Report Code: 11425 | Available Format: PDF | Pages: 94

Germany Automotive Digital Services Market by Type (Mobility on Demand [Ride Hailing and Sharing, Car Sharing], Logistic Fleet Management, In-Vehicle Digital Services [Dashboard Infotainment {Entertainment, Navigation, Call}, ADAS, IoT {E-Call/B-Call, Usage based Insurance, V2X}]) - Market Size, Share, Development, Growth, and Demand Forecast, 2013-2023

- Report Code: 11425

- Available Format: PDF

- Pages: 94

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Germany Automotive Digital Services Market Overview

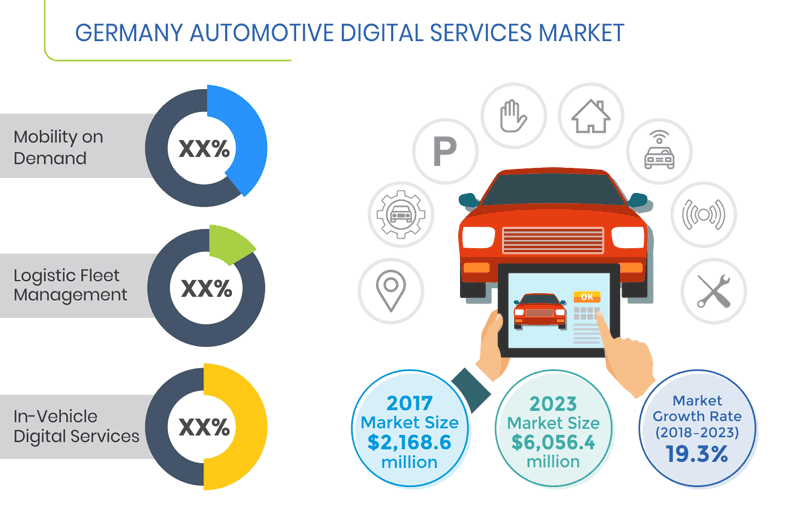

The German automotive digital services market is estimated at $2,168.6 million in 2017, witnessing a CAGR of 19.3% during the forecast period. Significant growth in advanced driver assistance systems (ADAS) and mobility-on-demand services has benefited the market till now and increasing penetration of these services would continue to benefit the industry during the forecast period.

Based on type, the German automotive digital services market is segmented into mobility on demand, logistic fleet management, and in-vehicle digital services, where in-vehicle digital service is estimated to hold the largest share. Among all the in-vehicle digital services, ADAS is estimated to account for the largest share in the German in-vehicle digital services market in 2017. High installation rate, comparatively high price, and growing demand for driver assistance systems are the major factors driving the growth of the ADAS market.

On the basis of type, mobility on demand is segmented into ride hailing and sharing and car sharing. Ride hailing and sharing is estimated to account for a larger share in the German mobility-on-demand market in 2017. Wide consumption of ride hailing and sharing services by customers, growing penetration of these services in key urban cities, and the factor of convenience associated with these services are the key reasons behind the larger share of this category in the German automotive digital services market.

Germany Automotive Digital Services Market Dynamics

Drivers

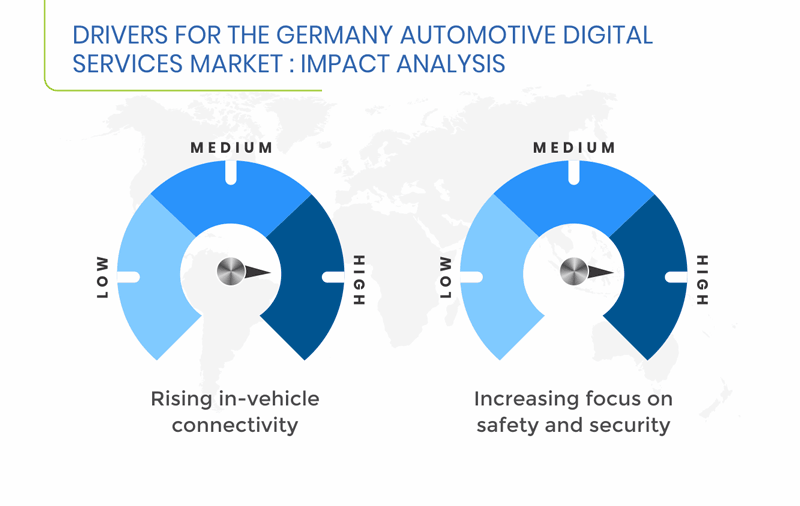

The rising safety and security concerns for fleet in addition to the increasing demand for telematics-enabled trucks in Germany are driving the German automotive digital services market. Vehicle safety and security have become a major area of focus for automakers, end users, and the government. Safety and security are increasingly becoming important aspects associated with the end-user car-buying decision. These features are also being incorporated by automakers in their cars as a unique selling proposition to differentiate their product from others.

Governments in many countries are also proposing to make some of the ADAS mandatory for passenger cars. The European Commission is currently revising general safety requirements in vehicles, and the industry participants are quite hopeful that the ADAS related to security and safety of the vehicle will become mandatory for passenger cars. Stringent safety regulations coupled with end-user preference for safety features are expected to drive the German automotive digital services market in the coming years.

Restraints

High cost of digital services is a major factor restraining the growth of the German automotive digital services market. Incorporation of ADAS and IoT systems, such as lane departure warning adaptive cruise control, and automatic emergency braking, can considerably increase the cost of the vehicle. Due to this factor, these systems are majorly installed in premium cars. The high cost of installing such systems often becomes a constraint for the automakers selling low- or mid-priced cars. Similarly, new-age dashboard infotainment systems come with a range of digital content platforms, including Apple CarPlay and Android Auto, and warning systems, which increase the overall price of the vehicle.

Thus, high upfront costs of the systems hamper the mass adoption of these features, which, in turn, affects the industry growth. However, the expected decline in the prices of many of these features during the forecast period would lower the impact of this restraint on the German automotive digital services market to some extent.

Opportunity

Technological innovations in the areas of connected cars, ADAS, and artificial intelligence are creating new opportunities for the players operating in the German automotive digital services market. These technological innovations are paving the way for driverless cars. Automobile vendors and technology companies are already working toward making this transportation system a reality. Many of the human–machine interface systems in cars would soon become fully digital, thereby increasing the digital content consumption of the driver and the passengers.

Major automakers such as BMW AG, Audi AG, Ford Motor Company, and Volkswagen AG have plans to launch driverless cars during the latter half of the forecast period, benefitting the German automotive digital services market.

Germany Automotive Digital Services Market Competitive Landscape

The key players in the German automotive digital services market include Uber Technologies Inc., Daimler AG, Robert Bosch GmBH, TomTom NV, FEV Group, MAN SE, Continental AG, Bayerische Motoren Werke (BMW) Group, and Volkswagen AG.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws