Report Code: 11473 | Available Format: PDF | Pages: 112

India Automotive HMI Market by Product (Instrument Cluster, Touch Screen Display, HUD, Steering Mounted Controls, RSE, Multifunction Switches), by Interface (Visual, Mechanical, Acoustic), by Access (Multimodal, Standard), by End-Use (Economy Cars, Medium Cars, Premium Cars), by Region (Northern, Western, Eastern, Southern) -Market Size, Share, Development, Growth, and Demand Forecast, 2013-2023

- Report Code: 11473

- Available Format: PDF

- Pages: 112

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

India Automotive HMI Market Overview

The Indian automotive HMI market attained a size of $466.9 million in 2017 and is forecasted to reach $1 billion by 2023, registering a CAGR of 14.1% during 2018–2023. The major factors driving the market growth are increasing passenger car sales in the country, rising in-vehicle connectivity, and increasing demand for in-vehicle safety and comfort features.

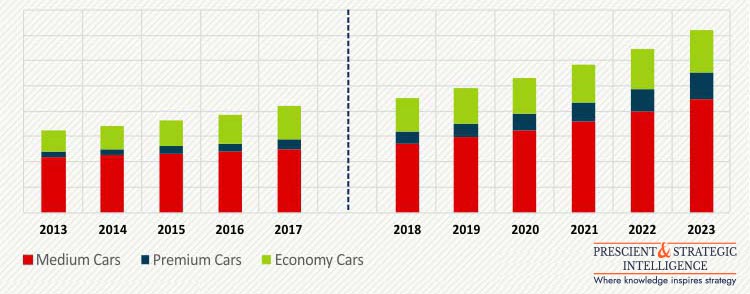

INDIA AUTOMOTIVE HMI Market, BY END-USE, '000 UNITS (2013-2023)

Automotive HMI comprises multiple systems which allow drivers to interact with their vehicle. It is not only a principal connector between the driver and vehicle, but also bridges the gap between the driver and interior systems in a passenger car. It uses various mechanisms such as voice commands, touch, and human body language as operating instructions to operate the systems in a vehicle. Innovation regarding different automotive HMI components is expected to drive the dynamics of Indian automotive HMI market in coming years.

In terms of interface, the Indian automotive HMI market is segmented into visual interface, mechanical interface, and acoustic interface. Among these, visual interface has been the dominant category in terms of size. This category is also expected to see a significant growth during the forecast period, attributed to the increasing adoption of visual interface in medium cars.

Geographically, the western region of the country held the largest share in the Indian automotive HMI market in 2017, benefited by the significant sales of medium and premium car sales. During the same year, the eastern region accounted for the lowest share in the market, due to low income levels and lower economic growth in this part of the country, restricting car sales in this region.

Dynamics of India Automotive HMI Market

Trends

The touch screen display market in the country is expected to witness a significant growth during the forecast period. Declining prices of entertainment systems coupled with increasing demand of connected vehicles is expected to drive the demand for these displays in the Indian automotive HMI market.

In the late 2000s, touch screen displays were restricted to expensive cars in the country. However, during the historical period, automakers increasingly installed touch screen displays in mid-priced cars. The declining prices of touch screen displays have contributed immensely to their swelling adoption in medium passenger cars. Apart from this, increasing competition among automakers compels them to install the latest technological features in their cars to lure buyers. Furthermore, with increasing penetration of smartphones in the country, buyers demand seamless integration of smartphone functionalities and apps in the car infotainment systems, thereby benefiting the growth of touch screen displays in the Indian automotive HMI market.

Drivers

People wish to stay connected with the outer world even while travelling. In the near future, automobiles too, would increasingly become more connected with the outer world through cloud services. Responding to customer preferences, automotive manufacturers through partnerships with IT or consumer electronic vendors, are increasingly integrating in-vehicle connectivity features in the infotainment systems. Rising in-vehicle connectivity would lead to increased use of HMIs to display the information, and enable smoother interaction of users with the system, thereby benefiting the Indian automotive HMI market.

For example, Reliance Jio Infocom Ltd, a telecom operator in India, awarded a contract to the U.S. based AirWire Technologies, to manufacture connected car device to be installed in passenger cars in the country. Also, Reliance Jio Infocom Ltd is in talks with the leading car manufacturers – Maruti Suzuki India Ltd and Hyundai Motor India, to install the device in their passenger cars. Installation of this device in passenger cars will bring services such as Wifi hotspot, entertainment, location-based apps, telematics to passengers in the car. Such developments are expected to benefit the Indian automotive HMI market during the forecast period.

Restraints

HMI systems and technologies such as multi-touch screen, gesture recognition, and instrument clusters are costly. Due to this, many of the HMI products majorly get installed in premium cars. High-cost of installing such systems could become a huge budgetary constraint for emerging economies like India. Along with huge installation costs, the mass adoption of these systems is also hindered due to the lack of skilled machinists capable of handling advanced HMI technologies. Thus, the high upfront and maintenance costs of HMI systems hamper mass adoption of these products, affecting the Indian automotive HMI market adversely.

India Automotive HMI Market Competitive Landscape

Some of the major players operating in the Indian automotive HMI industry are Visteon Corporation, Panasonic Corporation, Continental AG, Robert Bosch GmbH, DENSO Corporation, Nippon Seiki Co. Ltd., Alpine Electronics Inc, Alps Electric Co., Ltd, Omron Corporation, ZF Friedrichshafen AG and Valeo SA.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws