Report Code: 10190 | Available Format: PDF

Foam Blowing Agents Market Report: Size, Share, Strategic Developments, and Growth Potential Estimation, 2024-2030

- Report Code: 10190

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

Market Overview

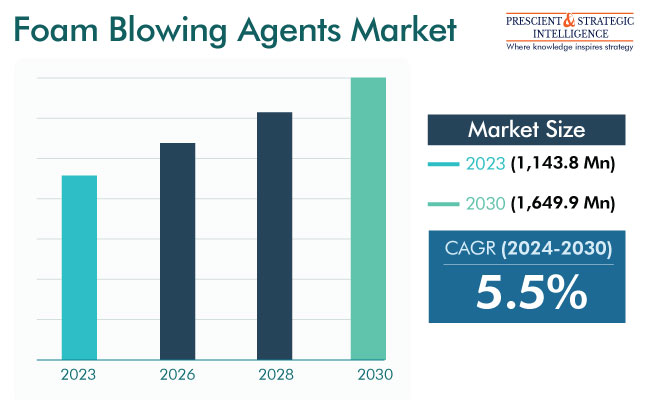

The foam blowing agents market is set to generate USD 1,143.8 million (E) in 2023 and further grow at a CAGR of 5.5% in the forecast period of 2024–2030, reaching USD 1,649.9 million by 2030. This can be ascribed to the rising demand for various kinds of polymeric and phenolic foams in the automotive, construction, and electrical appliances industries.

Blowing agents, which are essential to the foam-blowing process, can be liquids or gases that cause tiny bubbles to form in plastics. They provide the foam with special qualities, such as low weight, excellent insulation, and flexibility. Manufacturers can obtain customized properties by altering a number of factors during production, including the kind of base materials utilized and the particular combination of gas agents.

The market is being driven by the increasing demand for flexible foam materials, rising research and development activities to enhance product performance, sustainability, and efficiency; and expanding product acceptance in packaging materials. One of the most-widely used varieties of polymeric foams is polyurethane, which has a wide range of uses in the electronics, flooring, automobiles, construction, packaging, and medical equipment industries.

Foam Blowing Agents Made of Hydrocarbons Are Most Popular

The hydrocarbons category holds the largest share within the material segment. Although the production of these materials is taxing on the environment, they do not contain volatile organic compounds, therefore, have a low ODP. Additionally, foam blowing agents made of hydrocarbons are majorly utilized to produce polyurethane foam for insulation purposes. Additionally, the guidelines for the phaseout of HFCs and HCFCs might further propel the usage of hydrocarbons.

Building and Construction Industry Is Biggest End User

The building and construction division dominates the global foam blowing agents market on the basis of end user. In this regard, the demand for these chemicals is being considerably impacted by the growth in the residential, commercial, and industrial infrastructure sectors. Products such as sealants, insulation, nd adhesives are widely consumed in the construction sector.

Further, the strict laws and rules encouraging eco-friendly building methods, to lower carbon emissions, are accelerating the usage of foam blowing agents for producing block pipe and roof insulation. One of the most-significant sustainable construction certification programs around the world is Leadership in Energy and Environmental Design (LEED). The non-profit U.S. Green Building Council (USGBC) has created a set of rating systems for the design, building, use, and upkeep of green homes, neighborhoods, and buildings with the aim of conserving the environment.

Apart from that, the growth of the flooring and furniture industries, which depend on polymeric foams for shock absorption, has been aided in recent years by the increase in purchasing power parity (PPP). Polymer foams are high in demand here, and in order to improve certain characteristics and nature of polymers, foam blowing agents are used.

These substances enlarge and make pores in the polymer matrix, thus giving it a cellular structure. The cellular structure gives it strength, while utilizing very little material. Thus, polymeric foams have a number of benefits, including low density, low heat transfer, and high flexibility, making them appropriate for the construction and automotive industries.

Expansion of Aerospace Industry

The aircraft manufacturing industry is rapidly growing due to the increasing disposable income and rising number of passengers. As the travel and tourism industry expands, an increase in the investment in civil aircraft will foster the market expansion. In order to improve comfort and lower noise levels, the aerospace sector uses these agents in seating, soundproofing materials, and interior components, thus boosting the market.

Great thermal insulation qualities are a hallmark of polymeric foams, which can also be tailored for varied physical characteristics. These materials may also be made rigid or flexible by changing their chemistry, structural characteristics, density, or raw components. As a result, the demand for foam blowing agents is high in aircraft manufacturing as they enhance the vibro-acoustic and thermal insulation properties of low-resilience polyurethane foams.

Both Airbus and Boeing forecast more than 40,000 new commercial aircraft orders till 2042, which reflects a massive rise in the consumption of foam blowing agents.

| Report Attribute | Details |

Market Size in 2023 |

USD 1,143.8 Million (E) |

Revenue Forecast in 2030 |

USD 1,649.9 Million |

Growth Rate |

5.5% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

Eco-Friendly Approach Is Key Trend

The sector advance is being helped by the rising environmental sustainability consciousness. Industries are looking for sustainable solutions to lower their carbon footprint as the world's concern for the environment grows. The use of foam blowing agents is essential for these projects. Hydrocarbon- and hydrofluorocarbon-based products have seen a high demand in a variety of applications, including refrigeration and wall sheathing and roofing due to their diminished effect on the climate. Governments and regulatory agencies are enforcing stronger environmental rules, forcing businesses to adopt greener practices.

Growing Usage of Polyurethane Foam Is Strongest Market Driver

On the basis of application, the polyurethane foam category will continue to generate the highest revenue over this decade. This is because of the increasing usage of low-GWP foam blowing agents for the production of spray polyurethane foam. The material remains high in demand for insulation purposes in the automotive, construction, and oil & gas industries, where energy efficiency is a key agenda currently.

Automotive Industry Growing Rapidly in Market

The automotive category is expected to witness a high CAGR in the market during this decade. This industry is continuously evolving and introducing innovations in the production technology and materials used to manufacture vehicles. Foam products are used in the automotive industry to manufacture wiper cowls, side skirts, bumpers, and roll pans, as they offer support, comfort, durability, and safety. The key application of foam blowing agents is to make insulation materials, to block out noise and maintain the desired temperature inside automobiles.

Major Foam Blowing Agents Producing Companies:

- Honeywell International Inc.

- Solvay SA

- Arkema SA

- Exxon Mobil Corporation

- Linde plc

- Daikin Industries Ltd.

- The Chemours Company

- Haltermann Carless

- Foam Supplies Inc.

- Harp International Ltd.

- DuPont de Nemours Inc.

- Sinochem

- ZEON Corporation

- Nouryon

- Marubeni Corporation

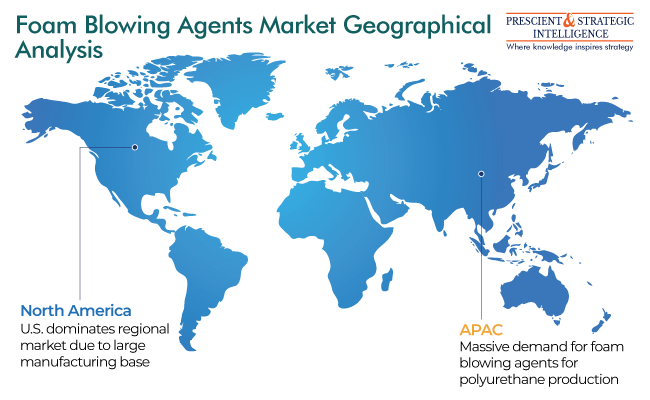

APAC Has Largest Market

APAC contributes the most revenue to the foam blowing agents market, as it is home to the top automotive manufacturing countries in the world: Japan, South Korea, India, and China.

Additionally, India is now the third-largest aviation industry, with the launch of the UDAN Yojana in 2016 significantly augmenting aircraft orders from domestic carriers. The primary goal of this program is to lower the cost of airline tickets and boost regional air connectivity. Since its launch, tier 2 and tier 3 cities’ airports have seen a massive improvement in infrastructure. This has, in turn, encouraged regional airlines to induct new aircraft in their fleet.

Additionally, Asia stands as the most-populous continent with over 55% of the world’s population. On account of the growing population and increasing rate of urbanization, the need for infrastructure development has risen. As per reports, China’s expenditure on the infrastructure sector will rise by huge number in this decade. As per a report in Global Times, in 2023 Q1 along, 14 Chinese provinces announced 12,571 major infrastructure projects with a total investment of USD 1.03 trillion (RMB 7 trillion).

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws