Report Code: 10319 | Available Format: PDF

Household Vacuum Cleaners Market Revenue Forecast Report: Size, Share, Recent Trends, Strategic Developments, Segmentation Analysis, and Evolving Opportunities, 2023-2030

- Report Code: 10319

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

Market Overview

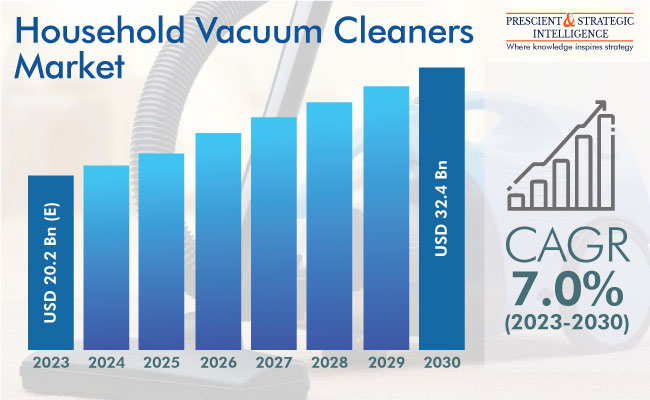

The household vacuum cleaner market revenue is USD 20.2 billion (E) in 2023, and it will advance at 7% compound annual growth rate during 2023–2030, to reach USD 32.4 billion by 2030.

The growth of the market is mainly attributed to the high disposable incomes, changing lifestyles, surging purchasing power, rising awareness of home hygiene, and expanding working population. Additionally, The introduction of the work-from-home model during the pandemic resulted in a surging number of people confined to their homes. This boosted the need for various home appliances, particularly cleaning products.

Furthermore, the surging prevalence of asthma and allergy because of the dirt and dust in residential areas augments the need for residential vacuum cleaners. Moreover, the increasing accessibility of advanced products, which can effectively eliminate the smallest of impurities, is boosting the market progress.

Increasing Incidence of Illnesses from Unclean Surfaces

The increasing incidence of respiratory illnesses is a key driver for the market. Dust, pollen, microbes, and other agents, which can easily accumulate on floors, furniture upholstery, and carpets, cause various breathing issues, such as bronchitis, COPD, asthma, and pneumoconiosis. As per the Centers for Disease Control and Prevention, dust mites and mold are the key indoor triggers for asthma. Further, allergy to dust is highly common, and in people who display extremely severe responses to this condition, anaphylaxis can occur.

Further, COVID-19 is known to affect people already susceptible to breathing issues more severely than others. Moreover, children often sit on and eat off the floor, which carries a risk of several illnesses, such as MRSA, campylobacteriosis, gastroenteritis, stomach flu, aspergillosis, UTI, bacterial endocarditis, bacteremia, and diverticulitis. Hence, the focus on regularly cleaning in homes is growing, which is propelling the need for vacuum cleaners.

Growing Popularity of Central and Robotic Vacuum Cleaners

The arrival of robotic and central vacuum cleaners has enabled the completion of cleaning tasks without the intervention of humans. Modern vacuum cleaners are highly convenient and time-efficient, which continues to drive the market. Advanced robotic vacuum cleaners offer easier operations for the elderly because these cleaners can be remotely controlled. Consumers, during the pandemic, favored robotic vacuum cleaners with self-cleaning features (AI technology) and sensors that improve their efficiency.

In turn, the mounting requirement for advanced cleaning devices is prompting market players to manufacture devices with the latest technology. For example, Travelodge partnered with Killis in February 2022 to produce an advanced robot vacuum cleaner, called RoboVac Buddies. This vacuum cleaner allows for thorough cleaning in public spaces, under the bed, bar cafes, and hotel hallways.

Further, central vacuum cleaners have started becoming popular in developed countries; although, they can only be used in modern buildings with integrated utilities. Such appliances are devoid of a tank, instead featuring just a pipe and the suction head. The pipe is connected to an outlet in the wall, which leads to a central dust tank in the utilities area of the building. These appliances, thus, save the trouble of taking the heavy dust tank along from one room to another.

Canister Vacuum Cleaner Is Major Revenue Contributor

In 2023, the canister category, based on product, is the largest contributor to the household vacuum cleaner market. These variants are easily available and offer a high suction power for residential users. The integration of HEPA filters in these residential appliances reduces the risk of pulmonary side-effects, for instance, asthma and allergies.

The robotic category is also likely to observe a rise in revenue during the projection period. The requirement for robotic cleaning technologies has surged in response to COVID-19, to enable more-effective cleaning and contaminant removal. Moreover, automatic charging and voice commands enabled by digital voice assistants, including Google Assistant and Amazon Alexa, are encouraging customers to buy such smart home appliances. Additionally, navigation technology, remote control, and voice control lessen the need for human intervention and save time.

Online Category Is Leading Distribution Channel

In 2023, the online category, based on distribution channel, is generating significant revenue. This is because of the implementation of lockdowns all over the world to control the spread of COVID-19. Since then, many more vacuum cleaner businesses have started to sell their products online, as cleaning became an important daily task in homes.

Moreover, the surging requirement to globalize the process of digital sales and offer a seamless experience to consumers is expected to boost the growth of this category. Online platforms allow consumers to compare the product performance, reviews, and offers before buying it. For example, Fantasia Trading LLC launched its cordless handheld vacuum cleaner, named eufy, on Amazon in February 2022.

| Report Attribute | Details |

Market Size in 2023 |

USD 20.2 Billion (E) |

Revenue Forecast in 2030 |

USD 32.4 Billion |

Growth Rate |

7.0% CAGR |

Historical Years |

2017-2022 |

Forecast Years |

2023-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

APAC Is Dominating Market

APAC is the largest contributor to the global household vacuum cleaner market, with China being a major buyer of these appliances. This is attributed to the rising purchasing power of customers, accessibility of cost-effective products, as well as the existence of key market players in the region. Moreover, the extensive usage of online shopping platforms in emerging economies, including India, as well as the rapid electrification of rural areas, is boosting the requirement for vacuum cleaners.

Additionally, the increasing consciousness among consumers regarding the benefits of advanced cleaning products for homes, especially since the pandemic, has increased the requirement for vacuum cleaners across Asia. Thus, the major players in the region are expanding their product portfolios of household vacuum cleaner products. For instance, Panasonic Holdings Corporation launched MC-YL633, a dry vacuum cleaner for convenient cleaning, in India in April 2022.

Europe also held a significant share in the market in recent years, and it is expected to grow at a considerable rate throughout the forecast period. This can be attributed to the easing of COVID-19 lockdowns and a surge in the sale of domestic vacuum cleaners with improved features. Moreover, the surging need to maintain better hygiene standards, to prevent the spreading of various diseases, encourages households to invest in vacuum cleaners.

Some Key Companies in Household Vacuum Cleaner Market Are:

- Snow Joe LLC

- Dyson Inc.

- BISSELL Inc.

- Oreck Corporation

- Stanley Black & Decker Inc.

- LG Corporation

- Panasonic Corporation

- Electrolux AB

- Koninklijke Philips N.V.

- Emerson Electric Manufacturing Co.

- Haier Group

- iRobot Corp

- Vorwerk & Co. KG

- Techtronic Industries Co. Ltd.

- Alfred Karcher SE & Co. KG

- Eureka Forbes

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws