Report Code: 10480 | Available Format: PDF

- Home

- Life Sciences

- Pregnancy Rapid Test Kit Market

Pregnancy Rapid Test Kit Market Report: Size, Share, Recent Trends, Strategic Developments, Segmentation Analysis, and Evolving Opportunities, 2024–2030

- Report Code: 10480

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

Market Overview

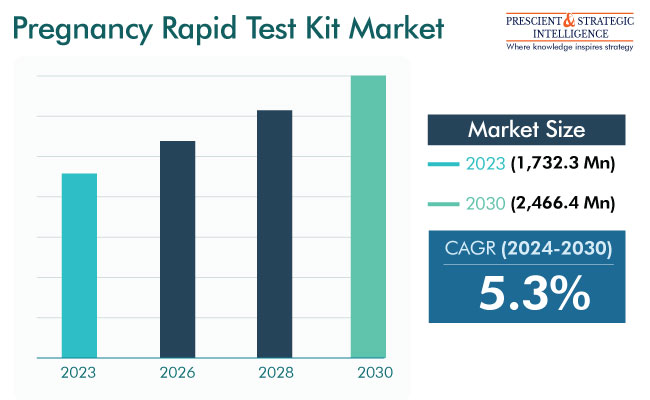

The pregnancy rapid test kits market is set to generate an estimated revenue of USD 1,732.3 million in 2023, and it is set to grow at a CAGR of 5.3% during 2024–2030, to reach USD 2,466.4 million by 2030.

The market will grow due to the rising awareness of the importance of early pregnancy detection, increasing number of infertility cases, and surging demand for reliable and affordable diagnostic testing. Additional factors that support the market advance include the expansion of the personalized healthcare sector and an increase in kit manufacturers’ promotional efforts.

The players are pursuing mergers & acquisitions, product innovations, collaborations & partnerships, and joint ventures to gain a sizable market share. The latest innovations include non-invasive kits that detect HCG in saliva samples. Additionally, Mylab, an Indian healthcare technology business, launched pregnancy test kits costing as little as INR 55, which is even less than USD 1, in June 2022.

People can also employ rapid tests for pregnancy and fertility at the point of care, to qualitatively detect the presence of hormonal substances, such as FSH, LH, and HCG, in a urine or blood sample. For rapid detection, a small amount of blood or urine is required, depending on the device being used. Following contact with the sample, these devices use color-changing immunoassay techniques to display the result.

Telehealth Services Have Boosted Pregnancy Rapid Test Kit Market

The market has also been impacted positively by the expansion in the availability of telemedicine services. Through telehealth programs, women have access to medical specialists, who may counsel them on concerns related to pregnancy. While using the test, people who think they have less expertise on them can consult a medical practitioner via phone or video conferencing. The doctor can clear any doubt about the procedure and advise people on the correct way of using the test kit.

Increasing Incidence of Infertility

The increasing incidence of infertility is a prominent factor propelling the growth of the global market for pregnancy rapid test kits. According to the World Health Organization, 1 in 6 people around the world suffer from infertility. The overall incidence of this condition is 16.5% in LMICs and 17.8% in HICs.

As age increases, it becomes difficult to conceive, which leads to a high number of infertility cases. Further, aging females are prone to a range of hormonal disorders, such as abnormal uterine bleeding, fibroids, and polyps, which could necessitate pregnancy rapid tests in case they are having difficulties in conceiving.

Rising Usage to Detect Unplanned Pregnancies

According to the WHO, each year, about 73 million induced abortions are performed worldwide. Three out of ten (29%) of all pregnancies and six out of ten (61%) of all unplanned pregnancies result in induced abortions. The WHO produced a list of essential health services in 2020, which includes comprehensive abortion treatment.

A variety of healthcare professionals can successfully manage abortion as a straightforward medical intervention, by administering medication or performing a D&C. A person can also safely self-manage an abortion at home within the first 12 weeks, by using medicines. This hints at an increase in the demand for pregnancy rapid test kits to diagnose an unplanned pregnancy.

Midstream Is Fastest-Growing Category

Midstream would be the fastest-growing category during the forecast period, on the basis of product. One study found that digital midstream pregnancy tests provide the most-reliable readings, depending on the HCG level in the urine.

