stations in Delhi from March 2020. Some other partners of ETO Motors are Noida Metro Rail Corporation (NMRC), Hyderabad Metro Rail (HMR), Kochi Metro Rail Ltd. (KMRL), Nagpur Metro Rail Project (NMRL), South Central Railway, and Telangana State Road Transport Corporation (TSRTC).

India E-Rickshaw and On-Demand Ride Hailing Market Size Breakdown by Segment

The research offers market analysis of the India e-rickshaw and on-demand ride hailing market for the period 2020–2030.

Market Sizing and Industry Dynamics

- Historical market size of electric rickshaw for the period (2010-2019)

- Number of pedal rickshaws in selected cities, concerns of drivers, and their thought process toward electric vehicle

- Leading electric rickshaw loader providers

- Emerging trends, derivers, restraints, and growth opportunities in the market

- Potential of the market during the forecast period

- The market analysis of current players, their business models and offerings, sales data, scale of businesses (organized and unorganized)

In-Depth Analysis

- User’s geographical profile analysis in tier 1, 2, and 3 cities, based on the following factors:

- User profiling

- Scope of e-rickshaw services for short-distance travel, metro connectivity, carrying school children, work trip, and others

- Preference of e-rickshaws for general purpose and last-mile connectivity

- Existing mode of last-mile transport in tier 2 and tier 3 cities

- Average distance travelled and average expenditure on last-mile transportation

- Average distance and expenditure of transportation from nearby tier 3 cities/towns to villages

- User’s current commuting patterns

- Hurdles associated with existing last-mile transportation

- Challenges, motivation, and recommendations for ride hailing services

- List of cities covered; Kolkata, Delhi, Mumbai, Ahmedabad, Pune, Bangalore, Hyderabad, Jaipur, Lucknow, Bhopal, Nagpur, Chandigarh, Surat, Varanasi, Ranchi, Mathura, Bhagalpur, Haridwar, Udaipur, Kharagpur, and Gaya

- Driver profile analysis in the tier 1, 2, and 3 cities, based on the following factors:

- Educational background

- Work background

- Aspirations

- Willingness to work in the segment

- Gender and age

- Motivation factors

- Others including driver’s expectations and loyalty

- Additional analysis on:

- Number of drivers to be acquired for the services

- Challenges associated with the acquisition of the drivers in target cities

- Addressal of drivers’ hidden needs, if any

- Various sources/channels to acquire the drivers

- Current challenges being faced by the drivers

- Demand and opportunities available in this sector

- List of cities covered; Kolkata, Delhi, Ahmedabad, Jaipur, Lucknow, Bhopal, Nagpur, Chandigarh, Varanasi, Ranchi, Mathura, Bhagalpur, Haridwar, Kharagpur, and Gaya

- Study on charging infrastructure covering the following aspects:

- Existing charging infrastructure for e-rickshaws

- Scope/feasibility related to the implementation of solar charging stations

- Government policies related to solar power generation

- Leading solar panel providers/vendors

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws