Report Code: 11550 | Available Format: PDF | Pages: 162

Flocculants & Coagulants Market by Type (Flocculants [Anionic, Cationic, Non-Ionic], Coagulants [Organic, Inorganic]), by Application (Water & Waste Water Treatment, Oil & Gas, Mineral & Extraction, Pulp & Paper), by Geography (U.S., Canada, U.K., Germany, France, Italy, Russia, China, Japan, India, South Korea, Brazil, Mexico, Saudi Arabia, South Africa) - Global Market Size, Share, Development, Growth, and Demand Forecast, 2013-2023

- Report Code: 11550

- Available Format: PDF

- Pages: 162

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Outlook

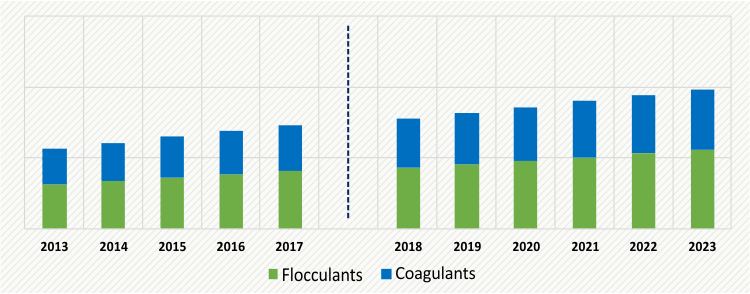

The flocculants and coagulants market revenue was $10,270.2 million in 2017, and it is expected to reach $14,225.3 million by 2023, exhibiting a CAGR of 5.4% during 2018–2023. The market growth thrives on the surging demand for clean water, owing to the booming population, and rising adoption of desalination across the world.

Flocculants and coagulants are utilized for separating solids from water during the water treatment process. Flocculants facilitate the clumping of particles, which enhances the whole process, whereas coagulants neutralize the electrical charges present in the water and collect the dissolved substances to create larger particles that can be removed by clarification, filtration, or any other solid elimination process.

The flocculants category held the larger revenue share, of 55.0%, in 2017, within the type segment of the flocculants and coagulants industry. This was because the filtration or separation of solid particles from liquids through the flocculation process is easier than via the coagulation process. During the flocculation process, the solution is gently mixed to aggregate the small clumps formed during the coagulation process and form larger clumps. It is easier to separate the large clumps as they settle down easily.

GLOBAL FLOCCULANTS AND COAGULANTS MARKET, BY TYPE, KILOTONS (2013-2023)

In the coming years, cationic flocculants will register the fastest growth in the flocculants and coagulants market, in terms of value, owing to their increasing consumption in the food and beverage industry to treat water and in the mining sector. Similarly, within the coagulants category, inorganic coagulants held the larger share in 2017 due to their low cost and wide application across industries.

In 2017, the water and wastewater treatment category held the largest revenue share, of 55.0%, within the application segment, due to the surging demand for these chemicals in municipal water treatment plants, itself due to toughening government regulations regarding the supply of clean water.

The Asia-Pacific (APAC) region held the largest revenue share, of 40.0%, in the market for flocculants and coagulants in 2017. Moreover, APAC is also expected to exhibit significant growth in the coming years owing to the spurring demand for these products from the flourishing chemical industry, robust economic growth, and high industrial output of the region. Moreover, the high water treatment chemical demand from the oil and gas, food and beverage, and metal industries is expected to support the market growth in the region.

Market Dynamics

The shift from traditional products to technically advanced products is a key trend in the flocculants and coagulants market. Traditional products, such as chlorine and alum, are being substituted with technically advanced flocculants and coagulants in water treatment plants owing to the latter’s cost-effectiveness and better performance. Additionally, the soaring concern among environmentalists regarding the usage of chlorine has led to the high-volume consumption of eco-friendly products.

The demand for flocculants and coagulants is prospering due to the surging demand for clean water. The rapid urbanization and industrialization on account of the booming population have a direct impact on the quality of the water. According to the U.S. Environmental Protection Agency (EPA), nearly 1.1 billion people across the world do not have access to safe drinking water and over 2.6 billion people face inadequate sanitation supplies. Waterborne diseases, which result from inadequate sanitation, lead to the death of around 3,900 children daily.

The emergence of enhanced water treatment technologies, including membrane filtration, advanced oxidation, biological filtration, high-pressure membranes, ion exchange, two-stage membrane filtration, and ultraviolet irradiation, is posing a major threat to the industry growth. Similarly, technologies such as granular activated carbon, oil–water separator treatment of oily effluents, electrosorption, adsorption technique, fixed biofilm reactors, integrated treatment, aerobic treatment, and wetlands to treat industrial wastewater, which act as alternatives to flocculants and coagulants, hinder the flocculants and coagulants market growth.

Competitive Landscape

Some of the major players operating in the global flocculants and coagulants market are BASF SE, Kemira Oyj, SUEZ, Evonik Industries AG, Akzo Nobel N.V., Ecolab Inc., SNF s.a.s., Solvay SA, Feralco AB, Chinafloc, National Aluminium Company Limited, National Aluminium Company Limited, and Kurita Water Industries Ltd.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws