Report Code: 11393 | Available Format: PDF | Pages: 144

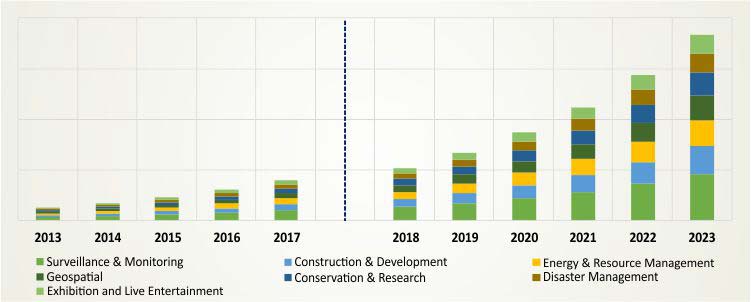

Geospatial Imagery Analytics Market by Collection Medium (GIS, Satellites, UAVs), by Imaging Type (Image, Video), by Analysis (Geovisualization, Network, Surface), by Vertical (Government, Energy & Mining, Defense, Agriculture & Forestry, Media & Entertainment, Civil Engineering & Archaeology), by Application (Surveillance & Monitoring, Construction & Development, Energy & Resource Management, Geospatial, Conservation & Research, Disaster Management, Exhibition & Live Entertainment), by Geography (U.S., Canada, U.K., Germany, France, Russia, Sweden, China, Japan, India, South Korea, Taiwan, Israel, Brazil, U.A.E., South Africa) - Global Market Size, Share, Development, Growth, and Demand Forecast, 2013-2023

- Report Code: 11393

- Available Format: PDF

- Pages: 144

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Geospatial Imagery Analytics Market Overview

The global geospatial imagery analytics market reached $3,196.2 million in 2017, and it is expected to advance at a CAGR of 28.7% during 2018–2023. The growing demand from enterprises due to the increasing market competition and technological advancements in this field is the key factor driving the progress of this market.

GLOBAL GEOSPATIAL IMAGERY ANALYTICS MARKET, BY COLLECTION MEDIUM, $M (2013 – 2023)

Based on collection medium, the geospatial imagery analytics market has been categorized into geographic information system (GIS), satellites, unmanned aerial vehicles (UAVs), and others. Out of these, the GIS category held the largest market share in 2017. This was due to the heavy adoption of GIS systems in various industries, including aerospace and defense, oil and gas exploration, water and wastewater, and government.

Based on imaging type, the geospatial imagery analytics market has been bifurcated into image and video; wherein the image category held the larger share in 2017. On the basis of analysis, the market is categorized into geovisualization, network analysis, and surface analysis. Reinforced by the rapid development of spatial technologies, including GIS, 3D virtual globes, and multimedia atlases, the geovisualization category held the largest market share in 2017.

Based on region, Europe held the largest share in the geospatial imagery analytics market in 2017. This is attributed to the increasing demand for geospatial analytics solutions integrated with artificial intelligence (AI), machine learning, and the rising commoditization of geospatial data. In addition, the increasing adoption of geospatial analytics by government bodies in the region for public safety and security is also driving the growth of the market.

Geospatial Imagery Analytics Market Dynamics

Trends

The launch of small and nano satellites in large numbers is one of the key trends being observed in the geospatial imagery analytics market. As these satellites are lighter and smaller than traditional satellites, weighing less than 500 kg, they are easier to launch. In addition, as these satellites offer lower cost and quicker, more-frequent, and broader access to space, organizations such as Space Exploration Technologies Corp. and National Aeronautics and Space Administration (NASA) are increasingly investing in their launch.

Drivers

Advancements in geospatial imagery analytics are a major factor supporting the growth of the market. Presently, as advanced technologies such as big data and AI offer a faster and efficient analysis of data, geospatial imagery analytics companies are rapidly integrating these technologies into their offerings to deliver meaningful insights in less time. The banking, financial services, and insurance (BFSI), healthcare, retail and e-commerce, defense, and disaster management sectors are increasingly adopting geospatial imagery analytics solutions to classify large volumes of data and extract meaningful information out of it.

Opportunities

The growing use of location-based services (LBS) is offering immense growth opportunities to the global geospatial imagery analytics market. As per a study, the number of location-based service users in the U.S. increased from around 196 million in 2016 to nearly 219 million in 2017. The use of these services is increasing on account of the surging number of internet-enabled devices, globally. Internet-connected devices come with location-based features, which help consumers in the interpretation of real-time maps into useful insights. Geospatial data analytics is the core of LBS. With the rising smartphone adoption and quick sharing capabilities of hyper-local information, the usage of LBS is surging and consequently offering tremendous growth opportunities to the players operating in the market.

.jpg)

Geospatial Imagery Analytics Market Competitive Landscape

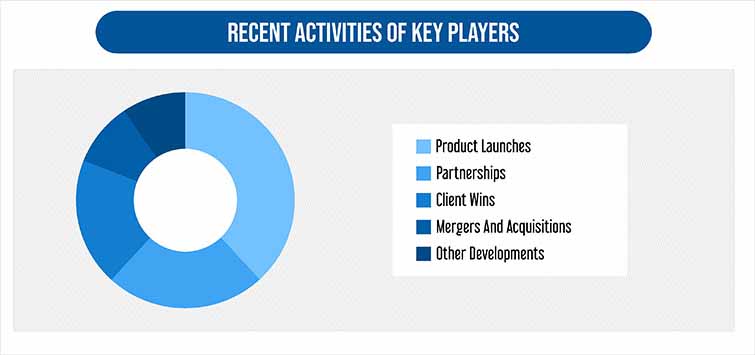

The geospatial imagery analytics market is fragmented due to the presence of a large number of global and regional players. As the market is highly fragmented, the competition is rife. The major players in the market are focusing on product launches, mergers & acquisitions, and partnerships to expand their market foothold. For instance, in February 2018, Environmental Systems Research Institute (ESRI) Inc. acquired ClearTerra LLC, a geospatial and activity-based intelligence tool provider, for an undisclosed amount. Through this acquisition, the former planned to improve its geospatial imagery analytics business by allowing its ArcGIS platform users to easily discover and extract geographic coordinates from unstructured textual data, such as e-mails, reports, and briefings.

Additionally, in February 2018, Trimble Inc. launched the Trimble MX9 mobile mapping solution for geospatial imagery analytics professionals. This product contains a vehicle-mounted mobile lidar system (MLS), multi-camera imaging, and field software for capturing high volumes of data for various mobile mapping applications, including road surveys, 3D-modeling, topographic mapping, and asset management. Some of the major players operating in the geospatial imagery analytics market are Fugro N.V., Google LLC., Trimble Inc., ESRI Inc., Planet Labs Inc., UrtheCast Corp, KeyW Corporation, Orbital Insight, SpaceKnow Inc., Skylab Analytics, Maxar Technologies Inc., and Satellite Imaging Corporation.

Key Questions Addressed/Answered in the Report

- What is the current scenario of the global geospatial imagery analytics market?

- What are the historical size and present size of the different categories within the market segments and their future potential?

- What are the major catalysts for the market and their impact during the short, medium, and long terms?

- What are the evolving opportunities for the players in the market?

- Which are the key regions from the investment perspective?

- What are the key strategies being adopted by the major players to expand their market share?

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws