Report Code: 11696 | Available Format: PDF | Pages: 115

India E-Cigarette Market Research Report: By Product (Cig-a-like, Vaporizer, Vape Mod, T-Vapor), Gender, Age-Group, Distribution Channel (Vape Shops, Online, Hypermarket/Supermarket, Tobacconist) - Industry Size Analysis and Growth Forecast to 2024

- Report Code: 11696

- Available Format: PDF

- Pages: 115

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

India E-Cigarette Market Overview

India e-cigarette market was valued at $7.8 million in 2018 and is expected to register a CAGR of 26.4% during 2019-2024. Rising health awareness among the traditional cigarette smoking populace and growing cancer related cases in the country is driving the adoption of e-cigarettes in India. Moreover, increasing popularity of ash-less vaping devices among the Indian consumers is boosting the growth of the market.

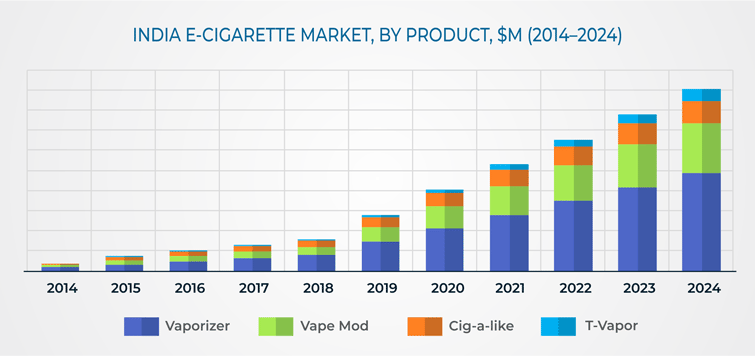

On the basis of product, India e-cigarette market has been categorized as vaporizer, vape mod, cig-a-like, and T-Vapor. The demand for vaporizer category is projected to grow with the fastest rate. This can be attributed to the growing popularity of modular vaporizers such as JUUL SMOK, and Eleaf. The rising popularity of vaporizer can be attributed to varied factors such as moderate cost, dense aerosol production, and flexibility with the type of flavors that can be used with this device.

India e-cigarette market has been segmented under the age groups of 16-24 years, 25-34 years, 35-44 years, 45-54 years, 55-65 years, and 65+ years. E-cigarettes are currently popular among the younger generation living in urban areas, due to the influence of social media channels. With more direct and indirect marketing, the consumption among other age groups across tier-2 and tier-3 cities is expected to rise in the country.

The e-cigarette aftermarket is categorized into refill, battery and charger, and others, which includes atomizers, tanks, and coils. Out of these, refill category held the largest share in the India e-cigarette aftermarket. Presently, India has over 0.3 million vapers. The number of vapers is projected to reach 0.6 million by 2024, indicating shift toward e-cigarettes from conventional tobacco products, which in turn would increase e-cigarette consumption, thereby, leading to more demand for e-cigarette accessories, mainly refills.

E-Cigarette refill aftermarket is categorized on the basis of flavor into fruit, tobacco, menthol, candy, savory/spice, bakery/dessert, beverage, menthol tobacco, and others. Out of these, tobacco was the most preferred flavor among consumers in India, as it helps vapers to quit conventional smoking, without having to experience sudden tobacco withdrawal symptoms. It is also observed that experienced vapers shift toward non-tobacco flavors, such as fruit and bakery/sweet, after prolonged usage; the market for these two flavors together contributed about 19% in the Indian e-cigarette refill aftermarket in 2018.

The northern region of India accounted for the largest share in total e-cigarette revenue in the country, in 2018. The surging number of consumers switching from traditional tobacco cigarettes to e-cigarettes has been driving the e-cigarette market growth in the region. Additionally, vaping trend is on the rise in cities such as Delhi, Gurgaon, and Chandigarh, primarily due to the prevalence of pub-culture. However, states including Punjab, Himachal Pradesh, Uttar Pradesh, and Rajasthan, have banned the sale on e-cigarettes, thus posing hindrance to the growth of e-cigarette market in the region.

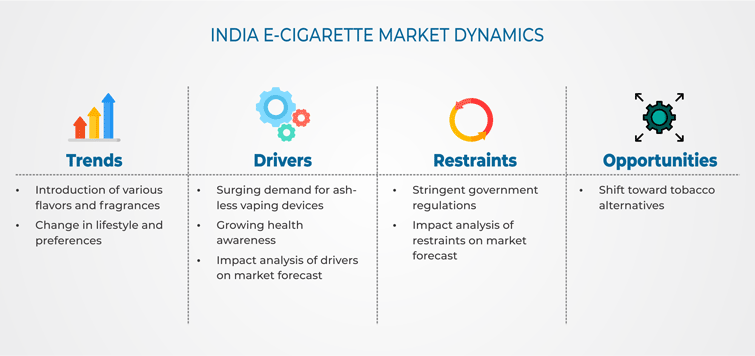

India E-Cigarette Market Dynamics

Growth Drivers

Smoke generated from burning tobacco is equally harmful to humans as it is to the environment. E-cigarettes eliminate the emission of smoke and instead, produce mist, which easily dissolves in the air within seconds. E-cigarette also eliminate the need for dumping cigarette butts and flicking ash openly. Used cigarette butts contain nicotine, carcinogens, and various other toxins. On account of this, demand for ash-less vaping device is growing in the country, providing steady growth to the overall India e-cigarette market.

Trends

With the growing popularity of e-cigarettes, vendors are introducing a wide range of e-cigarette flavors such as menthol, mint, chocolate, cola, bubble gum, and fusions of other fruits and flavoring substances to attract more customers. Among these various flavors, it has been observed that preference toward tobacco flavor is high in the country. Further, introduction of various flavors of e-cigarettes is luring the young populace (16-24 years) to use e-cigarettes. For instance, it has been recorded that young populace held the largest share of 33.6% in the market, in 2018, and is expected to hold 35.9% share by 2024.

Restraints

E-cigarettes, being less harmful, do not completely eliminate the risk of health damage caused by nicotine or emission of certain chemicals. Following an advisory from the Ministry of Health and Family Welfare, as of March 2019, 12 states in the country including Punjab, Karnataka, Maharashtra, Bihar, Kerala, Uttar Pradesh, Himachal Pradesh, Jammu & Kashmir, Puducherry, Tamil Nadu, and Jharkhand, have taken steps to ban the use of electronic nicotine delivery systems (ENDS) including e-cigarettes. Further, other states are also planning to ban the sale and consumption of e-cigarettes.

India E-Cigarette Market Competitive Landscape

Due to unclear regulations and import policies, the e-cigarette market in India is dominated by imported devices, majorly form China. Companies including JUUL Labs Inc., Joyetech Group, Shenzhen IVPS Technology Corporation Ltd., Shenzhen Eigate Technology Co., Ltd, and ITC Limited are the key players in the market. British American Tobacco p.l.c., Altria Group Inc., Japan Tobacco Inc., Imperial Brands PLC, Philip Morris International Inc., JUUL Labs Inc., Innokin Technology Co. Ltd., Shenzhen Kanger Technology Co., Ltd., Pax Labs, Inc., ITC Limited are some other major players trying to gain significant foothold in India e-cigarette market.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws