Report Code: 11723 | Available Format: PDF | Pages: 159

HR Analytics Market Research Report: By Offering (Retention, Recruitment, Workforce Planning, Compensation and Incentive Program, Employee Development, Employee Engagement), Deployment Type (On-Premises, Cloud), Enterprise Size (Large Enterprise, SME), Industry (BFSI, IT & Telecom, Healthcare, Education, Energy & Utilities, Government, Retail), Geographical Outlook (U.S., Canada, U.K., Germany, France, Italy, Spain, China, Japan, India, Australia, South Korea, Brazil, Mexico, U.A.E., South Africa, Turkey, Saudi Arabia) - Global Industry Analysis and Growth Forecast to 2024

- Report Code: 11723

- Available Format: PDF

- Pages: 159

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Outlook

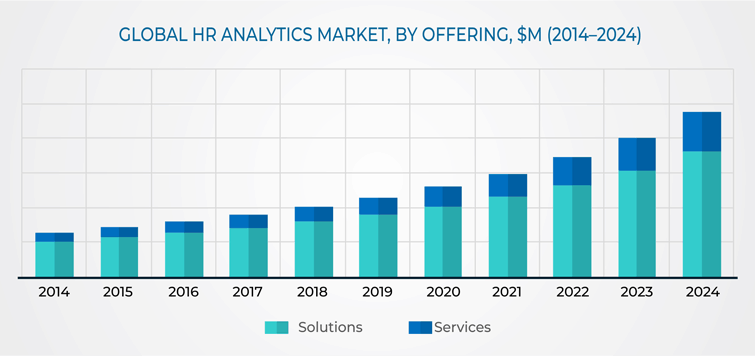

The HR analytics market size was $2,045.5 million in 2018, and the market is predicted to advance at a CAGR of 15.6% between 2019 and 2024. The burgeoning requirement for efficient hiring and talent retention strategies and workforce optimization and the changing work dynamics are the major factors fueling the expansion of the market.

The solutions category, within the offering segment, dominated the market for HR analytics in 2018 due to the increasing adoption of such software in all verticals. The workforce planning sub-category contributed the highest revenue to the market in 2018, under the solutions category, due to the mushrooming requirement for efficient resource usage within organizations. HR analytics helps in resource allocation for the entire project duration, which, in turn, allows businesses to maximize their productivity.

The professional classification, under the services category, led the HR analytics industry in 2018. This is ascribed to the growing requirement for software implementation, integration, and consulting services in organizations, for operational efficiency, regulatory compliance, and gaining insights into the technological advancements taking place in such software.

The large enterprise bifurcation held the larger share in the HR analytics market, within the enterprise segment, in 2018. This was due to the capability of large enterprises to make huge information technology (IT) investments for adopting HR analytics solutions. Moreover, these organizations usually have dispersed operations all over the world, and they are, therefore, compelled to adopt HR analytics solutions for appropriate employee retention and hiring and measuring the performance of employees.

The banking, financial services, and insurance (BFSI) category, under the industry segment, dominated the market in 2018. As financial companies are struggling to attract talented youngsters, engaging their existing employees, and optimizing their performance, they are rapidly adopting HR analytics solutions.

Geographically, North America held the major share in the market in 2018, primarily because of the existence of several large-scale industries with a highly skilled workforce in the region. Additionally, the surging IT expenditure and rapid technological advancements are fueling the market growth here.

Market Dynamics

The burgeoning requirement for workforce optimization is one of the major factors fueling the demand for HR analytics solutions, which is, in turn, propelling the advance of the HR analytics market around the world. Workforce optimization helps enterprises make their operations more efficient by ensuring that all the operations are in complete harmony and perfect synchronization. Workforce optimization assists organizations in:

- Aligning skills and resources to a specific customer demand and job, for faster turnaround

- Capturing data related to performance in a standardized framework, for improved decision making

- Empowering the HR to monitor the contribution and performance of employees

- Tracking work progress via processing and identifying those at risk of not meeting the service targets

Over the last few years, HR analytics has become a popular technique for achieving workforce optimization via the analysis of business data. It can help HR professionals gain a deeper understanding of the weaknesses and strengths of employees, future work shifts, and the best course of action going forward. With the growing requirement for expertise in new areas and increasing skill shortage in the workforce, the demand for effective workforce planning is rising sharply, as it can help businesses stay ahead of their rivals.

The adoption of machine learning and artificial intelligence (AI) in such software is creating lucrative growth opportunities for the players in the HR analytics market. Currently, the popularity of AI is ballooning all over the world. The value of the global AI industry is predicted to rise from nearly $650.0 million in 2016 to around $36.0 billion by 2025, exhibiting a CAGR of 56.5%.

AI could help HR professionals predict employee flight risk and the impact of talent decisions, identify high-potential employees, recommend learning courses, and discover engagement issues, which would, in turn, improve the workforce efficiency of enterprises.

Competitive Landscape

With the presence of numerous players, the global HR analytics market is highly competitive. However, few of the competitors, such as ADP LLC, SAP SE, Oracle Corporation, and Workday Inc., cumulatively held the major share of the market. Other prominent players in the market include MicroStrategy Incorporated, Sage Group PLC, Zoho Corporation, Kronos Incorporated, Visier Inc., Sisense Inc., and International Business Machines Corporation.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws