The market for hospital risk management solutions will generate USD 1.8 billion in 2024.

During 2025–2032, the hospital risk management industry will grow by 13.9%.

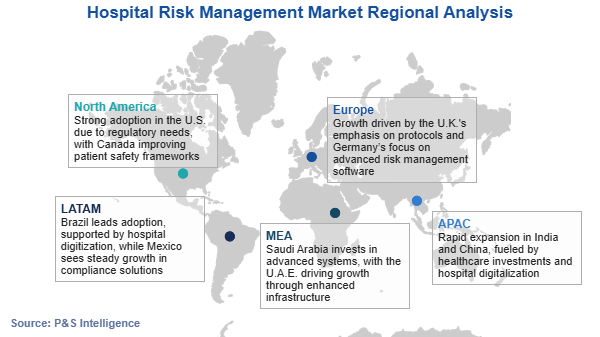

North America dominates the market for hospital risk management solutions, while APAC will witness the fastest growth.

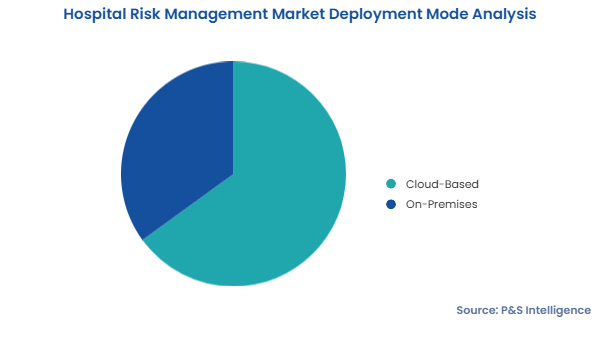

The cloud-based hospital risk management industry is already bigger than for on-premises solutions, and the situation will remain unchanged over this decade.

Hospital risk management solutions market is fragmented in nature.