The strips/dipsticks category makes the largest contribution to the market. This is mostly owing to the availability of a wide variety of such products at drugstores, hospital pharmacies, and even online. Moreover, they are the easiest to use, as all the person needs to do is collect her urine in a jar and dip the stick in it.

| Report Attribute | Details |

Market Size in 2023 |

USD 1,732.3 Million |

Revenue Forecast in 2030 |

USD 2,466.4 Million |

Growth Rate |

5.3% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

HCG Is Largest and Fastest-Growing Category

The HCG category dominates the test type segment, and it is also expected to grow at the highest rate during this decade. The ease with which such a test can be performed, as well as the high accuracy and straightforwardness of the results, is driving its growth. The human chorionic gonadotropin test quantifies the level of the hormone in the blood or urine.

Both confirming and keeping a track of the pregnancy are possible with this test. Only when a woman is pregnant is HCG present in bodily fluids. Following the implantation of the fertilized egg in the womb, the placenta begins to produce the hormone, its level doubling every two to three days.

Pharmacies/Drugstores Have Been First Choice of Consumers

The pharmacies/drugstores category has the largest share under the distribution channel segment. Rapid test kits for pregnancy are readily available over the counter without a prescription, as a result of which plenty of customers purchase kits at drugstores. Many people also like consulting the pharmacist on usage directions and other aspects of home pregnancy testing.

E-commerce is the fastest-growing category as it makes various kinds of test kits easily available. Additionally, the increasing tech-savvy population with access to the internet will drive the market. Moreover, during the COVID-19 pandemic, people were discouraged from going to clinics for the identification and confirmation of a pregnancy. This trend of online purchases of OTC healthcare products is likely to continue in the future owing to the conveniences this distribution channel offers.

North America Is Largest Market

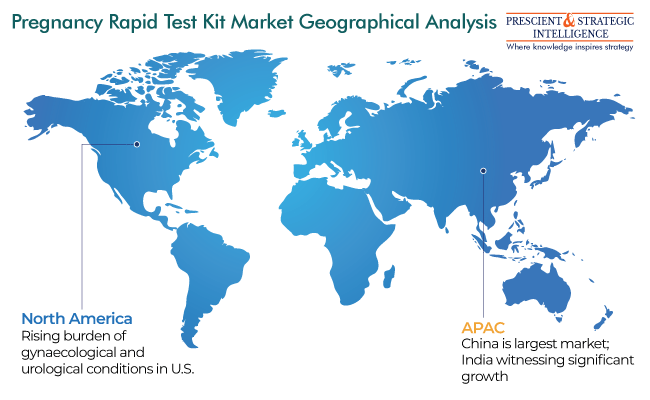

North America has the largest share, on account of the increasing rate of gynecological and urological conditions that prevent people from conceiving. According to the National Institutes of Health, each year, 84,000 cases of this condition are diagnosed and 28,000 women die of it in the U.S.

Along with that, in North America, 35–40% adults are obese. Obese women have a higher risk of infertility due to changes in the levels of certain hormones. Since the ability to conceive decreases, rapid test kits are often bought by those planning a family.

APAC is the fastest-growing market due to its huge population, which gives market players the encouragement to penetrate deeper into the region. Further, the rising awareness of and government initiatives for women healthcare and family planning are the key drivers. China holds the largest share in APAC, and India is one of the fastest-growing.

Moreover, the market in Europe will significantly grow over this decade because of technological advancements, rise in the public awareness of home pregnancy tests, and decrease in the number of childbirths and first-time pregnancy rate. Along with that, the increasing incidence of diseases that prevent people from conceiving is driving the market. Germany is one of the biggest markets in Europe due to the existence of numerous players and increasing awareness of pregnancy detection kits.

Key Players in Pregnancy Rapid Test Market:

- Abbott Laboratories

- Church & Dwight

- Piramal Enterprises Ltd.

- The Procter & Gamble Company

- Quidel Corporation

- Alere Inc.

- Prestige Brands Holding, Inc.

- Swiss Precision Diagnostics GmbH

- bioMérieux S.A.

- Mankind Pharma

Get a bespoke market intelligence solution

- Buy report sections that meet your requirements

- Get the report customized as per your needs

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws