Report Code: 11673 | Available Format: PDF | Pages: 120

Europe Autonomous Car Market Research Report: By Vehicle Autonomy (Semi-Autonomous Car, Fully Autonomous Car), Vehicle Type (Internal Combustion Engine, Hybrid Electric Vehicle, Battery Electric Vehicle), Application (Personal Commercial), Regional Insight (Germany, U.K., France, Italy, Spain) - Industry Trend, Competition Analysis and Forecast to 2030

- Report Code: 11673

- Available Format: PDF

- Pages: 120

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Europe Autonomous Car Market Overview

The European fully autonomous car market is expected to reach up to four million units by 2030, growing at a CAGR of 37.4% during the period 2023–2030. Government support for the development and testing of autonomous cars, evolution in connected car technology, and need for an efficient and safe driving option are the major factors driving the growth of the European Autonomous car market.

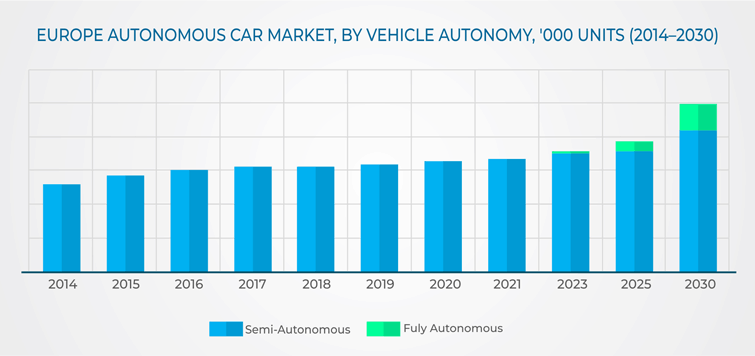

On the basis of vehicle autonomy, the European autonomous car market is categorized into semi-autonomous car and fully autonomous car. The semi-autonomous category held 100% of the market share in 2018. However, with the introduction of fully autonomous cars from 2023 onwards, the fully autonomous car category is expected to witness the faster growth. The growth of fully autonomous cars would be majorly fueled by the adoption of level 4 and level 5 autonomous cars for sharing services in numerous European countries.

Based on vehicle type, the European autonomous car market is categorized into (internal combustion engine) ICE, hybrid electric vehicle (HEV), and battery electric vehicle (BEV). Among these, ICE-based autonomous cars held the largest market share in 2018, in terms of volume. However, BEVs are expected to witness the fastest growth during the forecast period. This is because the deployment of fully autonomous technology is easier in BEVs as compared to other-fuel-type cars. To make a car self-driving, a number of cameras, sensors, radars, and other equipment are used. It is easier to achieve smooth connectivity among the electrical components in battery electric cars, compared to conventional fuel-based or hybrid electric cars.

On the basis of application, the European autonomous car market is categorized into personal and commercial. Of the two, autonomous cars used for commercial purposes are predicted to dominate the market during the forecast period. This would be due to the deployment of fully autonomous vehicles in sharing services along with the introduction of robotaxis for ride-hailing purposes. The growing availability of shared autonomous cars in the region is changing the car ownership scenario. Many people in the coming years are expected to use the sharing services frequently, thereby boosting the adoption of autonomous cars in commercial applications.

Geographically, the European autonomous car market is categorized into Germany, the U.K., France, Italy, Spain, and Rest of Europe. Among these, Germany was the largest market and held a market share of over 20% in 2018, in terms of volume. This is due to the presence of major original equipment manufacturers (OEMs) in the country, which are launching new models with advanced automation levels. Various OEMs including BMW, Volkswagen AG, and Tesla Inc. are introducing new car models for public purchase as well as for commercial purposes. These cars are equipped with advanced driver-assistance systems (ADAS) features, such as blind spot detection, smart park assist, and anti-lock braking system, making them an attractive option for consumers.

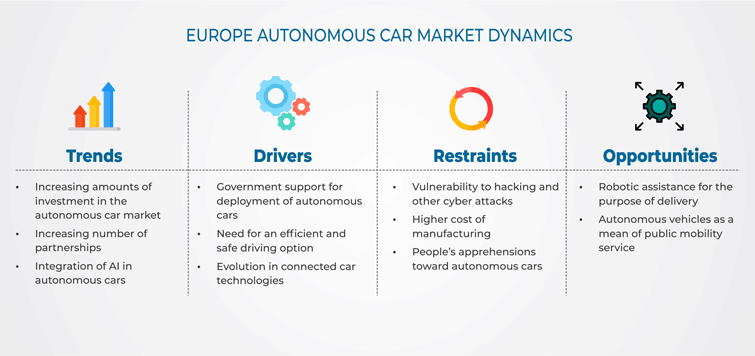

Europe Autonomous Car Market Dynamics

Drivers

The prevalent laws are well suited for the progress of the European autonomous car market. The rules governing the product liability, intellectual property, cybersecurity, and corporate/M&A transactions are quite favorable for the development of autonomous vehicles. For instance, in Spain, the Directorate General of Traffic (DGT) encourages the operation of all self-driving vehicles up to level 5 on the roads. In 2017, DGT collaborated with Mobileye with the purpose of preparing Spain’s regulatory policy and infrastructure ecosystem for autonomous cars. Additionally, an amendment was made to the German Road Traffic Act in June 2017, enabling a driver to pass off driving control to an autonomous car.

Today, semi-autonomous cars (level 1 to level 3), in which acceleration/deacceleration and steering can be controlled by the vehicle itself, are on roads. But regional laws mandate that the driver has to be on board and stay alert so that he/she is able to control the car in an emergency. But major OEMs and technology providers are working on level 4 and level 5 automation as they have received the authorization to test driverless cars on public roads. These initiatives by the government of several countries and auto manufacturers are driving the European autonomous car market.

Restraints

One of the key factors restraining the growth of the European autonomous car market is the excessive cost involved in the manufacturing of such cars, thereby making it difficult for most manufacturers to focus on them. The vehicles are extremely innovative and technologically advanced, which is the primary reason for the higher cost. The advanced software, hardware, and technology involved in the creation and functioning of the cars make manufacturing a costly affair.

Europe Autonomous Car Market Competitive Landscape

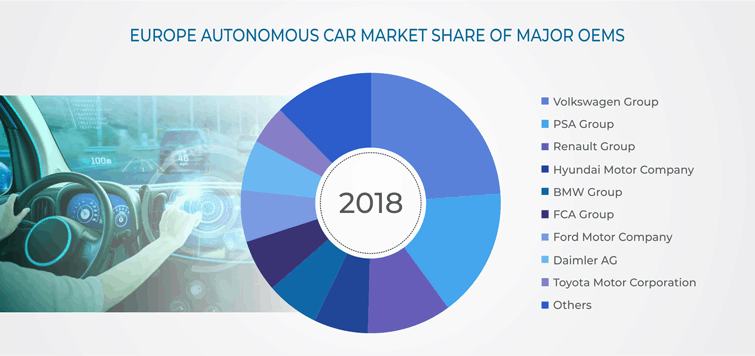

The European autonomous car market was dominated by three major OEMs, namely Volkswagen Group, PSA Group, and Renault Group, in 2018, who jointly accounted for over 50% of the market share. The recent trend in the market shows a significant number of collaborations and partnerships among the major OEMs. For instance, in 2018, Fiat-Chrysler entered into a partnership with the BMW Group for receiving software and hardware assistance from them. The other major manufacturers operating in the European autonomous car market in Europe are Tesla Inc., Daimler AG, BMW Group, General Motors Company, Fiat Chrysler Automobiles N.V., Ford Motor Company, and Toyota Motor Corporation.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws